Key Points:

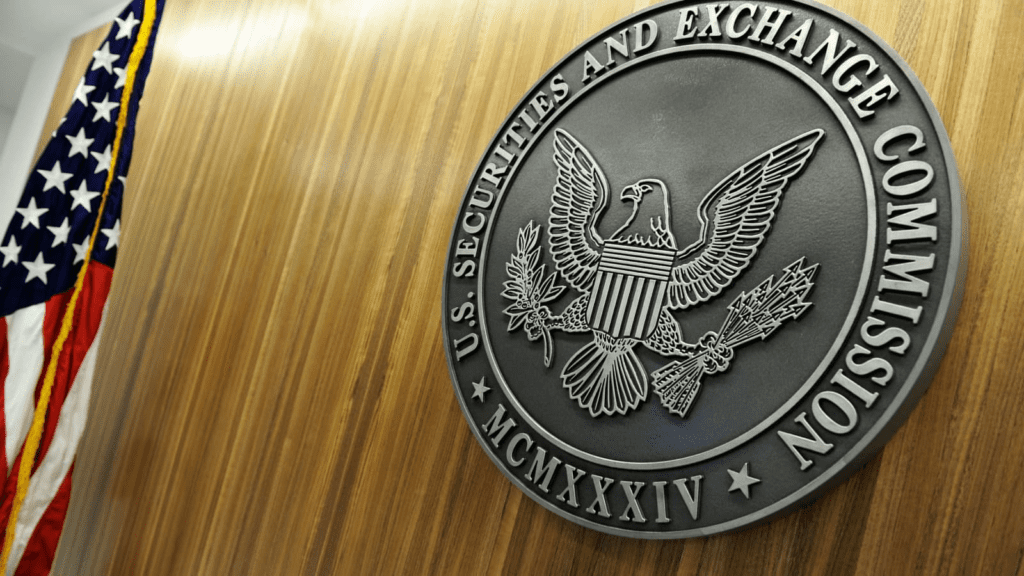

- The Securities and Exchange Commission has modernized disclosure requirements for equity security repurchases.

- The amendments will increase transparency and integrity in which issuers transact their securities, benefiting investors and markets.

- Issuers must now disclose daily quantitative share repurchase information and narrative information about their share repurchase activities.

The SEC has amended equity security repurchase disclosure requirements to enhance transparency. Issuers must disclose daily quantitative share repurchase information and narrative information.

The Securities and Exchange Commission recently adopted amendments to modernize the requirements for disclosing information about an issuer’s equity security repurchases. These amendments enhance disclosure and provide investors with the information required to assess the purposes and effects of share repurchases.

According to Gary Gensler, the amendments will increase transparency and integrity in issuing transactions. Through the required disclosures, investors will be able to assess issuer buyback programs better and reduce information asymmetries between issuers and investors. This ultimately benefits investors, issuers, and the markets as a whole.

“Today’s amendments will increase the transparency and integrity of this significant means by which issuers transact in their own securities. Through these disclosures, investors will be able to better assess issuer buyback programs. The disclosures will also help lessen some of the information asymmetries inherent between issuers and investors in buybacks. That’s good for investors, issuers, and the markets.”

said Gary Gensler

The amendments will require issuers to disclose daily quantitative share repurchase information either quarterly or semi-annually, providing a comprehensive view of their share repurchase activity. The required disclosures include the number of shares repurchased that day, the average price paid for the claims, and other relevant information.

Furthermore, issuers must check whether certain officers and directors traded in the relevant securities in the four business days before or after the announcement of the repurchase plan or program. This provides investors with a better understanding of insider trading activities.

In addition to the quantitative disclosures, the amendments expand the narrative repurchase disclosure requirements. Issuers must now disclose the objectives or rationales for share repurchases, the process or criteria used to determine the number of repurchases, and any policies and procedures relating to purchases and sales of the issuer’s securities during a repurchase program by its officers and directors, including any restrictions on such transactions.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News