Key Points:

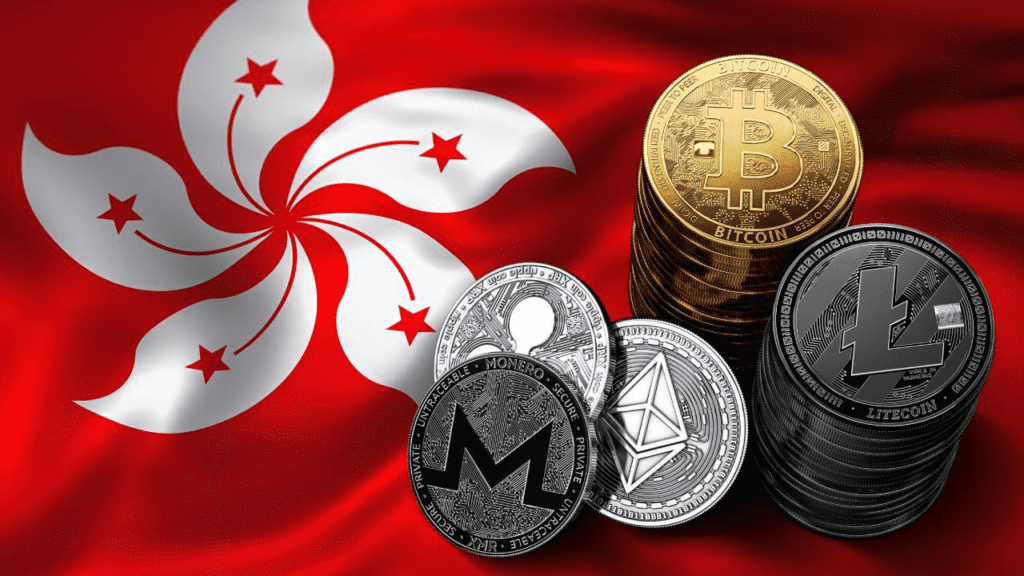

- Hong Kong’s Securities and Futures Commission (SFC) expresses support for tokenisation in finance, with plans to amend policies for better access to cryptocurrency investments.

- The SFC ensures investor protection and cybersecurity while exploring the benefits of tokenisation for improved efficiency.

- Franklin Templeton Investments is optimistic about the potential of blockchain and tokenisation, focusing on digital assets and a recent US-registered mutual fund using Polygon blockchain for transactions and record-keeping.

Hong Kong’s SFC supports tokenisation in finance, ensuring cybersecurity and investor protection. Blockchain enhances efficiency. Franklin Templeton also bullish.

Hong Kong’s Securities and Futures Commission (SFC) recently expressed its support for the use of tokenisation in the financial industry. Elizabeth Wong, head of the financial technology department of the SFC, said that the commission will continue to amend and evolve policies for better access to cryptocurrency investments.

The SFC has already provided certain regulatory oversight and investor protection to licensed virtual-asset platforms. Wong added that the SFC will apply the same code of conduct to fund managers looking to invest portfolios in virtual assets. Blockchain technology can ensure or enhance efficiency, according to Wong.

The watchdog is actively looking into the benefits of tokenisation while also ensuring that investors are not any worse off. Cybersecurity is the biggest concern for the SFC, ensuring that the token is free from hacking and has no vulnerabilities. The commission is keen to understand these challenges and is open to working with industry players.

This sentiment is shared by Brit Blakeney, senior vice-president of digital strategy and wealth management in Asia at Franklin Templeton Investments, who said that the industry has only scratched the surface regarding the potential of blockchain and tokenisation. Franklin Templeton is currently focused on a digital assets strategy and plans to grow its focus and presence in digital assets. The American asset manager in April announced a US-registered mutual fund that uses Polygon blockchain to process transactions and record share ownership.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News