Key Points:

- Robert Kiyosaki, author of “Rich Dad, Poor Dad,” backs Bitcoin and warns of real estate crash.

- Kiyosaki predicts the upcoming real estate crash will be worse than the 2008 financial crisis. He cites San Francisco office buildings losing 70% of their value.

- Kiyosaki advises individuals to invest in gold, silver, and Bitcoin to safeguard their assets in the economic downturn.

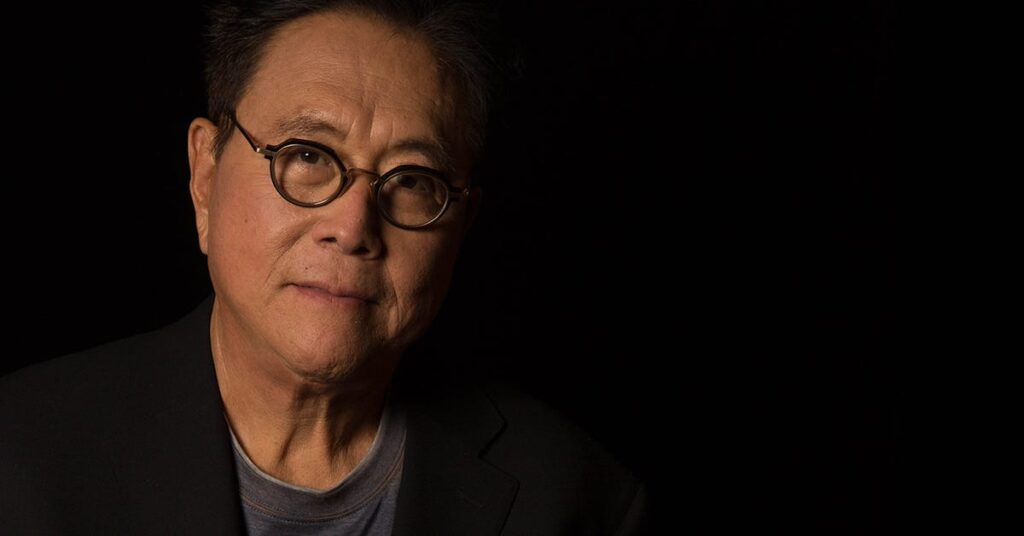

Bitcoin (BTC) has been a topic of discussion among financial experts and investors in recent times. Among those who have voiced their support for the cryptocurrency is Robert Kiyosaki, the renowned author of the best-selling book “Rich Dad, Poor Dad.”

Kiyosaki has been a vocal advocate of Bitcoin, as well as precious metals. As the market continues to be tumultuous, he emphasizes the importance of exploring alternative ways of preserving wealth.

Recently, Kiyosaki took to Twitter to express his unfiltered opinion on the state of the real estate sector. He predicted a grim future for the industry and highlighted the potentially catastrophic repercussions it may have on the global financial landscape.

Given Kiyosaki’s extensive experience and expertise in financial matters, his words carry significant weight and have garnered the attention of investors and individuals seeking insights into the current economic climate.

In his tweet, Kiyosaki provides a stark warning, advising individuals to consider alternative ways of preserving their wealth during these challenging times. He specifically highlights gold, silver, and Bitcoin (BTC) as the best stores of value to safeguard one’s assets amidst the impending economic turmoil.

Referring to the upcoming crisis as the “Greatest Real Estate crash ever,” Kiyosaki draws a striking parallel between the 2008 global financial crisis and the forthcoming economic downturn. He asserts that the magnitude of the upcoming crash will dwarf the impact of the 2008 crisis.

The book author further illustrates this point by citing the drastic decline in value experienced by office towers in San Francisco. In just a few years, these buildings have reportedly lost a staggering 70% of their value, raising questions about the future utility of such properties. He suggests that repurposing these buildings as homes for the homeless might be a potential solution.

Kiyosaki’s views on Bitcoin and precious metals have been widely discussed and debated among financial experts and investors. Some view these assets as a safe haven during times of economic uncertainty, while others remain skeptical of their long-term viability. Regardless, Kiyosaki’s warning about the state of the real estate sector and the impending economic turmoil serves as a call to action for individuals to consider alternative ways of preserving their wealth.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News