Key Points:

- DeFi tokens have grown significantly in market capitalization over the past week, with tokens such as UNI and LINK experiencing gains of over 20%.

- AAVE has seen the most impressive growth among DeFi tokens, increasing by 40% over the last seven days.

- The growth of DeFi tokens is partly due to regulatory pressures on traditional finance, and their decentralization makes them more attractive to institutional investors.

DeFi tokens have generally risen in recent times as the tokens are at a disadvantage with regulatory pressure in the United States.

DeFi tokens have generally risen in recent times as the tokens are at a disadvantage with regulatory pressure in the United States.

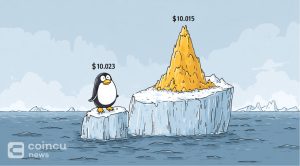

According to CoinGecko statistics, DeFi tokens have seen impressive growth in the past week, with market capitalization increasing from $41.5 billion to $46.2 billion.

The top DeFi tokens in terms of gains include UNI and LINK, with over 20% in the last 7 days. Notably, AAVE has increased by 40%, an achievement that far exceeds that of other tokens.

Since the US Securities and Exchange Commission considers decentralization to be one of the requirements for determining whether a token is a security, tokens such as PoW, DeFi, and meme coins may be invested in by institutional funds. Tokens driven by venture capital and extremely centralized, on the other hand, maybe bad.

The growth of DeFi tokens is also supported by Bitcoin as it crossed the $31,000 mark in the past week, sparking investor confidence.

The surge comes after BlackRock, the world’s largest asset management, submitted to the US Securities and Exchange Commission last week for a spot Bitcoin ETF, which the agency has yet to approve.

EDX Markets, a new digital asset exchange sponsored by prominent Wall Street giants Fidelity, Charles Schwab, and Citadel Securities, debuted earlier this week.

According to CoinGecko, the whole cryptocurrency market value is currently around $1.235 trillion, a 0.5% increase in the last 24 hours. However, we should probably wait for a slight correction from Bitcoin to enter this risky game, as DeFi’s strong growth is easy to dissipate if the major coins are not likely to rise.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News