Key Points:

- Arcadia Finance, a noncustodial DeFi protocol, was hacked and lost about $455,000 due to a code vulnerability.

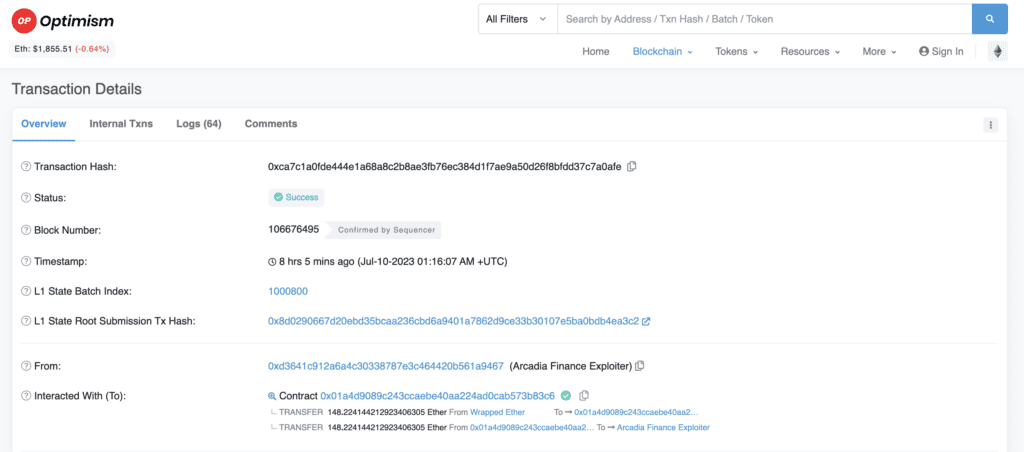

- The stolen funds were mostly from Optimism and have been washed via Tornado Cash. However, the stolen tokens on Ethereum remain parked at the suspected wallet address.

- According to a report by CertiK, hacks and exploits in the crypto space caused a loss of over $300 million in Q2 2023. The BNB Smart Chain recorded the most incidents, leading to $70,711,385 in losses.

Arcadia Finance’s DeFi protocol resulted in a loss of approximately $455,000.

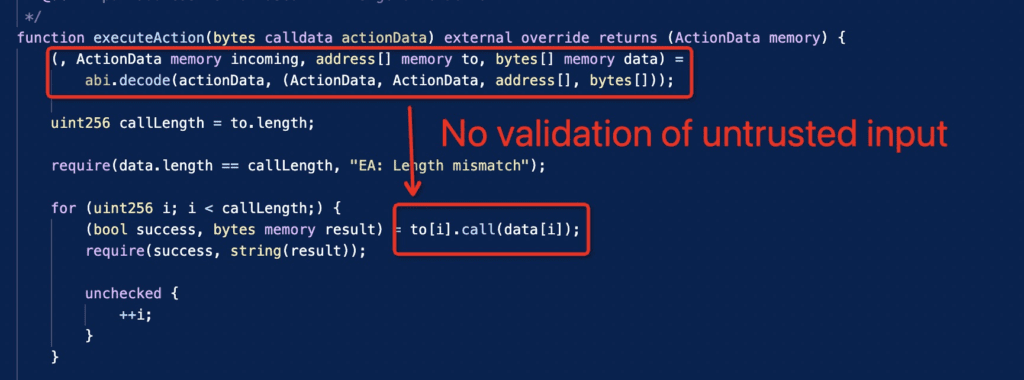

The blockchain investigator PeckShield who alerted about the hack, pointed out that the root cause of the hack was “the lack of untrusted input validation”. The hacker exploited this loophole to drain funds worth roughly $455,000 from Ethereum (darcWETH) and Optimism (darcUSDC) vaults.

Although Arcadia Finance confirmed the hack two hours after PeckShield’s intimation and paused the contracts to prevent further loss of funds, investigations are still underway. Unfortunately, there is another vulnerability in Arcadia’s code, which if exploited, could prove catastrophic for the protocol.

According to PeckShield: “In addition, there is a lack of reentrancy protection, which allows for the instant liquidation to bypass the internal vault health check.”

Most of the stolen funds were from Optimism, which was approximately 180 Ether, and have already been washed via Tornado Cash. However, the stolen tokens on Ethereum, worth over $103,000 at the time of writing, remain parked at the suspected wallet address.

In the second quarter of 2023, hacks and exploits in the crypto space resulted in cumulative losses of over $300 million. A report by blockchain security company CertiK revealed that a total of 212 security incidents were recorded in the quarter, resulting in a loss of $313,566,528 from Web3 protocols. In comparison to the previous year’s Q2 data, CertiK found that the number of crypto hacks declined by 58%. Out of these, the BNB Smart Chain recorded the most incidents, with 119 incidents leading to $70,711,385 in losses.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.