Key Points:

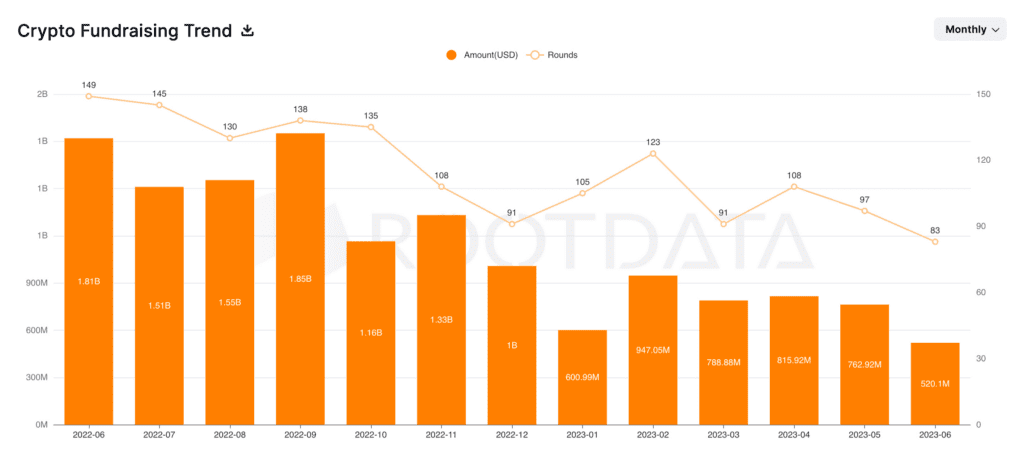

- Venture capital investment in crypto companies has dropped by over 70% in the past year.

- In June 2023, only $520 million was raised by 83 crypto projects, making it the lowest month for financing so far.

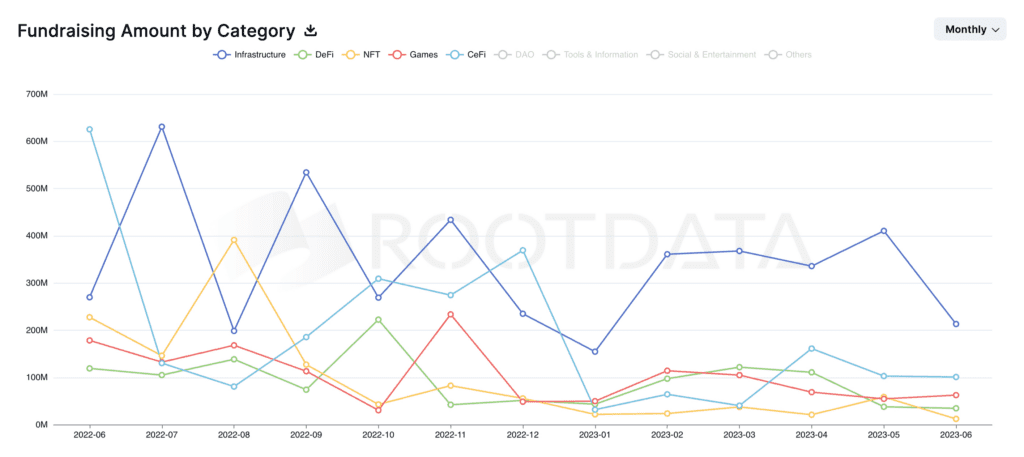

- Infrastructure, CeFi, and gaming were the top three categories receiving funding, with Coinbase Ventures being the most active VC firm in the space.

Venture capital investment in crypto companies has decreased by more than 70% in the last year, according to statistics provided by crypto analytics source RootData.

The digital asset market raised $1.81 billion in 149 rounds of funding in June 2022, whereas just 83 projects raised $520 million in June this year, the lowest month for financing thus far.

According to RootData, the infrastructure category topped the way with $213 million in financing for 26 projects in June. This is still a drop of almost 50% from May when 28 projects received $410 million. The category was won by Gensyn AI, a UK-based business, which received $43 million in a Series A investment headed by a16z.

CeFi (centralized finance) received $101 million in funding, accounting for approximately 20% of total financing. Gaming came in third with $62 million, with more than half of it going to Mythical Games, which received $37 million in Series C1. In that order, DeFi and NFTs finish up the list of categories.

Coinbase Ventures is the most active VC, having participated in 71 rounds this year, according to the site, followed by Hashkey Capital and Shima Capital, which funded 54 and 49 startups, respectively. The once-promising crypto asset class has taken a back seat to other assets, notably artificial intelligence.

During the last year, Ethereum has had 1,826 projects financed, whereas Polygon has seen 1,076 rounds. When the money was broken down by location, the United States got 34% of the total, the largest of any nation on the list.

According to WuBlockchain’s monthly report, there were 83 public investments by crypto VCs in June, a 14% decrease from May (97 projects) and a 44% decrease year on year (149 projects as of June 2022). In June, the infrastructure category accounted for around 31% of financed projects, DeFi for approximately 18%, CeFi for approximately 8%, and NFT/GameFi for approximately 20%.

Venture investors have continued a trend that started in 2022, despite controversies in the cryptocurrency business. The news of regulatory uncertainty, market downturns, and extraordinary collapses pushed venture investors out of the business.

The SEC filed two cases against the two biggest cryptocurrency exchanges in the market, Binance and Coinbase, in early June, shaking the cryptocurrency business and wiping out billions of dollars in assets of SEC billionaires in this field. Moreover, with the Fed still debating rate rises, venture capital companies may be less interested in investing in a very risky sector.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News