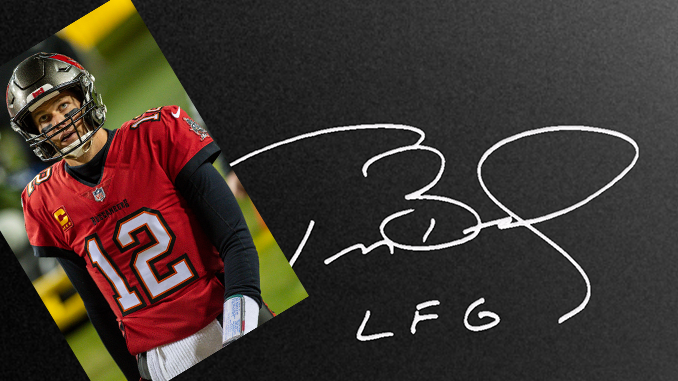

Tom Brady Autograph’s NFT Platform Reinvents Marketing Gameplan!

Key Points:

- Tom Brady’s NFT Autograph platform is facing significant challenges due to the bear market, leading to workforce reduction and revenue decline.

- The downturn in the overall crypto market has severely impacted the NFT Autograph platform’s operations.

- Tom Brady’s association with the cryptocurrency exchange FTX has also had unintended consequences for his reputation in the crypto industry.

Tom Brady’s NFT Autograph platform is facing significant challenges in the wake of the bear market and is now forced to change its strategy.

Sources familiar with the matter have revealed that the company’s revenue is expected to plummet in 2022, leading to a workforce reduction of at least 50 employees, primarily in coding, language marketing, and related assets.

The downturn in the overall crypto market has severely impacted the NFT Autograph platform’s operations. As the value of cryptocurrencies plummeted, investors and collectors became more cautious, resulting in a decline in demand for non-fungible tokens (NFTs) and related services. The company’s ambitious plans to revolutionize the sports memorabilia industry through NFTs have been hit hard by these market conditions.

Tom Brady’s association with the cryptocurrency exchange FTX has also had unintended consequences for his reputation in the crypto industry. As the brand ambassador for FTX, Brady received valuable shares of stock worth around $30 million. However, FTX has faced its own share of controversies and regulatory scrutiny, which has affected the public perception of the platform and, by association, Brady himself.

In January of the previous year, NFT Autograph platform had secured a significant boost through a Series B funding round, raising $170 million. The funding round was led by prominent venture capital firms a16z and Kleiner Perkins, indicating strong initial investor confidence in the platform’s potential.

While the challenges faced by NFT Autograph are significant, industry experts believe that the NFT market could rebound in the future. Despite the current market conditions, NFTs continue to gain attention and adoption in various sectors, including art, gaming, and sports. Whether NFT Autograph can navigate the current storm and adapt its strategy to the changing landscape remains to be seen.

Tom Brady’s foray into the world of NFTs initially promised to be a game-changer, but it now finds itself grappling with the realities of a volatile market and the associated risks. Only time will tell if the platform can regain its footing and establish itself as a significant player in the ever-evolving NFT space.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.