Bitcoin Network Hashrate Hits New Heights, Drives Price Surge

Key Points:

- Bitcoin’s hashrate reaches new highs, indicating growing interest in the cryptocurrency and intensified competition among miners.

- The surge in hashrate reinforces the security and robustness of the blockchain, while the fluctuation in ASIC prices suggests an evolving market demand for more efficient and cost-effective options.

- Bitcoin’s price surge reflects growing investor confidence and renewed interest in the cryptocurrency, bolstered by increased institutional adoption, positive regulatory developments, and a wider acceptance of cryptocurrencies in mainstream finance.

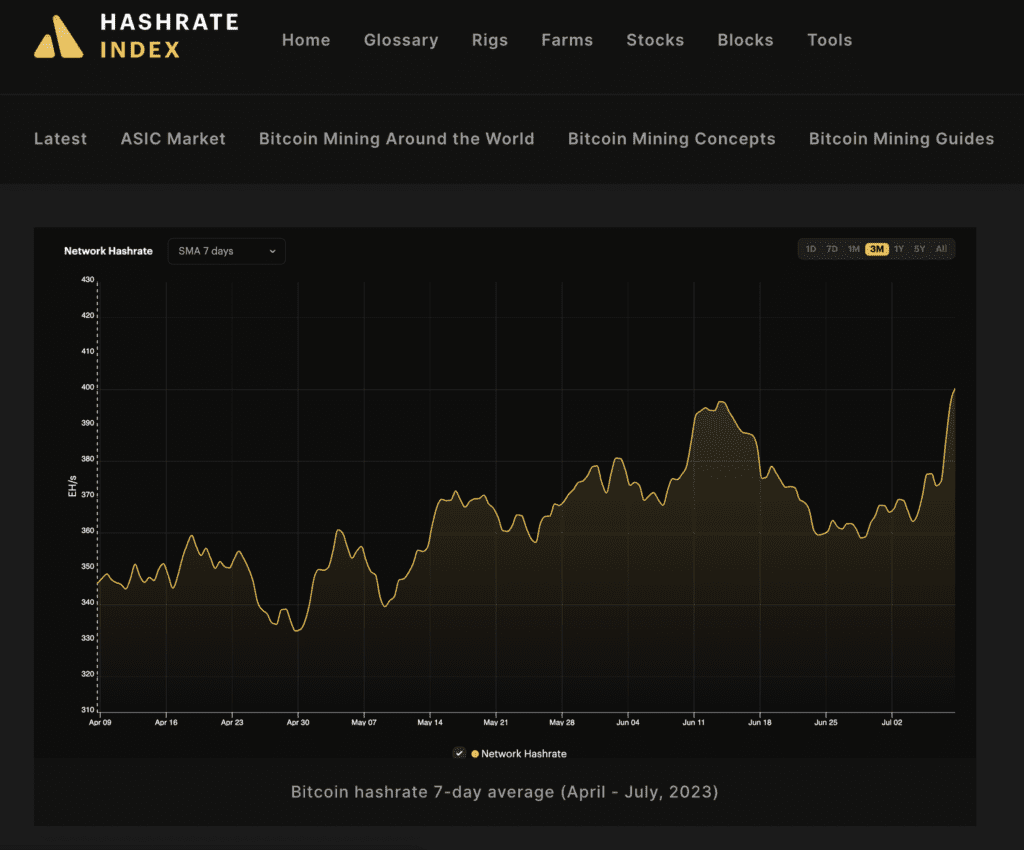

According to Hashrate Index, Bitcoin’s network hashrate has soared to new highs, reaching an average of 401 EH/s over the span of seven days and an average of 445 EH/s over three days.

This surge in hashrate indicates a significant increase in mining activity and highlights the growing interest in Bitcoin. Concurrently, the price of Bitcoin has witnessed a remarkable 14% rise over the past month, cementing its position as the leading cryptocurrency.

The surge in Bitcoin’s hashrate indicates an intensified competition among miners, as they strive to secure a larger share of the network’s mining rewards. The increase in hashrate is a positive sign for the Bitcoin network, as it reinforces the security and robustness of the blockchain.

In tandem with the hashrate surge, premium ASIC miners like the S19 XP have experienced a notable increase in price. These specialized mining rigs are highly sought after for their superior mining capabilities. However, the price increase has not been uniform across all ASIC models, with some experiencing a decline in prices. The fluctuation in ASIC prices suggests an evolving market demand, with miners opting for more efficient and cost-effective options.

Bitcoin’s price surge in the last thirty days reflects growing investor confidence and renewed interest in the cryptocurrency. Several factors have contributed to this upward trend, including increased institutional adoption, positive regulatory developments, and a wider acceptance of cryptocurrencies in mainstream finance. Bitcoin’s decentralized nature and limited supply have further bolstered its appeal as a digital store of value and hedge against inflation.

As Bitcoin’s price continues to climb, market analysts are closely monitoring its trajectory. Some experts believe that the current bullish trend may pave the way for new all-time highs in the coming months. However, others caution that price volatility remains a characteristic of the cryptocurrency market, advising investors to exercise caution and conduct thorough research before entering the market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.