Key Points:

- Hayes predicts increased money printing by central banks due to the ongoing global banking crisis, which will drive up the price of Bitcoin.

- He believes the BTC bull market will begin in late Q3 and early Q4 this year.

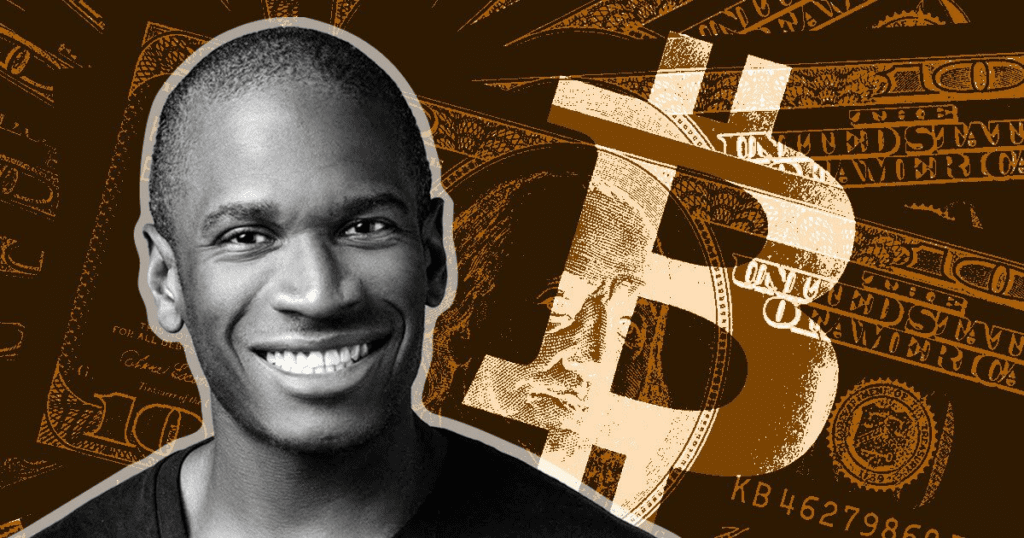

Arthur Hayes, the former CEO of BitMEX, discusses the impact of fiat banking and how it will ultimately lead to increased money printing by central banks, driving up the price of Bitcoin. He believes the BTC bull market will begin in late Q3 and early Q4 this year.

Arthur Hayes, the co-founder and former CEO of BitMEX, recently published an essay discussing the state of the fiat banking system and its impact on Bitcoin. Hayes believes the ongoing global banking crisis will ultimately lead to increased money printing by central banks, which will drive up the price of risk assets, including Bitcoin. Despite recent dips in Bitcoin’s price, Hayes remains bullish on the cryptocurrency’s long-term prospects.

Hayes notes that Bitcoin’s price is a function of fiat liquidity and technology. While most of his essays this year have focused on global macro events that influence the fiat liquidity side of the equation, he hopes to transition to writing about exciting things happening on the technological front of Bitcoin and crypto more broadly.

Hayes believes the real king of crypto bull market will begin in this year’s late third and early fourth quarter. He advises investors to be patient and not get too caught in short-term price fluctuations. He also encourages readers to take a vacation and enjoy nature and the company of friends and family, because, come to fall, they better be strapped into their trading spaceship, ready for liftoff.

Hayes delves into why, contrary to common monetary theory, raising interest rates will cause the quantity of money and inflation to rise, not fall. He argues that this sets up a situation wherein regardless of which path the Fed chooses, be it to hike or cut rates, they will accelerate inflation and catalyze a general rush for the exits from the parasitic fiat monetary financial system.

Ultimately, Hayes believes that money printing, yield curve control, bank failures, etc., will all come to pass, starting in America and eventually spreading to all major fiat monetary systems. He is confident that Bitcoin will remain a valuable asset for investors seeking to protect their wealth from the negative effects of inflation and currency devaluation.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News