Key Points:

- Accredited investors and corporate treasuries from outside of the United States will be able to invest in US Treasury bonds on-chain via Maple’s pool.

- Maple intends to offer a community vote on new tokenomics and usefulness for MPL later this year.

- The future pool will let authorized investors earn a dividend by investing their stablecoin holdings in US Treasury bonds.

CEO Sidney Powell announced in a protocol community call chat that Maple’s pool will allow certified investors and budgets of foreign-based companies to invest in U.S. government bonds on-chain across the country.

Maple Finance, a blockchain-based cryptocurrency lending service, is proposing to build a pool of lending fund investments in US government bonds, according to co-founder and CEO Sidney Powell during a community call on Tuesday.

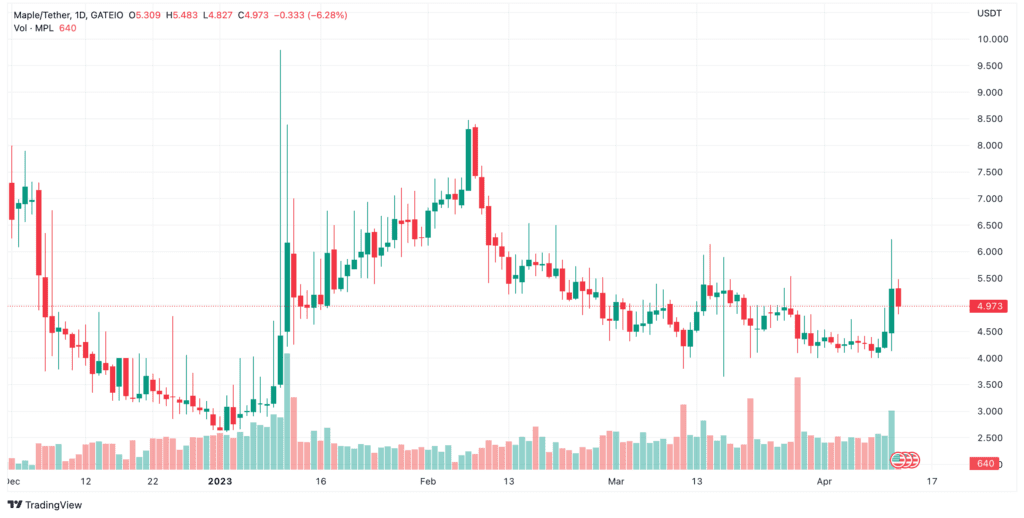

Powell also said that Maple plans to have a community vote later this year to assess new tokenomics and the use of the MPL token. MPL has risen by more than 20% ahead of the community call. But, because of market instability, its price has decreased to $5 at present.

These changes come as the platform recovers from a dismal year for cryptocurrency lending, which saw loan defaults. With the unexpected collapse of the FTX market in November, Maple faced $36 million in defaults, resulting in significant losses for liquidity providers.

As part of the protocol’s endeavor to market itself as a platform, Maple issued an enhanced version of its platform late last year and started a loan filing for taxes received last month. Credit platform that connects conventional finance with blockchain technology.

Powell said on the call that real estate financing would be a major trend. The planned pool will enable qualified investors and offshore corporate treasuries to profitably invest their steady cash in US government bonds.

The protocol anticipates a pool request since crypto investors are searching for returns on conventional assets such as government bonds, but trust in the banking system has plummeted in the aftermath of the recent financial explosions in the United States.

Powell said on the call that Maple is also working on new lending products. Borrowers will be able to manage their secured position using a new tool called Maple Prime. The protocol is designed to grow into unlimited-time lending, enabling borrowers to obtain lines of credit with no maturity date.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News