Since 2020, decentralized exchanges (DEXs) have experienced rapid growth. In August 2022 alone, the total monthly DEX trading volume exceeded $66 billion. To meet the growing demand for on-chain transactions with low fees, WOO Network launched WOOFi DEX in June 2022. So let’s find out what this platform is through this WOOFi review.

About WOOFi

Launched in June 2022, WOOFi DEX is WOO Netword’s decentralized exchange operated by Orderly Network. The platform is designed to offer high liquidity, advanced trading tools, a customizable user interface (UI), and a transparent order book to the NEAR protocol. This DEX helps connect traders to a platform that offers faster execution and lower fees and allows traders to maintain custody of their assets.

WOOFi DEX facilitates the spot trading of popular blue-chip assets such as BTC, ETH, and NEAR. The platform is expected to expand its services and implement functions such as margin trading, perpetual swaps, lending, and borrowing. Launched by leading market makers such as Kronos Research, AGBuild, and Ledger Prime, WOOFi DEX is positioned to provide an improved DeFi trading experience. It has the look and feel of a centralized exchange.

Main Features

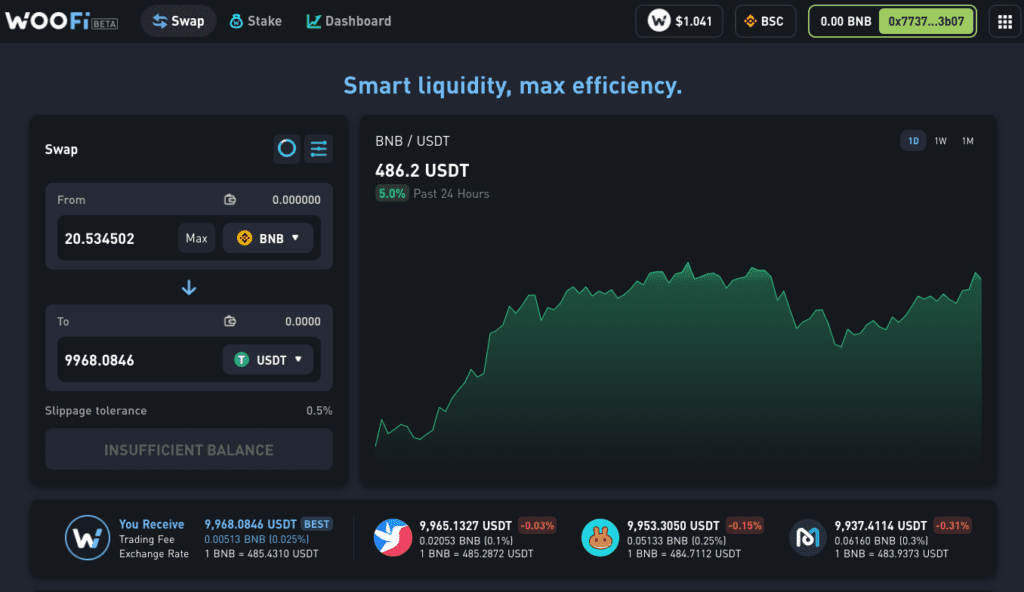

Swap

Swap is the primary function of WOOFi, and it is a decentralized exchange using a brand new on-chain market-making algorithm called Synthetic Proactive Market Making (sPMM). The spMM algorithm is designed for professional market makers to provide on-chain liquidity to better simulate the price, spread, and depth of the order book on centralized exchanges. According to recent tests, WOOFi’s sPMM liquidity pool can achieve over 300% capital efficiency (i.e., volume-to-liquidity ratio), higher than all other DEXes on the market. It enables the space’s lowest swap fees (i.e., 0.025%). Upon launch, Kronos Research will be the first market maker for WOOFi, while relying on WOO Network as the centralized liquidity source.

WOOFi Swap also allows users to perform a one-click cross-chain swap. Users can swap any asset on one chain for any investment on another without leaving the UI and going to a bridge.

The platform provides high-quality transaction execution on par with centralized exchanges on various blockchains with only a fraction of AMM’s TVL. This is especially useful on blockchains where liquidity on major assets is lower than on the Ethereum mainnet, as users do not need to pay exorbitant fees and suffer high slippage.

Earn

WOOFi Earn provides a hassle-free experience by offering “install and forget” profit generating strategies. Users can simply deposit funds into a vault and let automated strategies do the rest.

Since its launch, WOOFi Earn has implemented automated aggregated vaults across BSC, Avalanche and Fantom networks, charging the lowest performance fees on DeFi profit applications. Vaults automate the compounding process by harvesting rewards and reinvesting them with optimal frequency, helping to achieve higher yields.

Supercharger vault is the new flagship product of WOOFi Earn, which further increases user returns by providing liquidity its capital efficient sPMM pool. Each Supercharger vault applies a basic profit farming strategy combined with lending assets to the WOOFi sPMM team manager. We hope to continue rolling out additional Supercharger repositories to cover more assets and chains.

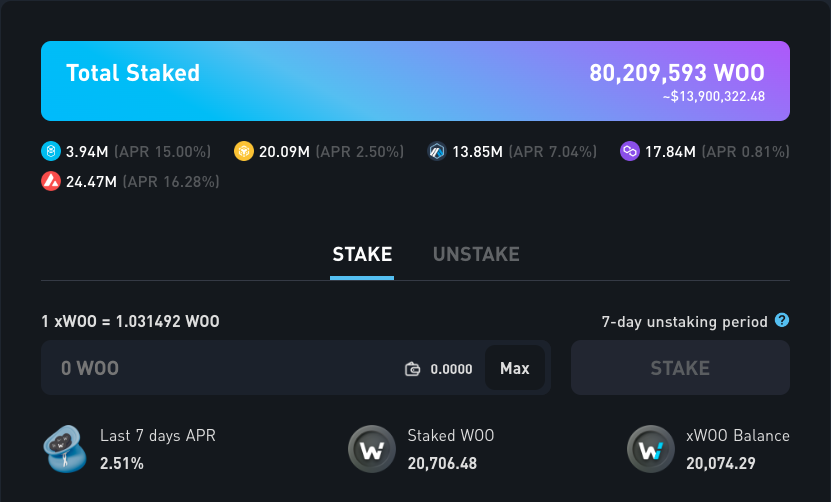

Stake

WOO token holders can stake their WOO tokens in the WOOFi “stake” page to receive profit from WOOFi swap fees collected in stablecoins. 80% of fees are used for daily redemption of WOO tokens, distributed to the staking pool on the same chain as rewards.

To ensure a sustainable APR, the staking rewards are purely from swap fees and do not rely on causing any inflation to the circulating supply of WOO. The APR varies on different blockchains depending on the swap fee and WOO set on each chain.

After staking WOO in staking smart contract, user will receive xWOO as LP token (WOO staking certificate). WOO staked can be redeemed for xWOO tokens after a non-staking period. The user’s xWOO balance will remain the same until a new wagering or canceling transaction is initiated and the corresponding base wager WOO amount is displayed on the staking page.

While holding xWOO tokens, users can automatically pool profits earned from fees collected in WOOFi Swap. When a user makes a trade on the WOOFi swap, a fee of 0.025% will be charged, from which 80% is used to reward xWOO holders and the remaining 0.005% is collected to incentivize volume through programs such as discounts, referrals, and transaction mining.

What makes WOOFi unique?

Liquidity model sPMM

Instead of adopting an automated market creation model (AMM) like most other DEXs, WOOFi leverages an innovative synthetic active market creation method (sPMM) to achieve deeper liquidity.

The sPMM model aims to simulate deep liquidity from WOO Network’s centralized exchange – WOO X, allowing WOOFi Swap to offer lower slippage and competitive DeFi prices while maintaining decentralization.

Layer of protection against sandwich attacks

A sandwich attack occurs when a malicious trader places an order before and an order after a pending transaction on the DeFi protocol to manipulate asset prices. The exploiter then pushes the asset’s price up by bidding at a price higher than the victim’s pending bid. When the victim buys at a higher price, the attacker can sell their assets at the new price, creating an artificial increase.

Sandwich attacks are quite common as large traders swap assets with DEXs built on top of AMM. Since AMM price discovery is driven by token balances in liquidity pools, attackers can take advantage of this transparency to inflate virtual prices.

In contrast, WOOFi’s sPMM price is determined by the parameters of the on-chain price feed rather than pool liquidity. Bad actors will not be able to predict prices based on token balances.

DEX pays for order processing

Currently, WOOFi has a broker program where it pays 0.5 basis points (bps) on volume submitted by third-party DApps as a rebate.

First build on BSC

Binance Smart Chain (BSC) was selected for the initial implementation of the WOOFi Swap due to the wide range of existing assets, users, and trading volumes. On a technical level, speed, low fees, and scalability make BSC a more stable environment for dAPPs and traders. In spring 2021, WOOFi’s initial proof-of-concept team was launched on BSC in partnership with DODO.

Since then, nearly $3.7 billion in volume has passed through the pool, despite only a few million assets (TVLs) inside smart contracts. This results in a substantial capital-efficient solution that gets the WOO Network into the BSC’s Most Valuable Builders Program.

What is WOO token?

WOO is the native token used by WOOFi and the larger WOO product suite. It offers staking rewards, fee discounts, and governance rights across the WOO Network ecosystem.

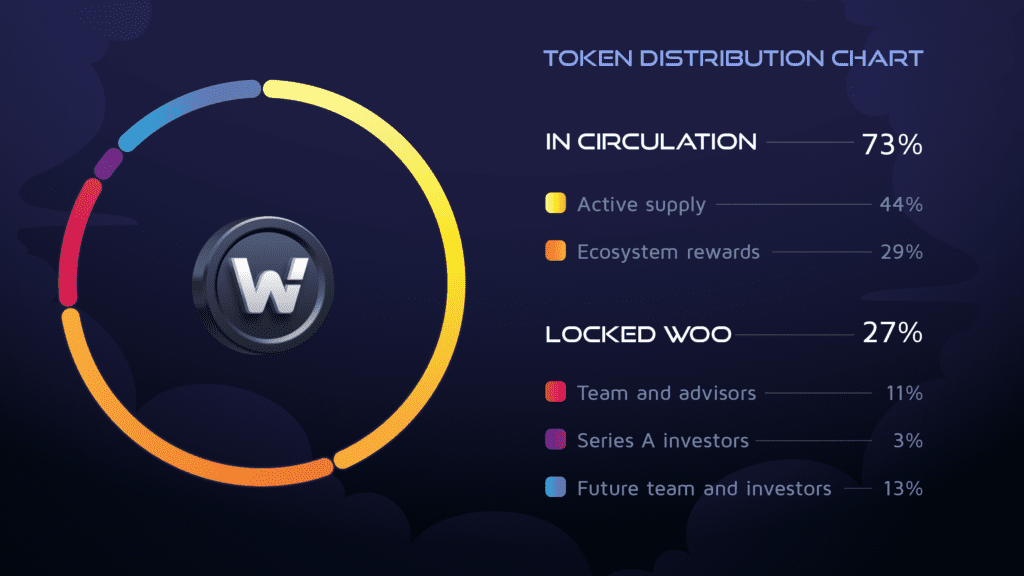

Native tokens have a cap set at 3 billion tokens. After the previous sell-out, the total supply dropped by nearly 25% to 2.2 billion. Check the latest circulation and total WOO supply in Coinecko. This data has been updated to reflect changes from the Q1 2023 token update.

Token Allocation

- Series A investors, which account for about 3% of the supply, will be awarded over 3.5 years, extending through 2025.

- 29% of the supply is retained as a reward for the WOO ecosystem, allocated to incentivize network usage and growth. More than 500 million of these rewards have been placed in a time-locked smart contract for more than 5 years, until 2028.

- 14% of tokens are awarded over 3.5 years to team members, advisors, WOO Ventures projects and Series A investors.

- 13% is retained for the team, advisors or additional investors. These tokens will be required to participate in the 3.5-year empowerment period once allocated.

Token utility

- Trading benefits

- Earn with WOOFi

- Institutional benefits

- Staking yield

- Launchpad

- Community

- Access to social trading (coming soon in 2023)

- Access and discounts for institutional yield strategies (coming soon in 2023)

Fee

WOOFi Swap eliminates these inefficiencies through connecting CeFi liquidity and hedging strategies to avoid temporary loss of LPs. This framework equates to a lower fee, with 0.1% on this platform, compared to Uniswap V2 and similar AMM-style DEXs which typically have a standard fee of 0.3%.

By paying a 0.025% minimum fee with WOOFi Swap, users can swap popular, financially sound blue-chip assets within or on WOOFi-supported chains.

Token holders can stake their WOO tokens on the WOOFi platform to earn revenue from this DEX’s 0.025% minimum swap fee.

Conclusion – WOOFi Review

The unique liquidity model that WOOFi uses is designed to mimic the order book of a traditional exchange. Instead of adopting an automated market creation model (AMM) like most other DEXs, WOOFi leverages an innovative synthetic active market creation method (sPMM) to achieve deeper liquidity. Besides, the more competitive pricing and overall good DeFi trading experience are also a plus for the project.

In the long term, WOOFi Swap will seek to add additional analytics, support more blockchains and assets, more utility for WOO tokens, and provide opportunities for users in the WOO Network ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

Coincu News