Key Points:

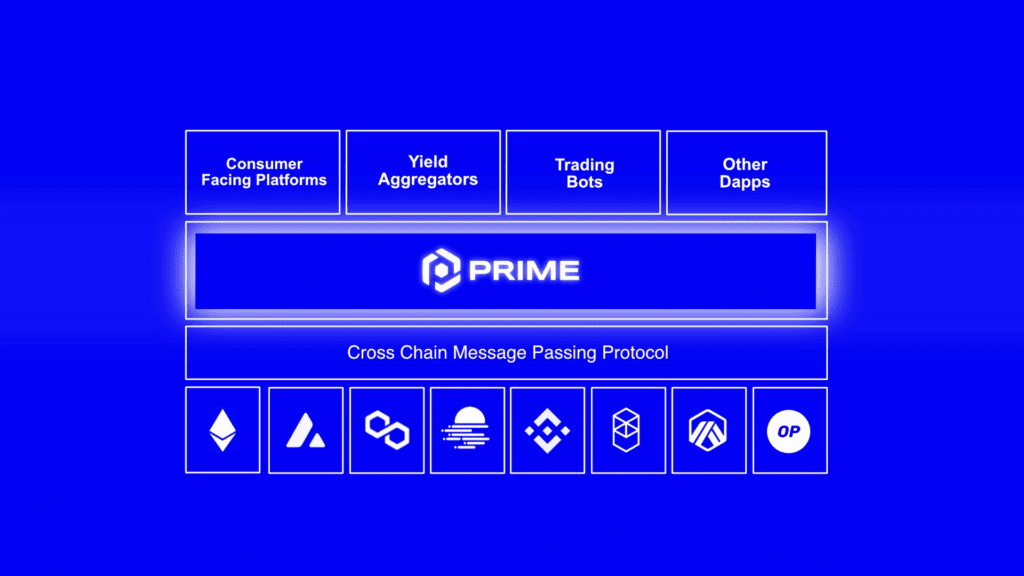

- The Prime Protocol was released on Moonbeam, Ethereum, Arbitrum, and Avalanche.

- It provides cross-chain prime brokerage, aiming to remove the need for token bridges, swaps, or wrapped assets.

- For interchain communication, the protocol employs Axelar’s Generic Message Passing.

According to a news release issued on Tuesday, Prime Protocol, a decentralized finance-based (DeFi) prime brokerage, has launched an asset-based loan service that intends to remove the requirement for inter-blockchain token transfers.

For interchain communication, the protocol employs Axelar’s Generic Message Passing, allowing users to cross-margin their entire portfolio and borrow against all of their on-chain assets through a single protocol.

It will allow users to borrow against the value of their whole asset portfolio across a number of supported blockchains, including Moonbeam, Ethereum, Arbitrum, and Avalanche, without the usage of token bridges.

According to Colney, Prime resolves infrastructure for that user to have a smooth experience by enabling users to receive quick liquidity on the chain, regardless of where collateral has been locked up.

After a deposit is made, Axelar will send a message and record the transaction on Moonbeam. When a user wishes to withdraw or borrow funds, they may do so using any chain allowed by the Prime protocol. After that, Axelar facilitates the message and distributes the tokens to the user’s preferred network.

Token bridges, which transfer cryptocurrency tokens from one blockchain network to another, might be vulnerable to attacks, possibly resulting in users losing their crypto to hackers.

Derek Yoo, CEO of PureStake, a development team for Moonbeam, stated:

“This is a significant security enhancement for the entire DeFi industry because it eliminates manual bridging as a point of vulnerability that is often exploited.”

Current DeFi protocol infrastructures primarily allow for the transfer of assets backed by a single kind of collateral on a single blockchain, according to Yoo.

Prime also includes “Universal Access,” a never-before-seen functionality built directly into the protocol that enables users to initiate a transaction on any chain supported by the protocol while utilizing assets they already possess on another chain as gas fees.

Prime on Mainnet offers all of the protocol’s capabilities, including Money Markets, Universal Access, and, of course, the basic cross-chain capability.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News