BREAKING: Fidelity Joins The Battle For Bitcoin ETF Supremacy, Bitcoin Soars $31,000

Key Points:

- Fidelity is expected to file a Bitcoin spot ETF application soon, marking its second attempt at launching such a product.

- The move is seen as an effort to compete with BlackRock, which has filed to develop iShares Bitcoin Trust, an ETF that would provide institutional investors with exposure to cryptocurrencies.

- A debut of a spot Bitcoin ETF is considered a game-changer by market commentators, and Fidelity’s entry into the market may rekindle investor interest in cryptocurrencies.

According to sources cited by The Block, the Wall Street giant Fidelity is expected to file its own Bitcoin spot ETF application soon.

This will be Fidelity’s second effort at a product of this kind. It applied for a bitcoin spot exchange-traded fund named the Wise Origin Bitcoin Trust in 2021, but the US Securities and Exchange Commission refused it in early 2022.

This is considered an effort to compete with asset management firm BlackRock, which took a similar step previously.

BlackRock, the world’s largest asset manager, has filed to develop iShares Bitcoin Trust, an ETF that would use Coinbase Custody and provide institutional investors with exposure to cryptocurrencies. Several asset managers planning to start their own spot Bitcoin funds, including Invesco, WisdomTree, and Bitwise, have followed BlackRock’s June 15 application.

Fidelity is another titan, with tens of millions of retail brokerage customers and more than $11 trillion in assets under management. The company is no stranger to cryptocurrency, having run an institutional custody and trading services operation in the market since 2018.

Previously, Fidelity Investments was said to be entering the Bitcoin ETF market soon. Reports have circulated that the world’s third-biggest asset management company is about to submit a spot Bitcoin ETF application with the SEC. It is stated that, in addition to registering for an ETF, it may purchase Grayscale Investments.

Market commentators have dubbed the debut of a spot Bitcoin ETF as a game changer since it may give investors with exposure to the market without having to deal with the underlying commodity. Given the firm’s size and importance in global markets, BlackRock’s registration has been highlighted as particularly noteworthy.

The measures have rekindled investor interest in cryptocurrencies, which had been dormant after a string of crypto company meltdowns, including the abrupt demise of exchange FTX late last year.

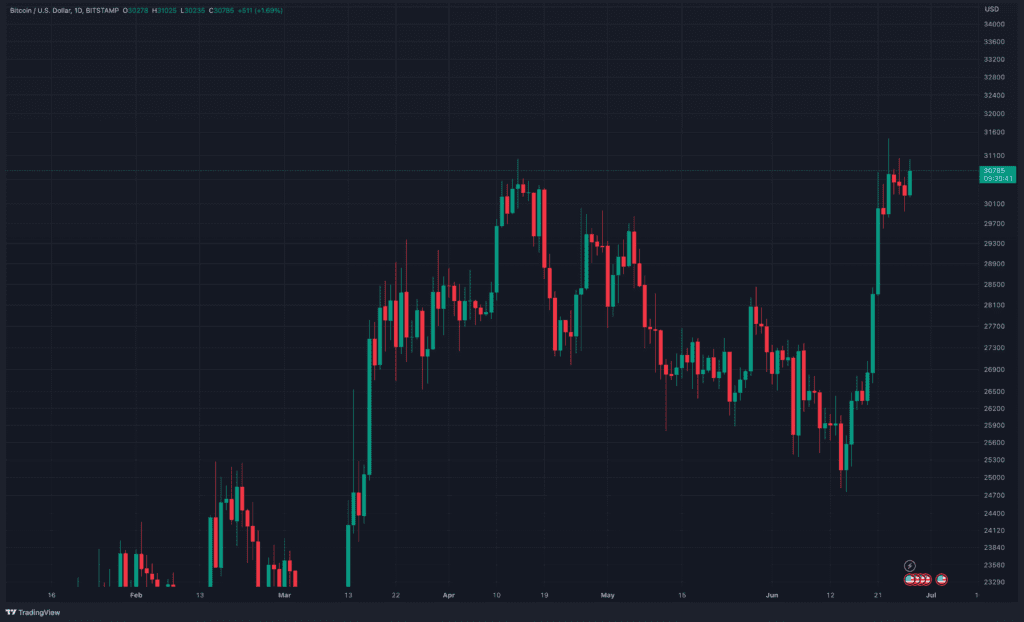

Bitcoin reacted positively to the news, quickly surpassing the $31,000 mark but recovered shortly after.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News