Bitcoin Price Plummets Below $31K, Experts Predict Further Decline

Key Points:

- Bitcoin price in decline, but bulls remain active above $30,000 support zone.

- Short-term bullish trend line forming, with support near $30,400.

- Next resistance near $30,700 and $31,400 levels, with potential for gains towards $32,000.

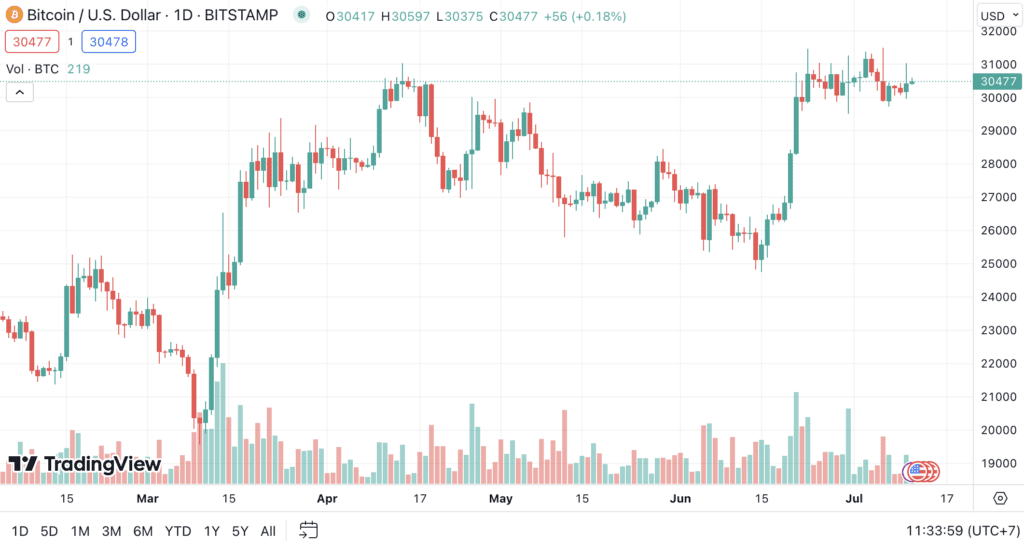

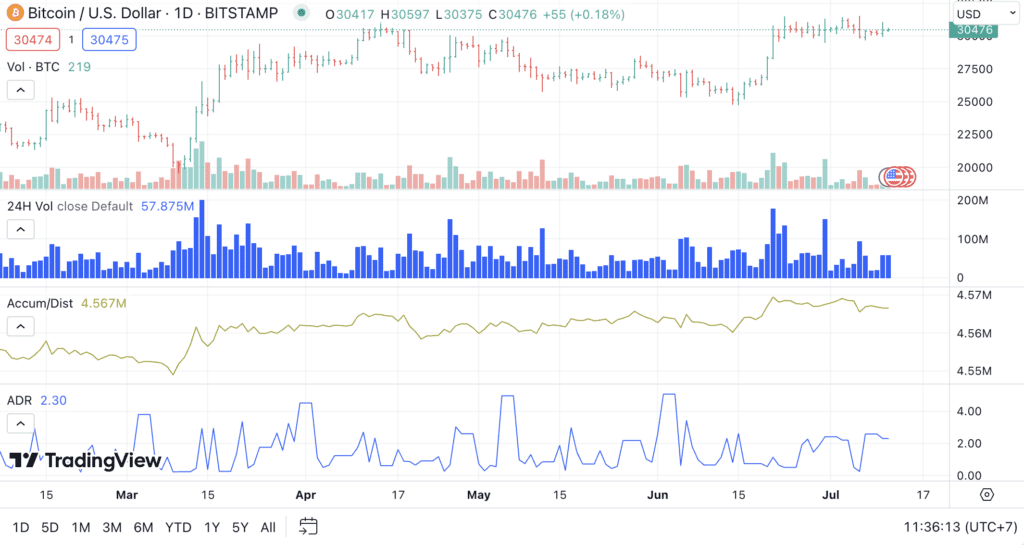

Bitcoin price started a fresh decline below the $30,500 support zone, which worried investors.

However, the bulls were again active above the $30,000 support zone, which helped to mitigate some of the concerns. Despite this, the price of BTC remained in a range and made another attempt to clear $31,000 but unfortunately failed.

Looking at the hourly chart of the BTC/USD pair, we can see that the recent low was formed near $30,214, which is a considerable drop from its recent high. However, the price is now moving higher, which is a good sign for investors. There was a move above the 23.6% Fib retracement level of the recent decline from the $31,020 high to the $30,214 low, indicating that there may be some bullish momentum building.

A short-term bullish trend line is forming with support near $30,400 on the same hourly chart. This trend line suggests that there are still some investors who are optimistic about Bitcoin’s future prospects.

Bitcoin price is trading above $30,200 and the 100 hourly Simple moving average, which is a positive development. However, the bulls are now facing resistance near the $30,600 level, which could make it challenging for prices to rise even further.

The next resistance is near the $30,700 zone, which is close to the 61.8% Fib retracement level of the recent decline from the $31,020 high to the $30,214 low. If the price manages to break above this resistance level, it might retest $31,000, which would be a significant milestone for investors.

The price must settle above $31,000, and the next major resistance is near the $31,400 level. If the price manages to break through this level, it could open the doors for a move toward the $32,000 resistance zone, which would be a strong indicator of Bitcoin’s long-term potential.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.