Binance Completes Burning Nearly 2 Million BNB Amid The Downfall

Key Points:

- Binance announces that the 24th BNB burn has been completed.

- During the second quarter of 2023, a total of 1,991,854 BNB were burned, with a value of $484.1 million.

- This could be a welcome sign in the downtrend of BNB over the past three months.

Cryptocurrency exchange Binance conducted the 24th quarterly BNB burn. Specifically, during the second quarter of 2023 burned, a total of 1,991,854 BNB were burned, with the value converted to $484.1 million.

Binance CEO Changpeng Zhao added that although the BNB burn has been done, there will still be some other large transactions to be done to “allocate/distribute coins to multiple addresses”. It is not clear why Binance had to make such transactions, which were not recorded in previous burns.

Burning BNB is a recurring activity performed by Binance every quarter, as mentioned in the BNB whitepaper. Since the beginning of 2022, the exchange has actively burned the amount of BNB until the total supply is reduced to only 100 million coins.

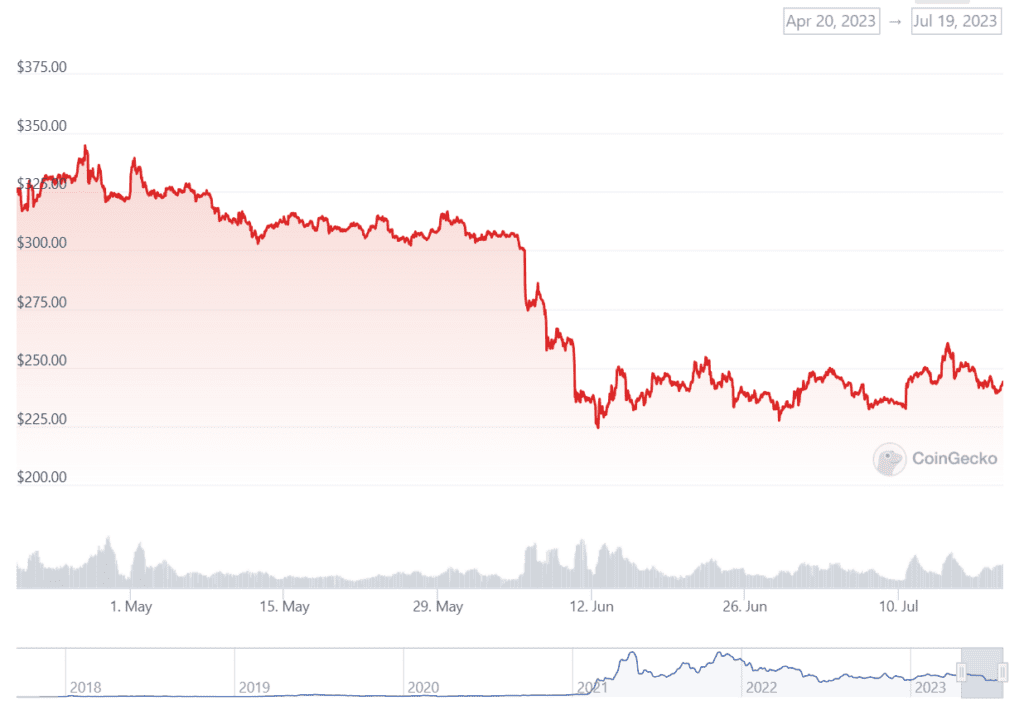

This could be a good signal to keep the BNB price from falling too much in a volatile market. BNB, in the last three months, lost more than 25% as Binance was hit by a wave of negative news globally, especially with the US Securities and Exchange Commission (SEC) lawsuit and FUDs related to the Executive departures and layoffs have also caused the exchange’s native token to fluctuate wildly.

In addition, BNB is still at risk of facing more than $200 million worth of liquidation on the Venus protocol if the price drops to $220. This amount of money has been sealed from the BNB Bridge attack in October 2022 but has yet to be resolved by the BNB Chain community.

Recently, however, there is a dynamic that makes BNB more attractive. On July 18, Binance also successfully held a Launchpad sale for Arkham Intelligence (ARKM), attracting more than 114,000 users to participate and lock up $2.4 billion worth of BNB.

Currently, BNB is trading at $243.07. According to CoinGlass data, short positions are becoming more dominant for BNB. BNB perpetual futures traders have turned bearish for BNB as Binance faces many challenges.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.