Aura Finance Empowers Liquidity and Adoption on Optimism Network

Key Points

- Aura Finance’s expansion to Optimism opens up new opportunities for partner protocols, enabling enhanced liquidity and adoption.

- Through collaborations with lending platforms, stablecoin protocols, and other key players, Aura aims to build a robust ecosystem that promotes seamless user experiences and widespread adoption.

- As Aura continues to attract utility partners and strengthen its presence on Optimism, the platform’s growth and impact are set to accelerate.

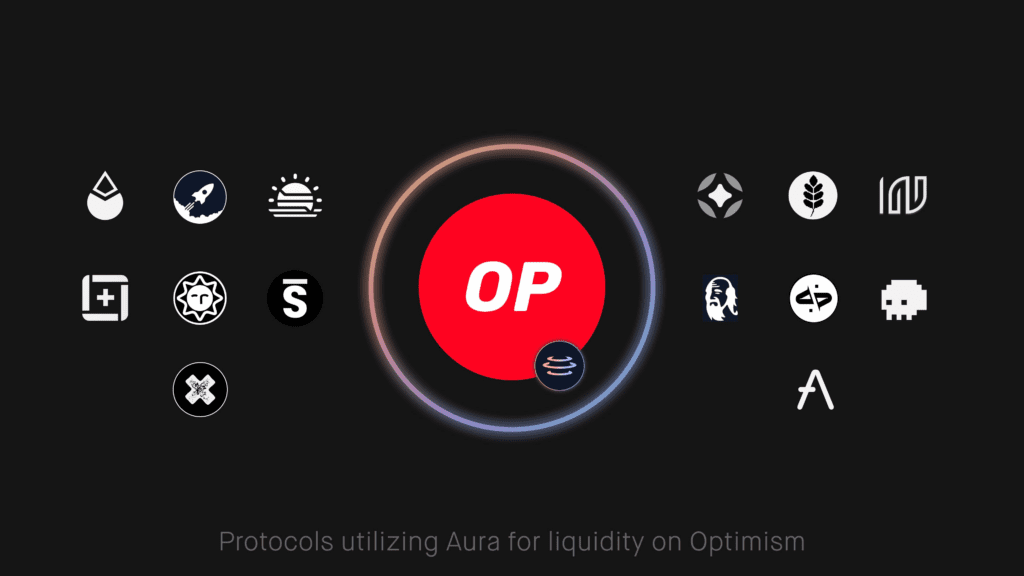

Aura Finance, the governance platform on Balancer, has launched on Optimism, offering increased adoption and liquidity for partners such as stablecoin protocols, lending platforms, bridges, and currency markets.

Aura Finance, the revenue governance platform built on Balancer, has announced its launch on Optimism. This expansion allows partners, including stablecoin protocols, lending platforms, bridges, and currency markets, to leverage Aura to enhance liquidity and drive adoption. By providing support for various protocols and fostering collaboration, Aura aims to strengthen the ecosystem and facilitate a seamless user experience.

Aura Finance will offer enhanced pools for leading lending protocols such as Aave, Tarot Finance, and Sonne Finance. These collaborations aim to improve liquidity and lending capabilities within the ecosystem. Additionally, Aura will facilitate native token liquidity pools for Beethoven X, further enhancing its liquidity infrastructure.

pStakeFinance will launch their ETH LST v2 on Layer2s, enabling minting and bridging of LST. By utilizing Aura as their liquidity hub, pStakeFinance can deepen LST liquidity on Optimism, enhancing accessibility for users. Ethos Reserve, a stablecoin protocol, will introduce an Aura ERN Stablepool and an 80/20 bOATH pool. Through Aura’s bootstrapping capabilities and network of utility partners, Ethos Reserve can leverage increased liquidity and expand its cross-chain presence.

QiDao Protocol, with its diverse collateral options, has integrated with multiple protocols across various chains. By leveraging Aura to enhance liquidity for their stablecoin $MAI, QiDao Protocol aims to attract more borrowers and liquidity providers, further strengthening its ecosystem.

Aura will support boosted pools from lending protocols such as Aave, Tarot Finance, and Sonne Finance. These partners may consider incentivizing deposits into these boosted pools to increase Total Value Locked (TVL). In addition, long-standing partners such as Lido Finance, Rocket Pool, Stargate Finance, and Inverse Finance will join Aura’s launch on Optimism, contributing to the growth and success of the platform.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.