Key Points:

- Banq, a Prime Trust company, has filed for bankruptcy in the United States District Court for the District of Nevada.

- TrueUSD has ceased redemptions, and Haru Invest has ceased operations, alleging concerns with an undisclosed partner.

Banq, a subsidiary of the troubled crypto custodian Prime Trust, has filed for bankruptcy in the United States District Court for the District of Nevada.

This comes as Banq’s parent company, Prime Trust, attempts to complete an acquisition with BitGo after experiencing a financial crisis as a consequence of the Celsius bankruptcy. However, TrueUSD, which has a banking connection with Banq’s parent company Prime Trust, said that the halt in stablecoin minting and redemptions is due to Prime Trust’s bandwidth concerns.

Haru Invest Korea (hereafter referred to as Haru Invest) has formally shuttered its office after issuing a notification to halt deposits and withdrawals. The operating halt was attributed to issues with an unknown service provider, which is believed to be Banq or Prime Trust.

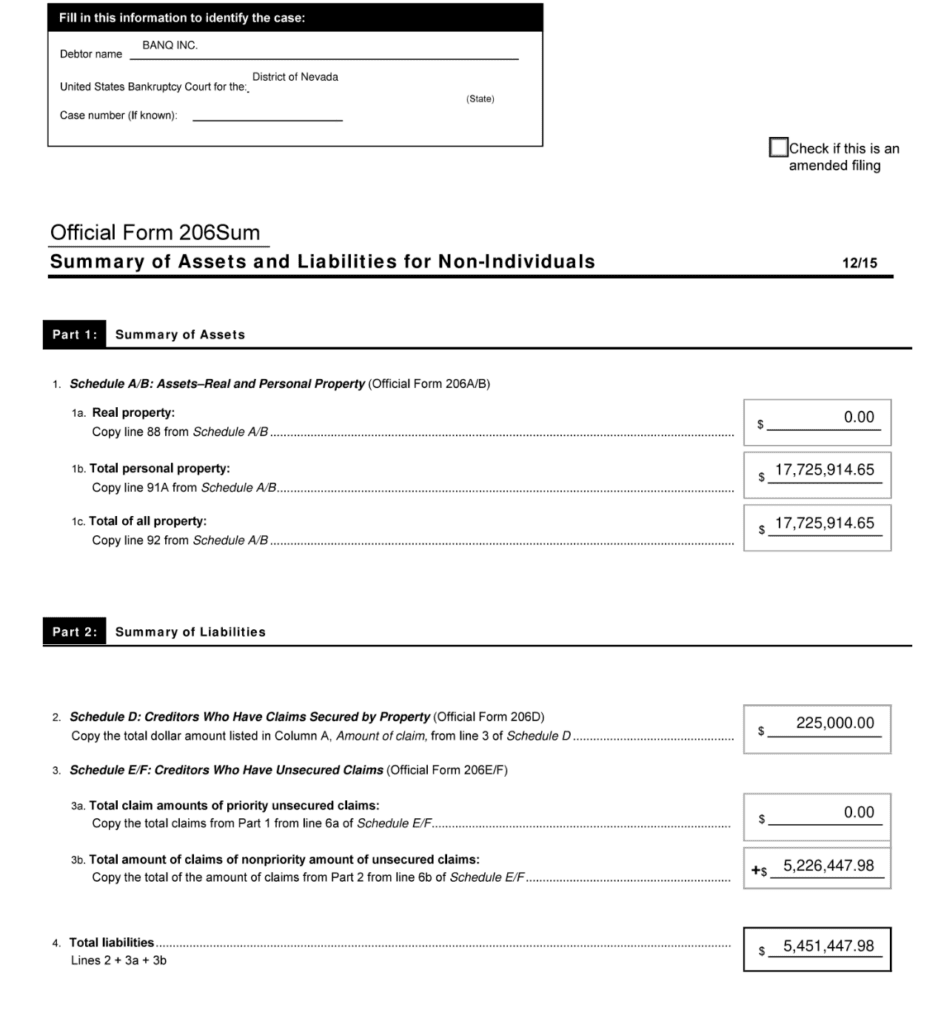

The corporation listed around $17.72 million in assets versus $5.4 million in liabilities in its bankruptcy petition. In addition, the business alleges in its complaint that former executives took $17.5 million in assets in an unauthorized transfer of trade secrets, confidential information, and technology to Fortress NFT Group.

Banq’s former CEO, CTO, and CPO created Fortress NFT Group. Fortress has been sued by Banq for allegedly obtaining trade secrets in order to create competing NFT platforms Fortress NFT and Planet NFT. It also claims they engaged in deceptive operations to conceal their wrongdoing.

The defendants “stole not only Banq’s technology, but also significant other value of Banq’s, and used the purloined property to launch Defendants Fortress NFT and Planet NFT using Banq’s assets, employees, trade secrets and proprietary technology, claiming all of it to be their own,” according to the complaint.

In a lawsuit filed against the three, Banq claimed that Scott Purcell, its former CEO, intended to steer the company toward NFTs. Purcell and the other defendants in the lawsuit signed arbitration provisions, so a judge ordered the matter to be arbitrated in early 2023.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News