Key Points:

- According to a recent Goldman Sachs survey, interest in crypto assets increased among home offices last year.

- The number of family offices that are not involved in cryptocurrency and are disinterested in future investments has increased to 62%, up from 39% in 2021.

- Also, the percentage of individuals exploring future crypto investments has fallen from 45% to 12%.

According to a recent study of Goldman Sachs’ institutional family office clients, there has been a dramatic drop in interest in cryptocurrencies among the rich elite, owing partly to the extraordinary market volatility seen over the previous year.

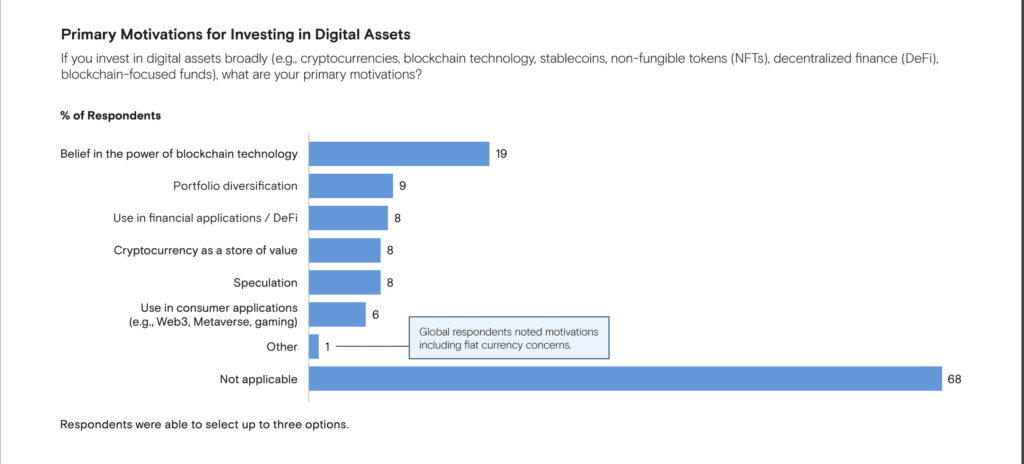

According to a Goldman Sachs analysis titled “Eyes on the Horizon: Family Office Investment Insights,” issued on May 8, 32% of family offices now have interests in digital assets. Cryptocurrencies, nonfungible tokens (NFTs), decentralized finance (DeFi), and blockchain-focused funds are all included in this category.

The proportion of family offices that are not involved in cryptocurrency and do not intend to participate in it in the future had climbed to 62% from 39% in 2021 when the investment banking giant first conducted its study.

According to the most recent study, the proportion of individuals possibly interested in crypto investment in the future has also dropped to 12% from 45%.

When asked why they invest in digital assets, the majority (19%) indicated their conviction in the potential of blockchain technology, with just 8% and 9% citing speculation and portfolio diversification, respectively.

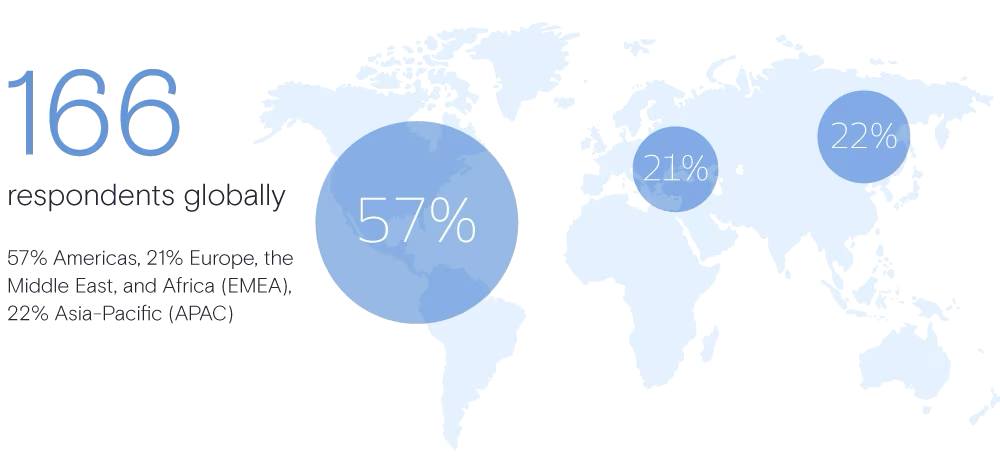

The poll collected answers from 166 family offices worldwide, with a net worth of at least $500 million (93%) and 72% possessing at least $1 billion. This year’s study was performed in January and February.

According to Goldman Sachs’ 2021 survey, nearly half of the family offices surveyed were interested in adding cryptocurrency to their investment portfolios, owing to factors such as higher inflation, prolonged low rates, and other macroeconomic developments following a year of unprecedented global monetary and fiscal stimulus.

These investors, however, are now more focused on raising allocations to public and private stocks and adding fixed-income exposure to capitalize on higher-rate prospects.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News