Key Points:

- Fantom network has the largest proportion of Multichain’s TVL, accounting for 36.7% and having $1.66 billion in assets.

- Despite rumors of Multichain team arrests and lack of communication, on-chain data does not reveal a massive outflow of capital from Fantom.

- Multichain handles 81% of Fantom’s total stablecoin MC, although some cross-chain routes were temporarily suspended due to force majeure.

Fantom Network, accounting for the highest proportion of Multichain’s TVL, has not experienced significant outflow despite the Multichain arrest rumors and lack of communication from the team.

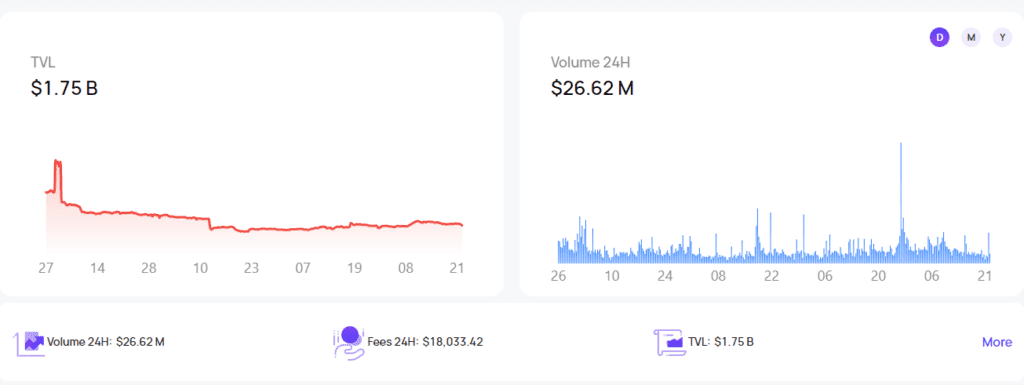

According to Wu blockchain, the Fantom network accounts for the highest proportion of Multichain’s $1.76 billion TVL, reaching 36.7%. The assets on the Fantom network are about $1.66 billion, and nearly 40% of the assets are wrapped assets of Multichain.

The main stablecoin on Fantom is 191 million USDC and 82 million USDT assets are issued by Multichain. Although Multichain is Fantom’s official cross-chain bridge, most chains operate normally, and there is no sign of a de-peg of USDC and USDT on Fantom.

Previously, a Twitter account known as “Ignas | DeFi Research” reported the rumors spreading on Twitter that the Multichain team had been arrested leading to a FUD resulting in a 5x increase in daily bridging volume.

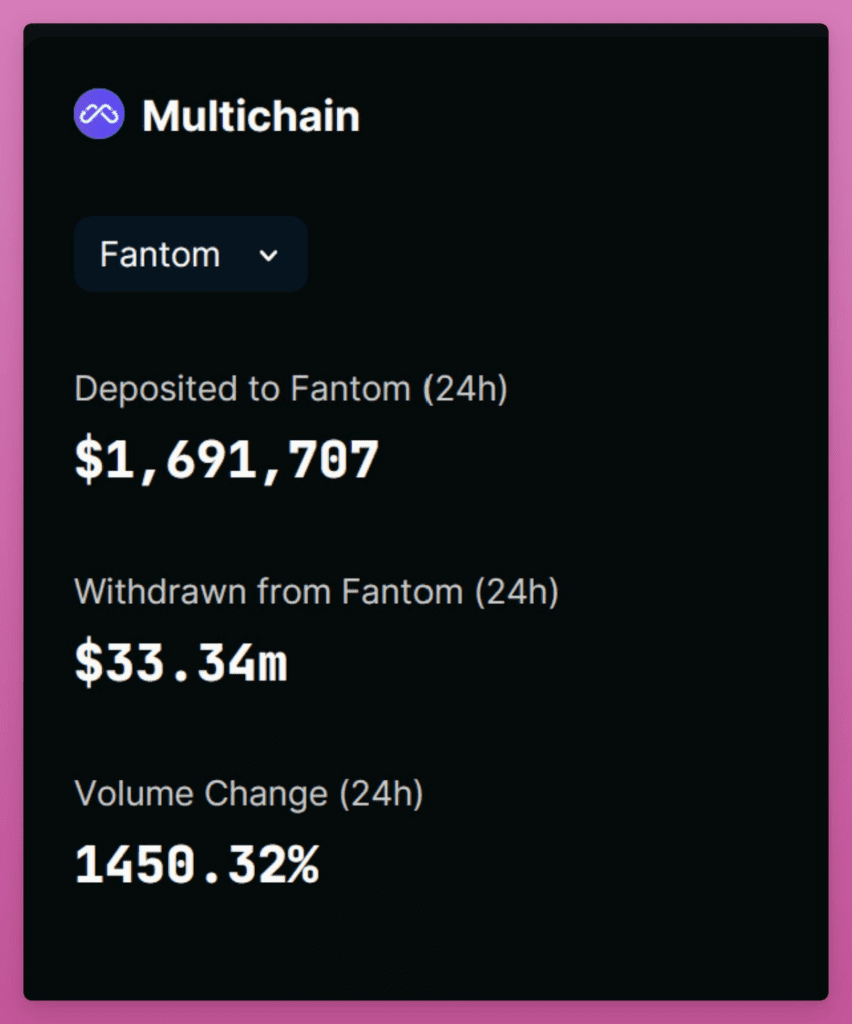

Despite this, the bridging volumes do not show signs of panic. “An Ape’s Prologue” reported that Fantom is the most exposed to Multichain’s wrapped tokens. 35% of its TVL locked depends on these wrappers. Multichain issues 40% of non-$FTM assets ($650M) and handles 81% of Fantom’s total stablecoin MC.

Although the amount withdrawn was larger than deposited by $18M, it is only 1% of its total TVL of $1.78B USD. Not much panic was seen.

Fantom should have experienced a significant outflow of TVL due to its reliance on Multichain. Although TVL has dropped by 9.55% in USD, adjusting for the price of FTM, the data shows no significant outflow of capital. The clearest sign of panic is the Multichain LPs on Fantom.

A total of $33M USD has been withdrawn by LPs from Fantom, with only $1.7M in deposits. Multichain reported that “some of the cross-chain routes are unavailable due to force majeure” and that Kava, zkSync, and Polygon zkEVM routes were temporarily suspended. Eighty-three transactions were pending for more than a day.

It is important to note that on-chain data does not reveal a massive capital outflow. However, the lack of communication from the team is worrying. The current Multichain CEO, Zhaojun, hasn’t been online in a week.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News