Solana Is Now Out Of Bear Price Zone, Next Target Will Be $26.5

Key Points:

- Solana (SOL) has experienced a positive trend reversal and has shown no signs of weakening in both short- and long-term time horizons.

- Solana is a high-performance blockchain platform designed for decentralized applications (dApps), known for its fast transaction speeds and unique consensus technique called Proof-of-History.

- While SOL’s trading volume has decreased, its current bullish effect is still evident, with the price holding steady at $22 after bouncing off the $20 resistance.

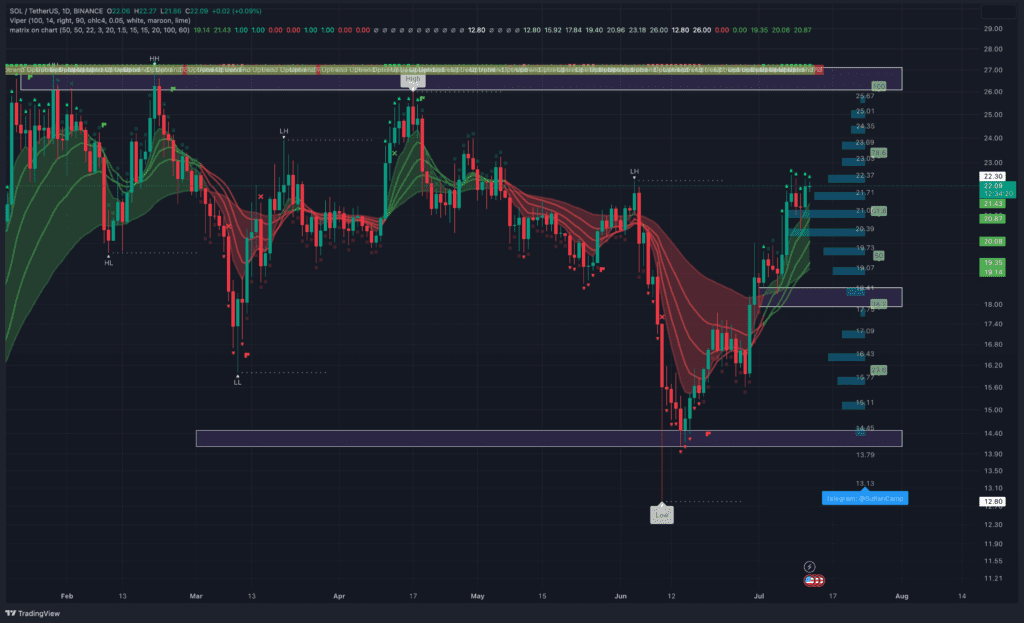

The price of Solana (SOL) broke out from short-term resistance, showing that the price has initiated a positive trend reversal.

Since its June 10 low, the SOL price has been on a rip and shows no indications of weakening in either the long- or short-term time horizons.

Solana is a high-performance blockchain platform designed to handle decentralized applications (dApps) and crypto projects while minimizing latency and security risks. Solana’s protocol employs a novel Proof-of-History consensus technique in addition to the more classic Proof-of-Stake model, allowing it to execute transactions at breakneck rates that few other blockchains can match.

As a result, after events related to FTX or FUD from the US Securities and Exchange Commission, SOL is still the token in the top 10 coins with the largest capitalization in the crypto market at the moment.

Solana’s trading volume has decreased relative to yesterday at $357,068,860. However, the current bullish effect is still evident. SOL is holding steady at $22 after bouncing off the $20 resistance.

One thing to note is that the 61.8% Fib level at $21.2 is also one of the psychological extremes that SOL has crossed, showing that the bulls are quite strong at the moment.

While Solana has made a relatively steady upward wave from its low in early June, investors still need to watch for more good signals to join.

Of course, selling now is a relatively risky option, as Bitcoin’s bullish momentum doesn’t show much, but altcoins are on the cusp of a recovery, signaling a possible uptrend.

The area we should consider could be the $20 support or the nearest psychological contention between the bulls and the bears at $21.2. This can be the optimal choice for short-term trades.

Potentially, the Fib %78.6 area at $23.4 is the nearest resistance, if SOL crosses this mark, our next target is $26.5.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.