Key Points:

- $300 million worth of money flows from centralized exchanges (CEX) to decentralized exchanges (DEX) after the collapse of SVB.

- USDC purchases on DEXs spiked while CEX halted USDC trading.

- The two most prominent cryptocurrencies in the lag market, Bitcoin (BTC) and Ethereum (ETH), also saw substantial volatility.

With the fall of Silicon Valley Bank (SVB), the market saw the movement of funds from centralized exchanges (CEX) to decentralized exchanges (DEX), also with trading volume USDC on DEX skyrocketed.

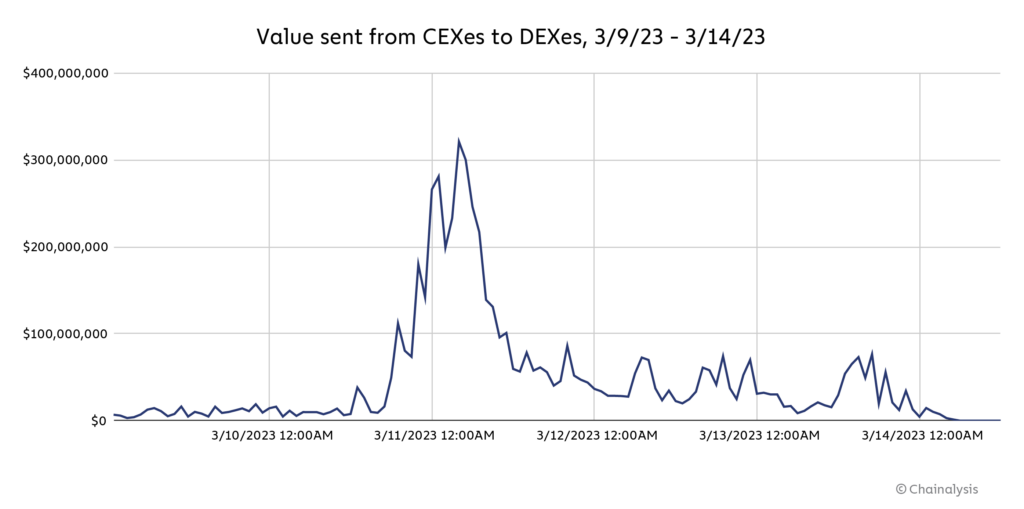

The collapse of Silicon Valley Bank (SVB) led to a massive influx of money from centralized exchanges (CEX) to decentralized exchanges (DEX). Blockchain analytics firm Chainalysis explained in a blog post on March 16 that outflows from centralized exchanges often spike when the market is volatile, as users can become anxious about not being able to access their funds if the exchange fails.

According to Chainalysis data, hourly outflows from CEX to DEX spiked to over $300 million on March 11, shortly after California regulators shut down Silicon Valley Bank.

A similar phenomenon was observed during the collapse of the crypto exchange FTX last year, and there are concerns that the contagion could spread to other crypto companies.

But data from Token Terminal, a blockchain analytics platform, shows that the increase in daily trading volume on significant DEXs was short-lived in both cases.

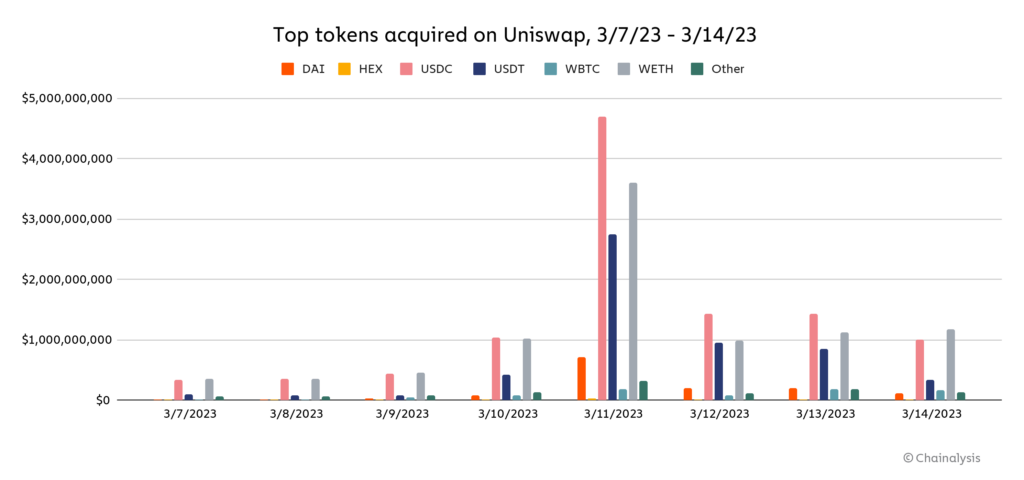

Chainalysis pointed to a surprising increase in USDC purchases on DEXs like Curve3pool and Uniswap, saying: “Some assets have seen a spike in user purchases, but not more than USDC.” users bought USDC when it was relatively cheap and bet it would re-peg to the greenback.

USDC was identified as one of the greatest assets moved to DEX, which was no surprise as USDC dropped after stablecoin issuer Circle announced that it has $3.3 billion in reserves stuck on SVB, causing many CEXs like Coinbase to stop trading USDC temporarily.

Chainalysis noted that what was surprising was the increase in the number of USDC buybacks on major DEXs like Curve3pool and Uniswap.\

“Curve saw acquisitions of USDT and DAI spike over the weekend as USDC depegged – but oddly enough, USDC saw an even bigger spike. This may suggest that some trader foresaw USDC regaining its peg, and sought to acquire it in bulk at a discount.”

The report shared.

Ether is not the only crypto asset with positive price movements since the SVB issue was resolved. Bitcoin followed a similar pattern, falling from $22,150 on March 8 to a one-month low of $19,670 on Friday the 10th, but then recovered to a three-month high of $26,000 on Tuesday. That price action shows the heightened demand for Bitcoin in recent days.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News