Shapella upgrade is set to go live on the Ethereum (ETH) network at epoch 194,048, or on approximately April 12, 2023.

This upgrade will provide many new features and improvements to the Ethereum network. One of the most anticipated improvements is the ability for stakers to withdraw (“unstake”) their deposits. This is a major milestone for Ethereum as it allows stakers to have more control over their funds and is a key step towards the development of a more mature and decentralized ecosystem. This new feature will also enable more people to participate in staking, which will help to secure the network and provide a more reliable infrastructure for decentralized applications. Shapella upgrade is an exciting development for the Ethereum community and is expected to significantly impact the future of the network.

What is Shapella Upgrade?

The Shapella hard fork is an upcoming network upgrade for Ethereum (ETH) that is generating a lot of buzz among crypto enthusiasts. This pivotal event promises to be one of the most significant developments in the crypto space in recent months, as it marks the most radical tokenomic change for the second-largest blockchain in the world.

One of the major changes that Shapella brings to the Ethereum (ETH) network is the ability for users to withdraw their deposits from staking contracts. This is a game-changer, as previously, users were not able to “unstake” their ETH coins once they had been deposited. Shapella’s agenda also includes important changes to the execution layer (Shanghai), consensus layer (Capella), and the Engine API.

It is important to note that the Shapella upgrade is scheduled to be activated on April 12, 2023, at about 10:27 p.m. (UTC). This has led to a lot of speculation about how the upgrade will impact the price of ETH. While the possibility of unlocking funds through Shapella derisks Ethereum (ETH) staking, it may also trigger selling pressure on ETH.

It is also worth mentioning that Ethereum (ETH) node operators will need to upgrade their client software to accommodate the changes brought about by Shapella. Fortunately, upgrades for all versions of consensus and execution layer software are ready.

Despite the potential risks and uncertainties, the Ethereum (ETH) community is eagerly anticipating the activation of Shapella. This hard fork marks a watershed milestone in Ethereum’s (ETH) progress toward full-fledged proof-of-stake (PoS), and it is sure to be a catalyst for further developments and innovations in the crypto space.

What is proof of stake?

Proof of Stake (PoS) is a revolutionary consensus mechanism that is transforming the way decentralized systems operate. It is an alternative to Proof of Work (PoW), which has been the dominant consensus algorithm in the crypto space for years. PoS offers a more democratic and inclusive approach to validate transactions and secure the network, making it accessible to a wider range of individuals and reducing the environmental impact of mining activities.

One of the main benefits of PoS is that it doesn’t require expensive mining equipment to validate transactions. Instead, network participants must lock a certain amount of the native cryptocurrency to become validators and earn rewards. This makes it easier for people who don’t have the financial resources to invest in expensive hardware to participate in the network and earn rewards, thus increasing the network’s inclusivity.

Moreover, PoS is more nature-friendly than PoW because it consumes less energy and reduces the environmental impact of mining activities. This is because PoS validators do not need to solve complex mathematical problems using powerful hardware, which consumes a lot of energy and generates a lot of heat. Instead, they use their stake in the network to validate transactions and secure the network.

There are different types of consensus algorithms based on PoS, such as Proof of Authority (PoA), Delegated Proof of Stake (DPoS), and Liquid Proof of Stake (LPoS), each offering various benefits and drawbacks depending on the network’s needs. PoA, for example, is ideal for private blockchains where identity verification is crucial, while DPoS is more suitable for public blockchains that require faster transaction speeds and scalability.

As of 2023, two of the largest PoS blockchains in the world are Ethereum (ETH) and Cardano (ADA). Ethereum is a popular platform for smart contracts and decentralized applications, while Cardano is focused on scalability and interoperability. Both networks have gained popularity among crypto enthusiasts and investors alike, and their adoption is expected to grow in the coming years.

What is staking in Ethereum (ETH)?

Initially, Ethereum (ETH) was launched as a proof-of-work (PoW) network that operated similarly to Bitcoin (BTC), and was designed to be secure and decentralized. However, in response to the growing concerns about the environmental impact and scalability of PoW, Ethereum (ETH) has been transitioning to proof of stake (PoS) as a more technically advanced, attack-resistant and eco-friendly network. This transition was included in its roadmap, and has been a major focus for the Ethereum (ETH) community in recent years.

In Q4 2020, a deposit contract was launched for Ethereum (ETH) stakers, which allowed anyone to join the staking process by locking 32 Ethers (ETH) as a minimum deposit. This move was seen as a major milestone in Ethereum’s (ETH) transition to PoS, as it provided a way for users to earn rewards by helping to secure the network. However, the minimum deposit of 32 Ethers (ETH) was too high for many users, which led to the emergence of liquid staking derivatives platforms that acted as intermediaries to enable enthusiasts with small deposits to also take part in Ethereum (ETH) staking.

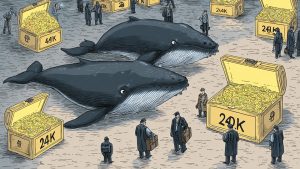

Despite the growing interest in Ethereum (ETH) staking, by default Ethereans were not able to withdraw their coins from deposit contracts. This led to a massive accumulation of over 18 million ETH, which is equivalent to $33.8 billion. While this is a testament to the growing interest in Ethereum (ETH) and its potential for long-term growth, it has also raised concerns about the impact of large sums of locked funds on the overall liquidity of the Ethereum (ETH) ecosystem. As a result, there has been growing interest in developing new solutions that can help to unlock these funds and improve the liquidity of the network, while still maintaining its security and decentralization.

Shapella is coming: Brief guide

Shapella is the name for the highly anticipated upgrade of Ethereum (ETH), which is derived from the city-host of Devcon 2 conference, Shanghai, and the brightest star in the northern constellation of Auriga, Capella. The upgrade is set to affect both the consensus layer (“Capella” part) and execution layer (“Shanghai” part) of the ETH blockchain. One of the main features of Shapella is the activation of the opportunity to “unstake” Ethers from deposit contracts, which allows stakers to withdraw their ETH from staking when the upgrade is live.

In addition to the withdrawal feature, Shapella includes a number of minor changes to the codebase of Ethereum (ETH), most of which are associated with withdrawal processes. As an ETH holder/staker, you may be wondering what you need to do to prepare for Shapella. The preparation procedures should only be considered by the operators of nodes and stakers, and ordinary users do not need to take any action regardless of the type of service they use to store their ETH coins.

However, node operators and stakers should upgrade their software builds to the required versions in order to synchronize with the post-Shapella network. For Consensus layer releases, the required versions are Lighthouse v4.0.1, Lodestar v1.7.0, Nimbus v23.3.2, Prysm v4.0.0, and Teku v23.3.1. For Execution layer releases, the required versions are Besu v23.1.2, Erigon v2.42.0, Go Ethereum (Geth) v1.11.5, and Nethermind v1.17.3. If an operator misses an update, their nodes would synchronize with a deprecated version of Ethereum (ETH) blockchain and would not be able to work with the post-Shapella network.

The Shapella upgrade is an exciting development for the Ethereum (ETH) community, and the ability to withdraw Ethers from staking is an important feature that many stakers have been eagerly anticipating. If you are an ETH holder/staker, it is important to be aware of the required software upgrades and to ensure that your node is synchronized with the post-Shapella network in order to take advantage of the new features and capabilities of the upgraded blockchain.

Conclusion

Scheduled on April 12, 2023, the Ethereum Shapella upgrade is a highly anticipated event in the cryptocurrency world. This upgrade will allow users to unstake ETH from the main contract, providing more flexibility in the management of their digital assets. Node operators are required to upgrade the software packs they are using to ensure the smooth transition to the new protocol.

Despite the excitement surrounding the Ethereum Shapella upgrade, some cryptocurrency analysts are warning of potential bearish effects for the ETH price in the short term. They believe that the influx of unstaked ETH into the market may lead to a temporary oversupply, causing the price to drop.

On the other hand, there are also bullish effects that could come with the Ethereum Shapella upgrade. With the new features and flexibility it brings, more investors may be attracted to the Ethereum ecosystem, increasing demand for ETH in the long run.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News