Telegram Bot Tokens Experience Surge In Value After $270 Million Bond Issuance Plan

Key Points:

- Telegram Bot tokens experience a surge in value following Telegram’s announcement of a $210 million bond issuance plan.

- Unibot (UNIBOT) emerges as a leading Telegram Bot token, showing significant growth and attracting a cult following in the crypto market.

- Telegram Bot tokens offer user-friendly alternatives for trading tokens compared to decentralized exchanges, leading to increased interest from traders and investors alike.

The value of Telegram Bot tokens has recently seen a significant surge following the announcement of Telegram’s plan to raise $270 million through bond issuance.

These tokens, associated with various Telegram Bot projects, have gained substantial traction in the crypto market, attracting scores of crypto traders looking for easy and user-friendly ways to trade tokens.

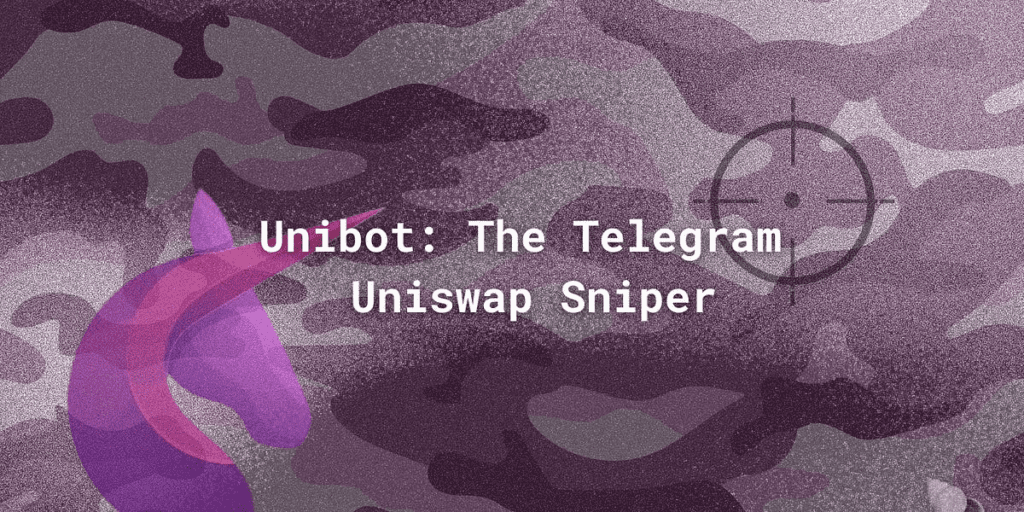

Leading the pack among the Telegram Bot tokens is Unibot (UNIBOT), which was launched in May and has quickly gathered a cult following.

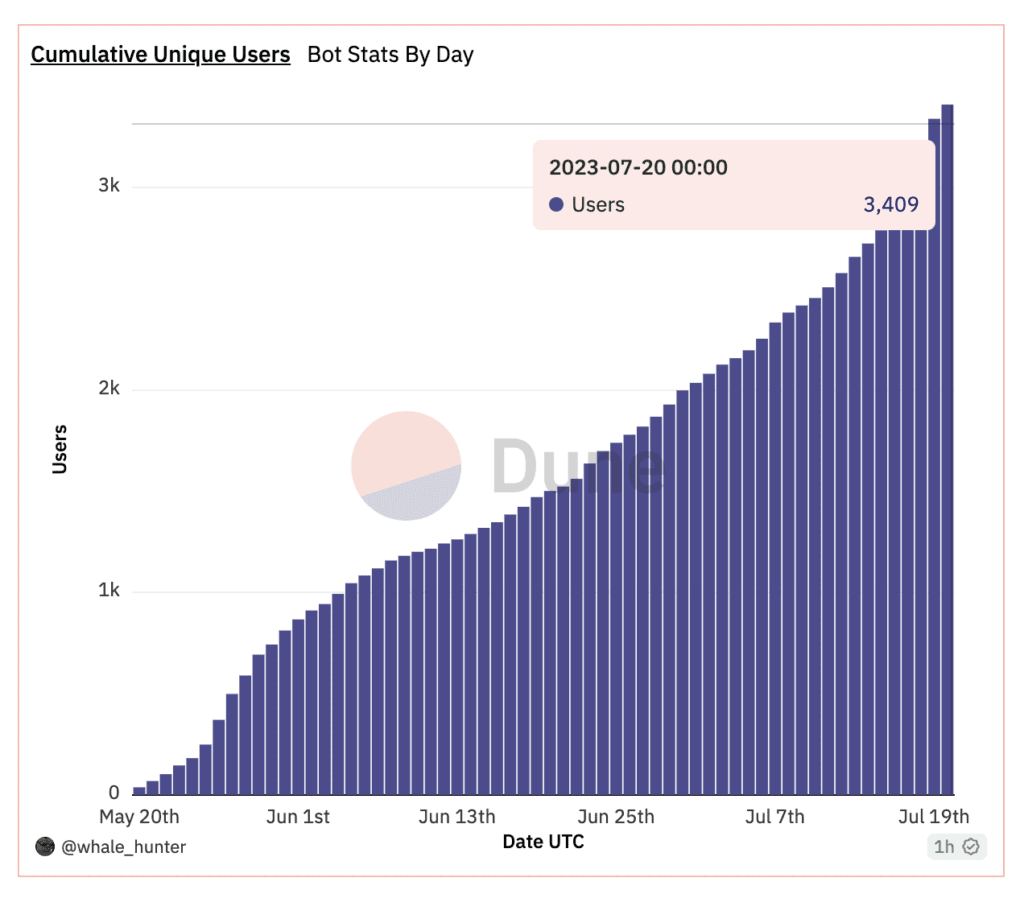

In the past week alone, UNIBOT tokens have risen by over 98%, and the platform has reported a steady spike in user growth, according to data from Dune Analytics. The platform has facilitated over $57 million worth of token trades, and it distributes nearly $1 million in revenue back to users, providing rewards that are proportional to the number of tokens held. Holders receive 40% of transaction fees and 1% of UNIBOT’s total trading volume. With over 3,400 users and a steady daily user count, Unibot has become a preferred choice for many traders.

The appeal of Telegram Bot tokens lies in their simplicity and ease of use compared to decentralized exchanges like Uniswap. While using a decentralized exchange may require logging into a wallet, cross-checking token information, and facing high fees to ensure smooth trades, Telegram Bot tokens offer a more straightforward alternative.

Other Telegram Bot tokens have also experienced significant increases in value. Tokens such as Wagiebot (WAGIEBOT), 0xSniper (0XS), Bridge (BRIDGE), and Bolt (BOLT) have surged by as much as 500% in the past 24 hours as traders seek to capitalize on the success of Unibot and the growing trend of Telegram Bot tokens.

Beyond their value as trading tools, Telegram Bot tokens have become essential for professional crypto investors. They offer a range of features that support the investment process, including on-chain tracking, wallet checking, price movement tracking, news updates, and monitoring new listings on decentralized exchanges. Many projects in this domain have also issued their own tokens, further fueling interest in Telegram Bot tokens.

Telegram has previously demonstrated its involvement in the cryptocurrency space by deploying various bots for cryptocurrency trading. The popular messaging app enables users to buy crypto through its @wallet bot, which allows transactions using bank cards after completing verification.

The news of Telegram’s plan to raise $270 million through a bond issuance has piqued the interest of the crypto community, leading to increased attention on tokens related to the platform. This surge in interest has resulted in Telegram Bot tokens becoming a “mini-trend” in the crypto market, attracting both traders and investors alike.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.