Key Points:

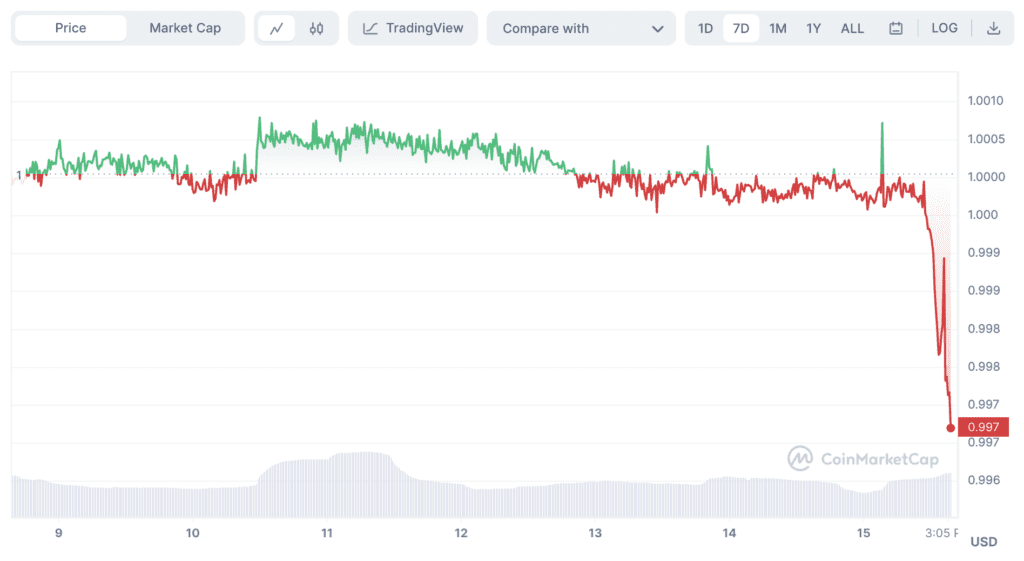

- On Curve, Tether’s USDT is somewhat de-pegged from its typical 1:1 relation with the US dollar.

- The event provides a one-of-a-kind arbitrage opportunity for astute DeFi traders.

- The whales took advantage of the situation to make millions of dollars in profits.

Whales have been selling enormous sums of Tether (USDT), the biggest stablecoin in the cryptocurrency market, causing its dominance inside the Curve 3pool liquidity pool to increase.

The unprecedented flood of USDT has raised questions about the stablecoin’s reliability and raised worries about USDT’s depegging.

Tether’s USDT, the top stablecoin with a stunning market valuation of over $83 billion, has de-pegged significantly from its regular 1:1 ratio with the US dollar on the Curve decentralized exchange, creating a unique arbitrage opportunity for clever DeFi traders.

The recent USDT dumping by whales has had a substantial influence on the makeup of the Curve 3pool. USDT presently accounts for more than 70% of the liquidity pool, with each currency accounting for more than 13%. This is the highest level since November 20, 2022.

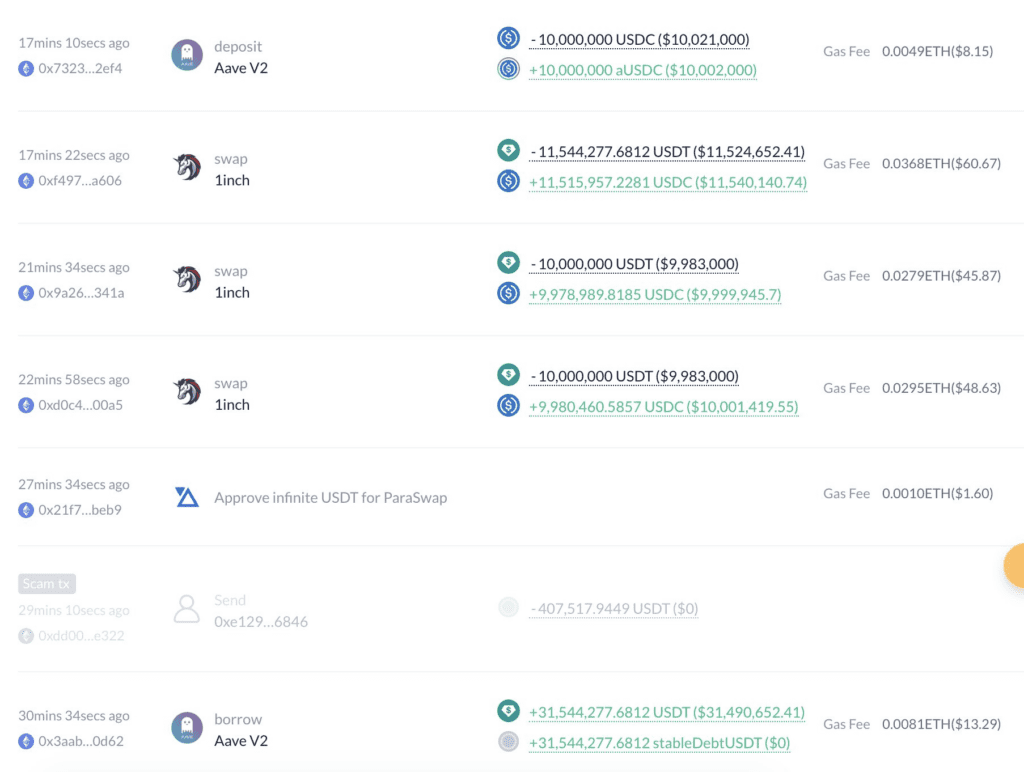

czsamsun.eth is a key actor in the USDT depegging situation, having apparently shorted USDT on Aave V2 after its depegging. He borrowed a significant quantity of USDT from Aave V2, precisely 31,544,278 USDT, and swapped it for 31,475,408 USDC at a cost of $0.9978. czsamsun.eth also deposited 10 million USDC back into Aave V2, indicating a determined attempt to capitalize on the depegging scenario.

The abrupt de-pegging of USDT from the USD offered a once-in-a-lifetime chance for these traders to benefit from arbitrage – taking advantage of price disparities across marketplaces. The difference between USDT’s lower trading price and its regular dollar parity.

An address 0xd2 profited greatly from the USDT de-peg. This address deposited 52,200 stETH ($85 million) through Aave V2 and borrowed $50 million USDC in phases, trading huge volumes of USDT at a reduced rate. In this case, the trader took advantage of the reduced USDT price by purchasing huge amounts using borrowed USDC, which was still pegged to the US dollar at a 1:1 ratio. If the USDT returns to its 1:1 peg, the traders may profitably sell their USDT, refund their borrowed USDC, and pocket the difference.

The recent dumping of USDT by whales, and the ensuing effect on the Curve 3pool, have generated new doubts about Tether’s stability and dependability. Tether is now trading at $0.9968, having lost 0.33% of its value in the last 24 hours. USDT, on the other hand, is one of the biggest and most extensively used stablecoins in the cryptocurrency industry.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News