UAE’s Royal Group Bets Billions Against US Stocks Amid Growing Global Recession Fears

Key Points:

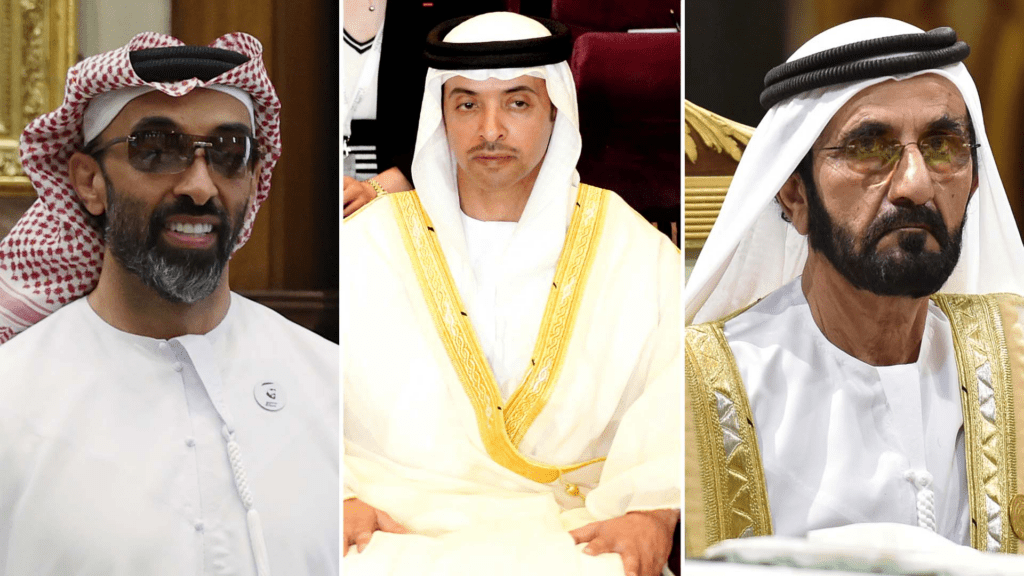

- The Royal Group, a conglomerate chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan, has built a short position worth billions of dollars in US stocks, betting against a potential global recession.

- As concerns of a worldwide economic slowdown continue to grow, the Royal Group has shifted more of its portfolio into short-term US Treasuries and is investing more in commodities and cryptocurrency.

According to Bloomberg, an investment firm controlled by a top Abu Dhabi royal has built a short position worth billions of dollars in US stocks.

The Royal Group, a conglomerate chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan, manages one of the world’s most enormous family fortunes through a vast network of subsidiaries.

As concerns of a global economic slowdown continue to grow, the Royal Group has become more negative on equities at the start of the year and shifted more of its portfolio into short-term US Treasuries.

They are also investing more in commodities and cryptocurrency, with plans to invest up to $10 billion into US and European stocks and other assets impacted by these concerns. It is unknown which stocks or sectors the Royal Group is betting against, and officials at the firm have declined to comment.

It is worth noting that Sheik Tahnoon’s firm has recently focused on investments in the developing world. The Royal Group has emerged as an influential player in global finance due to the drying up of funds in many markets worldwide.

With the potential credit crunch and rising oil prices threatening to weaken growth further while raising inflation, Bloomberg Economics anticipates that the US will fall into a recession in July two months earlier than initially expected.

Despite this, the Royal Group plans to increase its exposure to the US once valuations improve and the Federal Reserve signals it is preparing to cut interest rates. The group has revised its buy list of stocks in the US market and has already taken profits on some of its investments in late 2018.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News