Pear Protocol, an on-chain order matching trading platform, has announced the completion of a $1.25 million funding round, with participation from Flow Ventures, RNR Capital, Portico Ventures, and JY Capital. The project is still under development and in an area that is still less popular, but it can see the potential for synergies in derivatives trading. Users can deposit stable monetary assets and earn income through the investment plan set by the project. In this Pear Protocol review, let’s find out through the article below.

About Pear Protocol

Pear Protocol is an on-chain spread trading platform launched on Ethereum layer-2 Arbitrum. It allows users to create leveraged long and short positions on different assets using the concept of pair trading.

According to information in the Medium article about Pear Protocol review, the founder of the project is the former founder of Reimagined Finance and ReFi Pro. Reimagined Finance is an on-chain active asset management project. Users can deposit stable monetary assets and earn income through the investment plan set forth by the project.

On-chain spread trading platform Pear Protocol has secured $1.25 million in its seed investment round, allowing users to create leveraged buy and sell positions on various assets.

It is backed by investors from Flow Ventures, RNR Capital, Portico Ventures, and JY Capital, among others.

What is pair trading?

Pairs trading refers to a market-neutral investment strategy recommended by an analytical team founded by Nunzio Tartaglia, a trader at the Wall Street investment bank Morgan Stanley in the mid-1980s, whose members are mainly physicists, mathematicians, and computer scientists. The strategy tracks the performance of two historically correlated securities. When the correlation between two guards temporarily weakens, i.e., one stock goes up while the other falls in price, a currency pair trade will short the good-performing stock and buy the underperforming stock efficiently, thinking that both “differences” between them will eventually converge.

Pairs trading is a well-established trading style in traditional markets. It is seen as an attractive and popular way of trading for retailers and institutions, but we see it a little more in cryptocurrencies.

Currently, it is highly capital inefficient, difficult to reconcile and report, inconvenient to perform on CEX, and challenging to set up on-chain. Despite innovative liquidity models and robust architecture, DEX volume per DEX represents less than 2% of total crypto futures trading volume. While current protocols are sufficient for basic trading needs, there is an underserved area of the market, so the opportunity on-chain is enormous and with primitive trading like Pear coming soon. market.

According to the developers, daily futures trading volume typically exceeds $50 billion on CEX and $1.5 billion on DEX. The annual fee collected by the DEX alone exceeds $1 billion! They anticipate the CEX to DEX migration to continue, with a convincing opportunity for Pear to capture both existing and new market share.

How Pear Protocol works

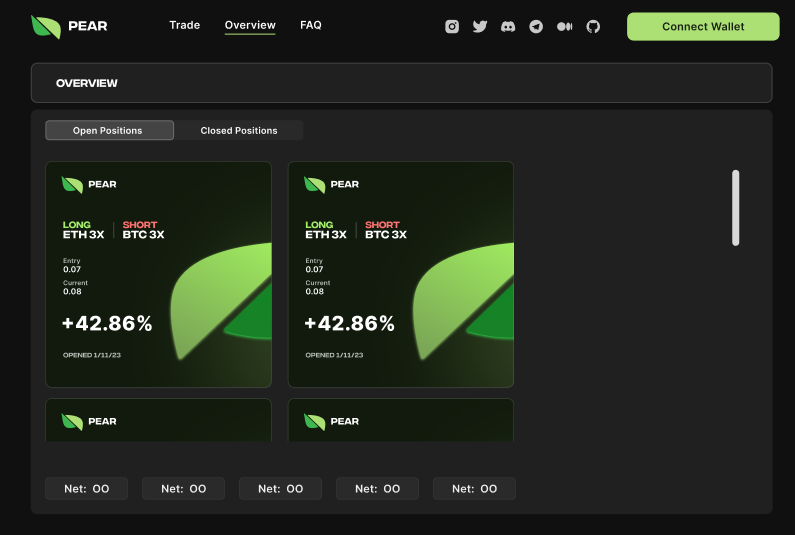

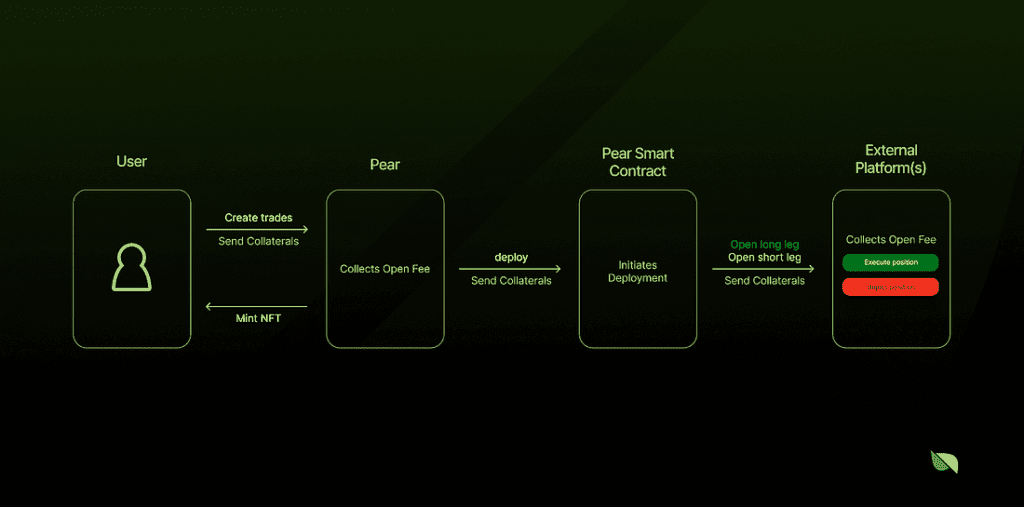

Pear establishes the need to trade in pairs. Users will be able to use USDC as collateral, set up long/short leverage pairs with just a few clicks and execute trades in a single trade. The positions on the platform are represented as ERC-721 (NFT token receipt).

According to Pear Protocol review, it will not build an independent liquidity pool but will use the liquidity of the existing derivatives platform on Arbitrum, and Pear Protocol only serves as a hybrid product for users. Users can choose to margin and short Ethereum while buying Bitcoin, while Pear will simultaneously open long and short positions in other derivative protocols.

Pear Protocol Review: Outstanding Features

Liquidity Agnostic is one of the key differentiators. This allows the platform to build on liquidity from several leading on-chain sources, ensuring users don’t have to worry about finding the best pairs to trade. They can instead focus on making informed decisions while Pear Protocol takes care of routing trades to the best sources of liquidity available.

To start with Pear Protocol Review is designed to manage trades efficiently, from opening to closing positions. The platform utilizes an ERC-721 tokenized position, allowing users to view open positions, visualize their current PnL, and seamlessly move their position to another wallet. This approach paves the way for exciting lending, borrowing, secondary market trading, and derivative product opportunities.

Pear Protocol’s innovative ERC-721 encryption slots represent a significant step forward in the DeFi landscape. By issuing NFTs for each trading position, users can easily visualize their open positions and monitor their PnL in real time, managing their portfolio correctly. The inherent composability of the ERC-721 token opens up many possibilities, including lending and borrowing.

Additionally, Pear NFTs can be listed and traded on secondary markets like DEXs and NFT marketplaces, enabling users to buy and sell open positions without directly interacting with the underlying strategy. This fosters greater liquidity, price discovery, and risk management.

Furthermore, tokenized positions open the door for developers to create innovative derivative products, such as index tokens, leveraged tokens, and inverse tokens, as well as leverage emerging NFT perp and options products from platforms like NFTperp, Hook Protocol, and Wasabi Protocol.

Pear Protocol Review: In the case of used

DAO Treasury and Portfolio Manager

DAO treasury funds in excess of $13.4 billion are a lot of on-chain capital that needs to be actively managed. Feedback from other DAOs about a platform like Pear has been overwhelmingly positive. Active on-chain portfolio managers find value in a single store for leveraged arbitrage. Argument trading, hedging, nuanced risk exposure, and market neutrality are all powered by the pairs trading architecture.

Narrative Trading

Narrative-based transactions are a penny in the crypto market. Cryptocurrency trading focuses on fast-forming stories – and often more than one story. The trading communities investigated by the project have spoken to are very interested in a platform that prioritizes the convenience of narrative-based trading.

For example:

- May 2022: $LUNA token price drop as a result of 3AC/Terralabs

- November 2022: $FTT token price drops due to the collapse of FTX

- November 2022: Token prices of centralized exchanges decrease due to FUD of their proof of reserve following the FTX crash (e.g., Kucoin, Huobi, Bybit, etc.)

- January 2023: Token price hike of AI projects due to massive growth in AI narrative

- February 2023: Most recent FUD-induced BNB token volatility on Binance operations and reserves

- February 2023: Token prices of ZK rollup projects increase due to the growth of ZK rollup narrative

- Ongoing Stories: Flippening (ETH vs BTC), Liquid Bet Derivatives (LSD), and growing benchmark yield dialogue

Dozens of micro-stories emerge between these. Pairs trading will complement these narratives nicely – and fortunately, Pear will soon hit the market to allow for sophisticated (and degenerate) speculation on the next wave of stories.

Pear Protocol Review: Token Distribution & Emission

The $PEAR token distribution is designed with fairness and long-term sustainability in mind. Out of the total hard-capped supply of 1 billion tokens, 20% (200 million tokens) are allocated to private and public sale participants. Thus far, 84 million tokens have been assigned to the private sale, with the remaining 116 million to be sold during the public sale at $0.025 per token.

The remaining token distribution is allocated to the Pear Treasury, Liquidity Pool, Team & Development, Trading Incentives/Emissions, and the $REFI Community.

As for the emission schedule, public sale tokens have a 1-year cliff followed by a 1-year linear daily vesting schedule after the Token Generation Event (TGE). This means that 50% of the tokens will be fully unlocked at the first-year mark, with the remaining 50% linearly vested throughout the second year, ensuring a stable token supply and promoting long-term growth.

Pear Protocol Review: Public Token Sale

Pear Protocol is gearing up for an exciting public token sale, with plans to raise up to $2.9 million in funding. The sale will take place on the Arbitrum Network and is set to begin at 12:00 UTC on Friday, April 14th. The public sale token price is fixed at $0.025 per $PEAR token, and the sale will last for ten days, ending on Monday, April 24th.

Participating in the public sale is simple. Prospective investors can use a variety of wallets, including Metamask, Rainbow, Coinbase Wallet, and any Wallet Connect integration. There is no minimum investment amount, making it accessible for everyone, but the maximum investment per wallet is capped at $100,000 USDC.

The $PEAR token will play a pivotal role in the Pear Protocol ecosystem. Token holders who stake $PEAR will receive benefits in the form of USDC yield and fee rebates or reductions. Additionally, token holders will be able to participate in governance decisions, ensuring the platform remains community-driven and responsive to user needs.

Conclusion

By revolutionizing pair-to-pair trading and leveraging the power of blockchain technology, Pear Protocol reivew has the potential to create a truly user-friendly and accessible trading platform for everyone. As the Pear Protocol team continues to innovate and build on their platform, the upcoming public token sale offers a unique opportunity for investors to support and participate in the project.

Pear Protocol review also says it will roll out more protocol updates in the months leading up to the launch. Tokenomics, our timeline, combined efforts, and roadmap will be detailed in due course.

Join us to keep track of news: https://linktr.ee/coincu

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.