Uniswap V3 is one of the most successful DEX for digital crypto. The latest Uniswap (V3) version introduces several new features, notably Concentrated Liquidity, which allows liquidity providers to add liquidity within a specific price range. The article will find out what this Concentrated Liquidity model is and what it has unique.

What is Concentrated Liquidity in Uniswap V3?

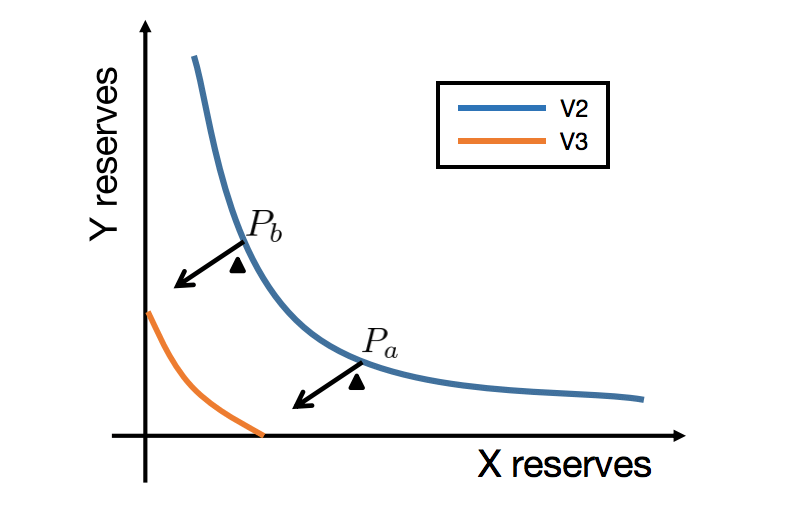

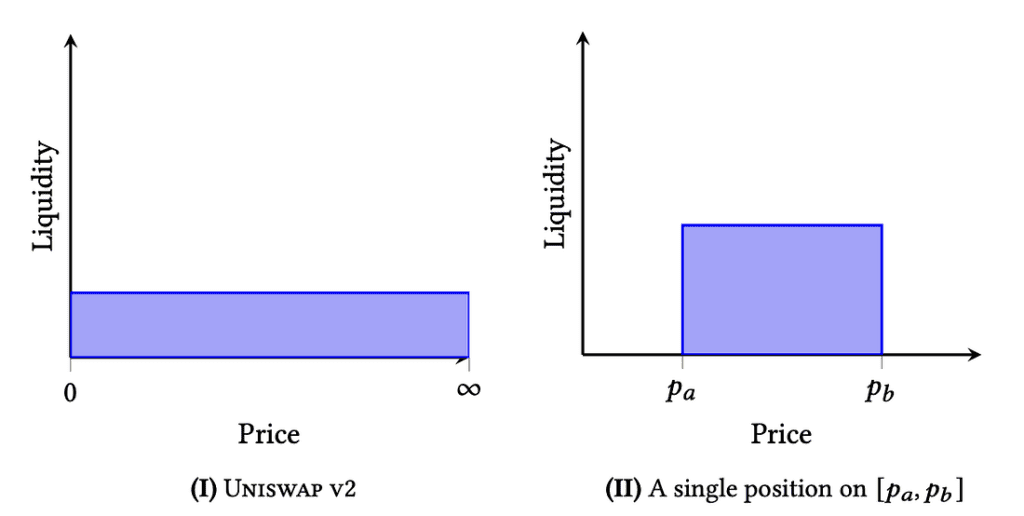

The defining idea of Uniswap v3 is centralized liquidity: liquidity distributed within a custom price range. In previous versions, liquidity was evenly distributed along the price line between 0 and infinity.

The former uniform distribution allows trading across the entire price range (0, ∞) without losing liquidity. In many pools, however, much of the liquidity is never used.

Consider stablecoin pairs, where the relative prices of two assets are relatively stable. Liquidity outside the typical price range of a stablecoin pair is rarely touched. For example, the DAI/USDC v2 pair uses ~0.50% of total available capital to trade between $0.99 and $1.01, a price range where LPs are expected to see high volume and earn the most fees.

With v3, liquidity providers can concentrate their capital on smaller price ranges (0, ∞). For example, in a stablecoin/stablecoin pair, the LP may choose to allocate capital only for the 0.99 – 1.01 range. As a result, traders are provided with deeper liquidity at average prices and LPs earn more trading fees with their capital. Uniswap V3 calls liquidity concentrated over a finite period of a position. LPs can have many different positions on each pool, creating individual price lines that reflect the preferences of each LP.

With the concentration of liquidity on Uniswap v3, that means you can set a certain price range where you provide liquidity. This is one way to reduce your impermanent losses. This range means you earn a fee if the market price is within your chosen range. One of the aspects of this new system is that liquidity providers will need to reset their price ranges in a volatile market to optimize profits.

How Concentrated Liquidity Works

In the new model, liquidity can be allocated to a range of prices, resulting in what is known as a concentrated liquidity position. LPs can open as many positions in the pool as they like, thus creating unique price curves that match their personal view of the market using what are known as range orders.

Concentrating liquidity around current prices and updating custom positions according to price changes is an effective strategy to maximize profits while limiting the risk of asset devaluation. The tighter the range set for a concentrated liquidity position, the greater the fee revenue you will earn, and vice versa. LPs can still choose to offer liquidity across the entire curve, but they will earn less in trading fees than choosing a smaller price range.

As the price fluctuates, liquidity from different LPs is used to execute swaps. Thus, the user is making a trade based on the aggregated liquidity from all the liquidity positions covering the current price. It makes no difference to the liquidity recipients that the transaction their swaps are in use.

Benefit

First introduced by Uniswap v3, centralized liquidity aims to improve capital efficiency and compensate for the mismatch of the original x*y = k formula in the market maker model standard auto field.

As the price of an asset rises or falls, it may exit the price bounds that LPs have set in a position. When the price exits a position’s interval, the position’s liquidity is no longer active and no longer earns fees.

As price moves in one direction, LPs gain more of the one asset as swappers demand the other, until their entire liquidity consists of only one asset. (In v2, we don’t typically see this behavior because LPs rarely reach the upper or lower bound of the price of two assets, i.e., 0 and ∞). If the price ever reenters the interval, the liquidity becomes active again, and in-range LPs begin earning fees once more.

Importantly, LPs are free to create as many positions as they see fit, each with its own price interval. Concentrated liquidity serves as a mechanism to let the market decide what a sensible distribution of liquidity is, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are, as rational LPs are incentivized to concentrate their liquidity while providing that their liquidity remains active.

This is one way to reduce your impermanent losses. This range means you earn a fee if the market price is within your chosen range. One of the aspects of this new system is that liquidity providers will need to reset their price ranges in a volatile market to optimize profits. This account becomes more costly for suppliers with less capital due to gas costs associated with price adjustments.

Providing liquidity on Uniswap v3 requires a more active presence than in previous platform versions. Recent analysis has shown that active liquidity providers will most likely outperform passive liquidity providers. Currently, services under construction will handle active management to remove complexity for liquidity providers looking for a passive solution.

Optimized Concentrated Liquidity

According to Uniswap, the once-continuous price-space spectrum has been partitioned by ticks to achieve centralized liquidity.

Ticks are boundaries between discrete areas in the price space. The ticks are spaced so that a 1-tick increase or decrease represents a 0.01% increase or decrease in price at any given point in the price space. Marks function as boundaries for liquid positions. When a position is created, the vendor must select the lower and upper checkmarks that will represent the outline of their position.

As the spot price changes during the swap, the pool contract will continuously swap the outgoing asset for the inbound asset, gradually using all available liquidity over the current tick period until the next tick is reached. At this point, the contract moves to a new tick and activates any dormant liquidity in a position whose boundary at the new tick becomes active.

While each group has the same basic number of ticks, in practice only a fraction of them can serve as active ticks. Due to the nature of the v3 smart contract, the tick distance is directly related to the swap fee. Lower fee tiers allow closer active ticks, and higher fees allow for a relatively wider gap of potentially active ticks.

Although inactive ticks have no effect on transaction costs during the swap, crossing an active tick increases the cost of the transaction it was crossed, as overtick ticks activate liquidity in any new position using certain tick as border.

In areas where capital efficiency is paramount, such as stable coin pairs, narrower tick spacing increases the granularity of liquidity provision and will potentially impact lower prices on swaps – the price of stable coin swaps is significantly improved as a result.

Pros and Cons

| Pros | Cons |

| Increase liquidity for trading pairs; Minimize slippage for Traders; Increase the efficiency of capital use for LP; Unleash individual liquidity strategies tailored to each LP; Large liquidity is the premise to exploit other DeFi products like Derivatives more efficiently. | First, similar to the traditional liquidity supply model, Impermanent loss is inevitable; Not suitable for projects with large price fluctuations in a short time; Ask LPs to brainstorm and have a more specific strategy. |

Conclusion

In general, the introduction of concentrated liquidity has lead to a significant decrease in fee revenue for passive LPs. While for the ETH-USDC pair, active LPs now earn more fees (accompanied by a higher risk) than passive LPs did in pre Uniswap v3 times, active LPs actually earns less from fees now than passive LPs used to for the USDT-USDC pair. In the end, the main beneficiary of the introduction of concentrated liquidity may be traders who profit from reduced slippage.

It will be interesting to see how the liquidity provision market evolves over time and to broaden the analysis in the future when data covering a longer period of time becomes available.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News