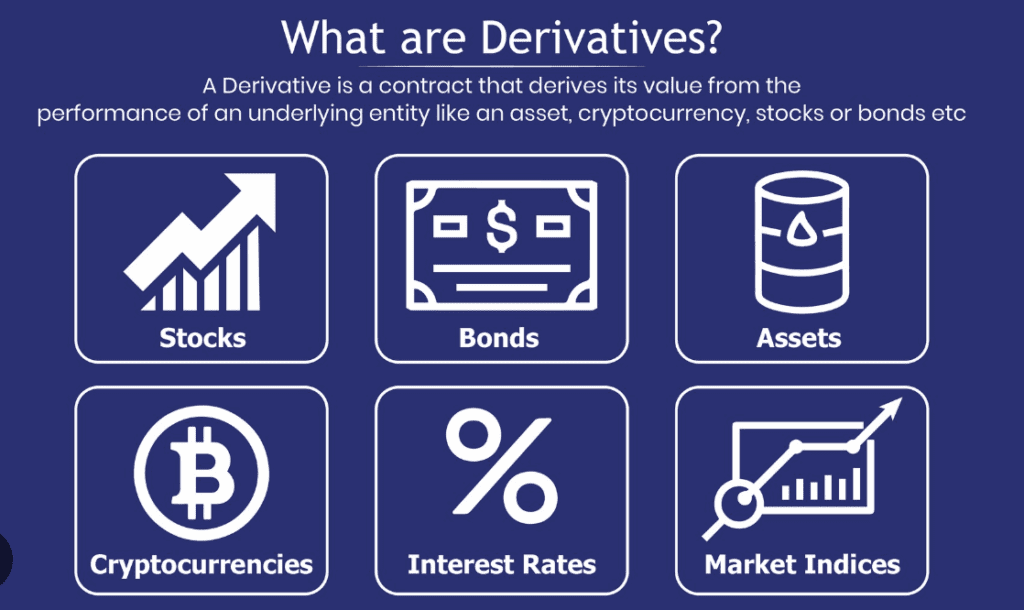

Derivatives are financial instruments or contracts that derive their value from an underlying asset. The underlying asset can be any instrument that has a value, such as stocks, bonds, commodities, currencies, interest rates, or market indices. Derivatives can be used for various purposes, such as hedging against risks, speculation, and arbitrage.

What Is a Derivative?

The term derivative refers to a financial contract whose value is derived from an underlying asset, group of assets, or benchmark. This underlying asset can be anything from stocks to commodities, making derivatives a versatile tool for traders and investors. Essentially, a derivative is a contract that derives its value from the performance of an underlying asset. It’s important to note that derivatives are not the asset themselves, but rather a contract that gives the holder the right or obligation to buy or sell the underlying asset at a specific time and price.

These contracts can be used to trade any number of assets and carry their own risks, which vary depending on the type of derivative. For example, options give the buyer the right, but not the obligation, to buy or sell the underlying asset at a set price and time. Futures contracts, on the other hand, obligate the buyer and seller to carry out the transaction at a specific price and time in the future.

Prices for derivatives derive from fluctuations in the underlying asset. This means that the value of the derivative is derived from the performance of the asset it’s based on. Since the underlying asset can vary, the price of the derivative can fluctuate as well. These financial securities are commonly used to access certain markets and may be traded to hedge against risk. Derivatives can be used to either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation).

Derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers. Despite being considered complex financial instruments, derivatives have become increasingly popular in recent years, with the global derivatives market now worth trillions of dollars. Derivatives are used by investors and traders to manage risk, speculate on market movements, and gain exposure to certain assets or markets. They are also used by financial institutions to manage their own risk exposure.

Derivatives are a powerful financial tool that can be used for a variety of purposes. They allow traders and investors to gain exposure to markets and assets they might not otherwise have access to, while also managing risk and maximizing potential returns. However, it’s important to remember that derivatives are complex financial instruments that come with their own set of risks. As such, it’s important to have a solid understanding of how derivatives work before investing in them.

Understanding Derivatives

A derivative is a financial instrument that holds a complex structure between two or more parties. Derivatives grant traders access to specific markets and assets that they otherwise might not be able to trade in. These types of securities are commonly used by advanced investors. The underlying assets of derivatives include stocks, bonds, commodities, currencies, interest rates, and market indexes, and their values are based on price changes in these assets.

There are various ways in which derivatives can be utilized. One such way is to hedge a position, which is essentially a strategy to mitigate risk by taking an offsetting position in a related security. Derivatives can also be used to speculate on the directional movement of the underlying asset or to give leverage to holdings. These securities are typically traded on exchanges or Over-The-Counter (OTC) and are commonly purchased through brokerages. One of the world’s largest derivatives exchanges is the Chicago Mercantile Exchange (CME).

It is important to note that when companies hedge, they are not speculating on the price of the commodity. Rather, the hedge is a way for each party to manage risk. Each party has its own profit or margin built into the price, and the hedge helps to protect those profits from being eliminated by market moves in the price of the commodity.

There is an increased risk of counterparty risk associated with OTC-traded derivatives. Counterparty risk refers to the danger that one of the parties involved in the transaction might default. These contracts trade between two private parties and are unregulated. To hedge this risk, the investor could purchase a currency derivative to lock in a specific exchange rate. Derivatives that can be used to hedge this kind of risk include currency futures and currency swaps. Additionally, it is important to note that over-the-counter derivatives can be customized to fit the specific needs of the parties involved, making them more complex than exchange-traded derivatives.

Special Considerations

Derivatives are complex financial instruments that are used to manage risk, speculate on price movements, and gain exposure to various asset classes. They were originally used to ensure balanced exchange rates for internationally traded goods, providing a system to account for the differing values of national currencies.

However, as the financial markets have evolved, derivatives have become increasingly popular among investors and speculators. For example, assume that a European investor has investment accounts that are all denominated in euros (EUR). If they purchase shares of a U.S. company through a U.S. exchange using U.S. dollars (USD), they become exposed to exchange rate risk while holding that stock. Exchange rate risk is the threat that the value of the Euro will increase in relation to the USD. If this happens, any profits the investor realizes upon selling the stock become less valuable when they are converted into Euros.

To mitigate this risk, the investor can use derivatives. For instance, a speculator who expects the Euro to appreciate versus the dollar could profit by using a derivative that rises in value with the Euro. Derivatives are becoming increasingly popular among investors because they provide a way to speculate on the price movement of an underlying asset without owning it. This allows investors to take advantage of market opportunities without having to invest in a holding or portfolio presence in the underlying asset.

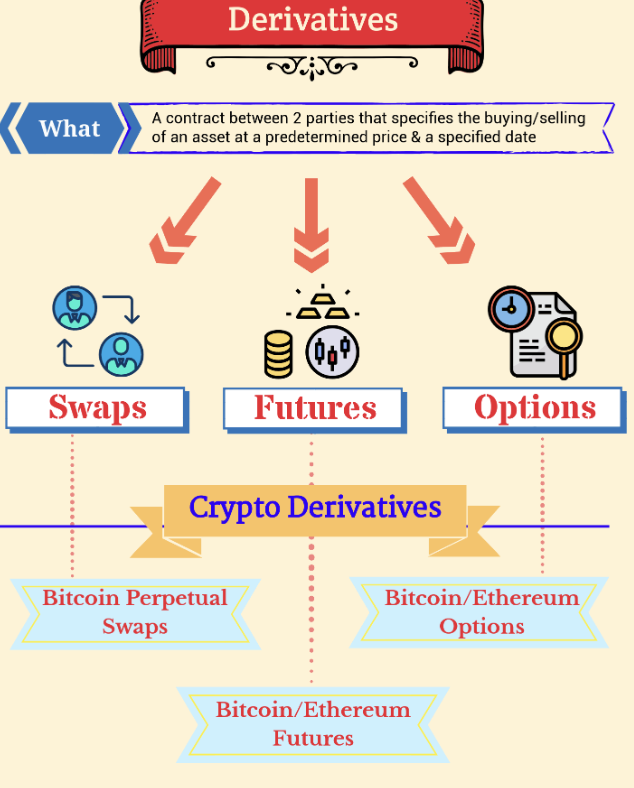

Derivatives come in a variety of forms, including options, futures, swaps, and forwards. Each type of derivative has its own unique characteristics and can be used to achieve different investment objectives. For example, futures contracts are commonly used to hedge against price fluctuations in commodities, while options contracts can be used to speculate on the price movements of individual stocks or entire markets.

Despite their benefits, derivatives can be complex and risky. They require a high level of understanding and expertise to use effectively. As such, it’s important for investors and speculators to carefully consider their investment objectives and risk tolerance before using derivatives.

Derivatives have become an important tool for investors looking to diversify their portfolios and manage their risk exposure. By providing a way to speculate on the price movements of underlying assets without owning them, derivatives offer investors a way to take advantage of market opportunities and achieve their investment goals.

Types of Derivatives

Derivatives have become an essential part of the modern financial system, and their use has grown significantly over the years. A derivative is a financial instrument whose value is derived from an underlying asset, such as a stock, bond, or commodity. Derivatives can be used for various purposes, including risk management, speculation, and leveraging a position.

The derivatives market is vast and continues to evolve, offering a wide range of products to fit nearly any need or risk tolerance. In addition to traditional derivatives, there are also specialized derivatives based on weather data, such as rainfall or temperature. These derivatives are used in industries such as agriculture or energy, where weather conditions can have a significant impact on business operations and revenues.

The derivatives market has two main classes of products: “lock” and “option.” Lock products, such as futures, forwards, or swaps, bind the respective parties from the outset to the agreed-upon terms over the life of the contract. On the other hand, option products, such as stock options, provide the holder with the right, but not the obligation, to buy or sell the underlying asset or security at a specific price on or before the option’s expiration date.

Futures contracts are agreements to buy or sell a specific asset at a predetermined price and date in the future. Forward contracts are similar to futures contracts but are not standardized and are traded over-the-counter. Swaps are agreements to exchange cash flows based on different variables, such as interest rates or currencies. Options contracts provide the buyer with the right to buy or sell the underlying asset at a specific price, but not the obligation to do so.

Derivatives play a crucial role in modern finance, but their complexity and risk have also led to controversies. The 2008 financial crisis, for instance, was partly caused by the widespread use of complex derivatives, such as mortgage-backed securities, that were poorly understood and mispriced.

Despite their challenges, derivatives remain an important tool for investors and businesses to manage their risks and achieve their financial objectives. The derivatives market will continue to evolve, and new products will emerge to meet the changing needs of market participants.

Futures

A futures contract is a standardized agreement between two parties to purchase and deliver an asset at an agreed-upon price on a future date. The use of futures contracts is widespread in various industries, including agriculture, energy, and finance. For instance, farmers use futures contracts to sell their crops before they even grow. By doing so, they can lock in a price for their crops and eliminate the risk of price fluctuations. Similarly, oil companies use futures contracts to hedge against the risk of falling oil prices.

In a futures contract, the buyer and the seller are both obligated to fulfill their commitment to buy or sell the underlying asset at the agreed-upon price when the contract expires. Futures contracts provide traders with an opportunity to hedge their risk or speculate on the price of an underlying asset. A trader who wants to hedge their risk can take a long position in a futures contract, which means they agree to buy the underlying asset at the future date. On the other hand, a trader who wants to speculate on the price of an underlying asset can take a short position in a futures contract, which means they agree to sell the underlying asset at the future date.

To illustrate, suppose an investor wants to hedge against the risk of rising oil prices. The investor can buy an oil futures contract that expires in the future at a fixed price. If the price of oil rises in the future, the investor can still buy oil at the agreed-upon price. However, if the price of oil falls, the investor loses money on the futures contract, but gains money on the actual purchase of oil.

Conversely, a speculator may take a position in a futures contract with the opposite view of the market. For example, a speculator may take a long position in a futures contract for oil if they believe that the price of oil will rise in the future. If the price of oil increases as predicted, the speculator can sell the futures contract for a profit. However, if the price of oil falls, the speculator loses money on the futures contract.

Cash Settlements of Futures

Not all futures contracts are settled at expiration by delivering the underlying asset. If both parties in a futures contract are speculating investors or traders, it is unlikely that either of them would want to make arrangements for the delivery of a large number of barrels of crude oil, for instance. In such cases, speculators can easily end their obligation to purchase or deliver the underlying commodity by closing (unwinding) their contract before expiration with an offsetting contract.

On the other hand, it is important to note that many derivatives are cash-settled rather than physically settled. This implies that the gain or loss in the trade is simply an accounting cash flow to the trader’s brokerage account. It is worth mentioning that futures contracts that are cash-settled include many interest rate futures, stock index futures, and more unusual instruments such as volatility futures or weather futures. Given the wide range of derivatives that are cash-settled, it is essential for traders and investors to understand the differences between cash-settled and physically settled contracts, as well as the implications of each type of contract on their overall trading strategy and risk management approach.

Forwards

Forward contracts are agreements between two parties to buy or sell an asset on an agreed-upon future date at an agreed-upon price. Unlike futures, forward contracts are not traded on an exchange, but rather over-the-counter between two parties. One of the benefits of forward contracts is that the parties can customize the terms, size, and settlement process to fit their specific needs, which can be particularly valuable for unique or complex transactions.

However, one of the downsides of forward contracts is that they carry a greater degree of counterparty risk for both parties. Counterparty risk refers to the risk that one of the parties in the contract may not be able to meet its obligations under the agreement. This can happen if, for example, one of the parties becomes insolvent. If this occurs, the other party may have no recourse and could lose the value of its position.

To mitigate this risk, parties in a forward contract can offset their position with other counterparties. However, this can also increase the potential for counterparty risks as more traders become involved in the same contract. Therefore, it’s important for parties entering into forward contracts to carefully consider the potential counterparty risks and take appropriate steps to manage them.

Swaps

Swaps are a popular type of derivative that enables the exchange of cash flows between two parties. This exchange can help companies manage risks and take advantage of opportunities in the financial market.

For instance, if a company borrows $1,000,000 at a variable interest rate of 6%, they may worry about rising interest rates that could increase the costs of the loan or discourage lenders from offering more credit. To mitigate this risk, the company could engage in an interest rate swap with another company, such as Company QRS. In this case, Company QRS agrees to exchange the variable-rate loan payments with fixed-rate loan payments of 7%. That is, XYZ will pay 7% to QRS on its $1,000,000 principal, and QRS will pay XYZ 6% interest on the same principal. At the beginning of the swap, XYZ will just pay QRS the 1 percentage-point difference between the two swap rates.

Swaps can also be used to manage currency-exchange rate risk or the risk of default on a loan or cash flows from other business activities. For instance, if a company deals with overseas clients, they may need to manage the risks involved in currency exchange rates, which might fluctuate and lead to unexpected losses. Similarly, if a company has a large loan that it fears may default, it can use a credit-default swap as insurance against the risk of default.

While swaps can be useful tools for managing risks, they can also be risky themselves. Swaps related to the cash flows and potential defaults of mortgage bonds, for example, were a key factor in the credit crisis of 2008. Before engaging in swaps or other derivatives, companies should carefully evaluate the risks and consult with financial professionals to ensure that they understand the potential impacts.

Options

An options contract is a type of financial instrument that allows two parties to agree to buy or sell an asset at a specific price on a predetermined future date. While options are similar to futures contracts, one key difference is that the buyer of an option is not obligated to follow through with the purchase or sale of the asset. This means that an option provides an opportunity but not an obligation, unlike futures contracts.

Options can be used to hedge or speculate on the price of an underlying asset. For example, imagine an investor owns 100 shares of a stock currently valued at $50 per share. While they believe the stock’s value will rise in the future, they’re also concerned about potential risks. To hedge their position, the investor could buy a put option that gives them the right to sell 100 shares of the stock for $50 per share until a specific date in the future known as the expiration date.

If the stock’s value falls to $40 per share by the expiration date and the put option buyer decides to exercise their option, they can sell the stock for the original strike price of $50 per share. If the put option cost the investor $200 to purchase, they will have only lost the cost of the option because the strike price was equal to the price of the stock when they originally bought the put. This strategy is known as a protective put because it helps mitigate the stock’s downside risk.

Now, let’s consider a different scenario. Imagine an investor doesn’t own a stock currently valued at $50 per share but believes its value will rise over the next month. In this case, the investor could buy a call option that gives them the right to buy the stock for $50 before or at expiration. Assume that this call option costs $200, and the stock rises to $60 before expiration. The buyer can now exercise their option and buy a stock worth $60 per share for the $50 strike price, resulting in an initial profit of $10 per share. Since a call option represents 100 shares, the real profit is $1,000, less the cost of the option—the premium—and any brokerage commission fees.

It’s important to note that in both examples, the sellers of the options are obligated to fulfill their side of the contract if the buyers choose to exercise the contract. However, if the stock’s price is above the strike price at expiration, the put option will be worthless, and the seller (the option writer) gets to keep the premium as the option expires. Conversely, if the stock’s price is below the strike price at expiration, the call option will be worthless, and the call seller will keep the premium. In conclusion, options contracts can be a useful tool for investors to manage risks and potentially profit from fluctuations in asset prices.

Conclusion

Derivatives are financial instruments or contracts whose value is derived from an underlying asset. These assets can include stocks, bonds, commodities, currencies, interest rates, or market indices. Derivatives are used for various purposes, such as hedging against risks, speculation on price movements, and arbitrage opportunities.

Common types of derivatives include futures contracts, options contracts, forwards contracts, and swaps. Futures and forwards are agreements to buy or sell an asset at a specified price on a future date. Options provide the holder with the right but not the obligation to buy or sell an asset at a predetermined price on or before a specific date. Swaps involve the exchange of financial instruments or cash flows based on specified conditions.

Derivatives serve as essential tools in financial markets, allowing investors and businesses to manage risk, increase liquidity, and gain insights into price movements. However, they also come with a higher level of risk and complexity, necessitating a thorough understanding and prudent management when using them in investment strategies.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.