Trending Bitcoin Spot ETFs Could Drive $30 Billion In New Demand: Report

Key Points:

- Recent NYDIG research speculates that momentum from Bitcoin Spot ETFs could bring in $30 billion in new demand for the digital asset.

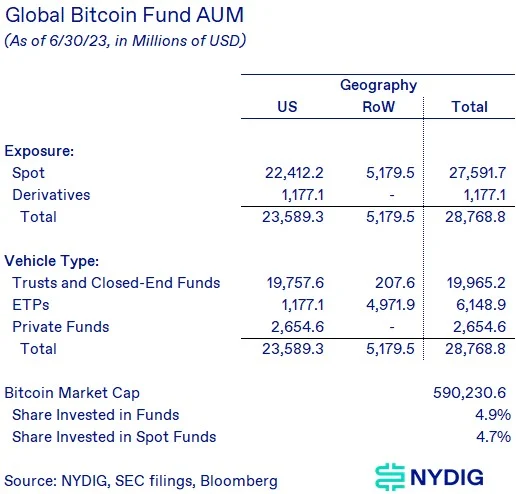

- Currently has $28.8 billion in bitcoin assets under management with $27.6 billion in spot-like products.

- The US SEC has accepted six spot bitcoin ETF proposals for consideration.

According to a recent research report by crypto exchange NYDIG, the Bitcoin Spot ETFs registration craze could generate $30 billion in new demand for the crypto market.

Currently, NYDIG has modeled that there are $28.8 billion in bitcoin assets under management with $27.6 billion in spot-like products.

Bitcoin is often referred to as digital gold, so it will inevitably be compared to the gold ETFs listed in the early 2000s. Currently, gold ETFs hold only 1.6% of the total global gold supply, the NYDIG pointed out, compared with 17.1% of central banks, while bitcoin funds hold 4.9% of the total bitcoin supply.

There is a huge demand gap for digital and analog versions of assets in funds. There is over $210 billion invested in gold funds, while only $28.8 billion is in bitcoin funds due to the asset’s high volatility.

The NYDIG’s conclusion that the real potential of a Bitcoin ETF lies in a convergence of factors: the launch of an ETF, a weaker US dollar, the Federal Reserve’s shift to quantitative easing, and a generational transfer of assets to younger individuals who are more likely to invest in cryptocurrencies.

In a twist on July 19, the US Securities and Exchange Commission (SEC) accepted applications to create a spot bitcoin exchange-traded fund from six companies, including BlackRock (BLK.N), for consideration, the first step in the agency’s process to decide whether or not to approve the latest round of proposals.

The SEC also officially recognized applications from Bitwise, VanEck, WisdomTree (WT.N), Fidelity, and Invesco (IVZ.N) for a similar spot bitcoin ETF, with those proposals appearing on the Federal Register on Tuesday and Wednesday.

It has been more than 10 years since the first application statement was filed for a spot bitcoin ETF, and investors are once again excited about the prospect that one of the existing applications will be approved.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.