Alchemix Review: Pioneering A Revolution In DeFi With Multi-Chain Stability

In the ever-evolving landscape of lending platforms, one name stands out for crypto investors seeking to maximize their earnings without the constant fear of asset liquidation – Alchemix (ALCX). Let’s find out details about this project with Coincu through this Alchemix Review article.

Cryptocurrency investors often face the dilemma of needing a loan but being apprehensive about the possibility of spending borrowed funds unwisely, leading to the risk of their assets being liquidated. Alchemix presents a transformative solution to this problem with its unique lending protocol that offers unparalleled peace of mind.

What is Alchemix?

Alchemix, the brainchild of innovative developers, introduces a novel concept of Synthetic Assets backed by future returns, offering users unprecedented opportunities to earn profits through sophisticated mechanisms.

At its core, Alchemix is a decentralized platform built on Ethereum, providing users with the ability to borrow cryptocurrency. The platform’s native token, ALCX, serves as a store of Synthetic Assets, representing a claim to any collateral in the Alchemix protocol. This ingenious approach to asset representation has garnered support from major enterprises, indicating its potential to shape the future of tokenization.

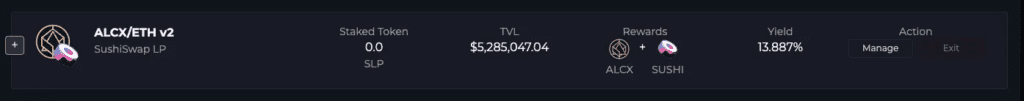

One of the key features of Alchemix is its unique staking mechanism, allowing users to stake their tokens and coins for profitable mining. As a result, the platform issues a token equivalent to the collateralized debt, effectively creating a Synthetix synthetic asset for liquidity providers (LPs) in the DeFi ecosystem. These LP tokens can then be traded for profit on derivatives, presenting users with a double profit mechanism.

The platform’s success is not solely tied to DeFi activities, as Alchemix incorporates an arbitrage mechanism that leverages the value of Synthetix synthetic assets received through trading transactions. This creates an additional avenue for users to capitalize on the value differentials, further enhancing their profitability.

Alchemix’s seamless process involves the issuance of tokens corresponding to the debt that users mortgage when staking their tokens. Simultaneously, users have the flexibility to instantly recover the encrypted value of stablecoins. This mutually beneficial arrangement automates electronic debt payments, ensuring a smooth experience for both lenders and borrowers.

To finance the repayment process, Alchemix utilizes profits earned from funds flowing into the platform. Consequently, users not only benefit from their DeFi activities but also earn money based on the aggregated assets’ differential value. This all-encompassing approach truly positions Alchemix as a platform offering a double profit mechanism. Now, the Alchemix Review article will explore the highlights of the project.

Highlights

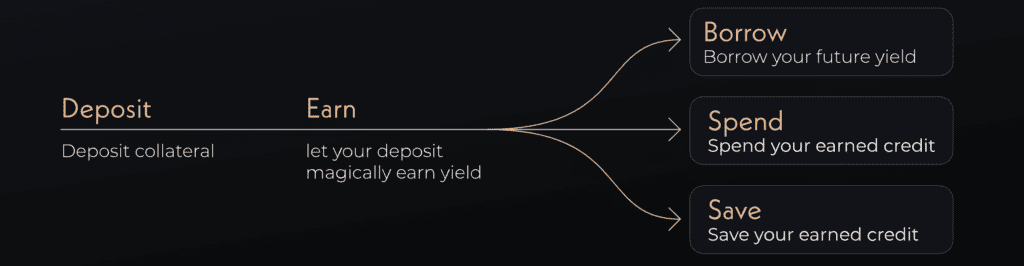

Traditionally, farming involves staking assets in a protocol and waiting for rewards. However, Alchemix aims to be more than just another farming platform. It serves as an innovative ecosystem that allows users to deploy their LP tokens in various ways, transcending the conventional limitations of traditional farming protocols.

Instead of merely earning regular LP tokens, users who choose Alchemix can now receive Synthetic tokens in return for their staked assets. Alchemix currently supports alUSD, a synthetic token minted from DAI, with plans to expand support to other stablecoins in the future. These synthetic tokens are tradable and subject to price fluctuations like any other standard cryptocurrency.

The core focus of the Alchemix project is centered around upgrading LP tokens, creating a new dimension for users’ assets. Rather than staking their assets in protocols directly, users can now deposit them directly into Alchemix. Once there, the project harnesses these assets for farming purposes, generating yield on behalf of the users. As a result, users receive synthetic tokens as a representation of their stake in Alchemix, opening up new possibilities for their assets.

The flexibility of Alchemix is a major advantage, as it can accommodate virtually any token that is involved in farming or has a vault mechanism within its native protocol. Whether it’s yvDAI Vault, aLINK Vault, or any other farming mechanism, Alchemix welcomes a diverse array of tokens to join its ecosystem.

One of the most attractive features of Alchemix is its user-friendly debt repayment mechanism. Interest earned from transactions is automatically directed towards repaying the users’ debts. This not only reduces the risk of users forgetting about their debts but also grants them the freedom to withdraw profits and utilize them at their discretion.

For those who often find it challenging to keep track of debts and repayments, Alchemix offers a reliable solution. With this seamless automation, users can rest assured that their debts are being settled, while they can focus on making the most of their earnings.

As the cryptocurrency market continues to evolve rapidly, Alchemix stands out as a pioneering platform that adds a new layer of functionality to LP tokens. By offering a diversified range of options for farming and yield generation, the project caters to both seasoned farmers and newcomers seeking innovative opportunities.

How does it work?

By depositing assets into the platform, users are granted access to an innovative and powerful financial ecosystem backed by Alchemix’s smart contract technology, resulting in the issuance of unique tokens called al-Tokens.

The core feature of Alchemix lies in its novel approach to creating synthetic assets, which necessitates a stable price mechanism, such as stablecoins or ERC20 tokens with on-chain profit-generating capabilities. Examples of compatible protocols include Compound, AAVE, and vault-like products like yDAI Vault or aLINK Vault.

Initially, Alchemix supports exchange rate stable tokens, paving the way for the issuance of alUSD tokens (where “al” denotes Alchemix platform). While the original plan encompassed multiple stablecoins, the protocol decided to start with DAI support. Nevertheless, the examples and principles applied to alUSD extend to other al-Tokens as well.

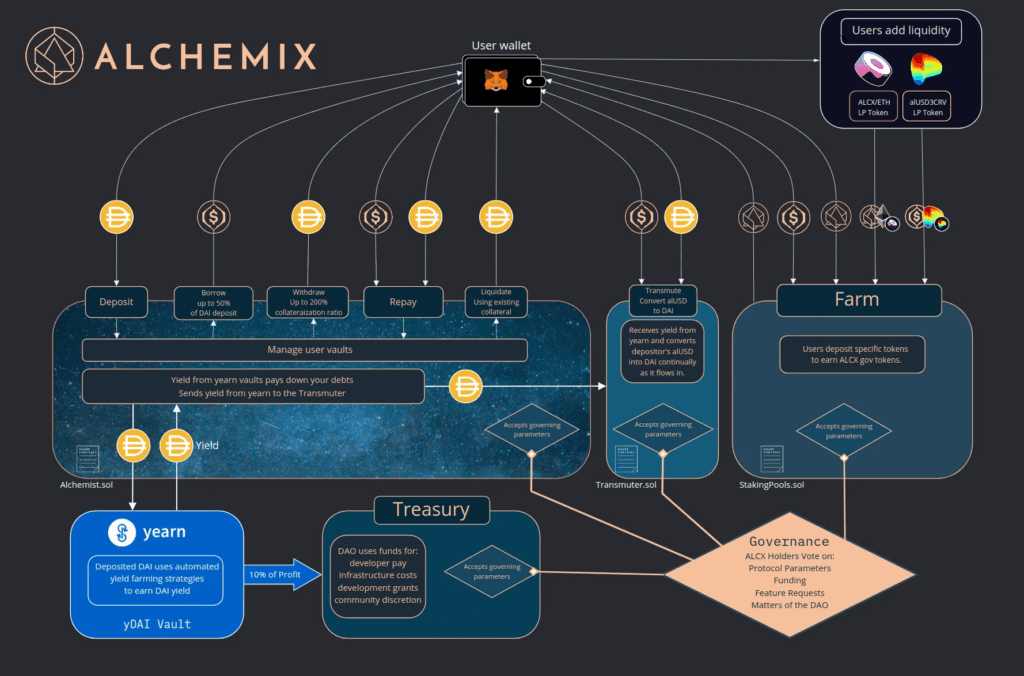

The Alchemix decentralized application (DApp) comprises several essential components, namely:

- Vaults: These act as hubs for profit generation, akin to MakerDAO and AAVE. In its initial phase, the protocol accepts DAI as the first collateral type.

- Transmuter: The Transmuter component enables users to stake synthetic assets, converting them back into the original assets over time.

- Farming: Alchemix also features a farming mechanism, encouraging active participation and providing rewards for users.

- Treasury: The Treasury is governed by the Alchemix DAO, a community-driven management system that guides the platform’s decisions and future development.

Let’s take a closer look at how the Alchemix platform works. Users begin by staking DAI into the Vaults pool contract. The staked DAI is then deployed by the Alchemix contract, generating profits within the Yearn yvDAI Vault. Here’s where the magic happens: users can borrow up to 50% of the DAI they deposited. For example, if a user deposits 1000 DAI, they can generate up to 500 alUSD.

As profits accrue in the yvDAI Vault pool, the protocol automatically reduces the alUSD debt. Given enough time, this debt will eventually be paid off by the Alchemix platform itself. This unique feature essentially allows users to repay their loans passively while retaining a portion of the initial collateral, providing them with additional financial flexibility.

Users are granted various options to manage their Vaults once they are open. For instance, if the collateral ratio exceeds 200%, users can immediately withdraw DAI or alUSD until their vault reaches a 200% collateral ratio. During the staking period, Alchemix automatically repays the earned profit, allowing users to withdraw more DAI or alUSD as desired.

Additionally, users have complete control over the staking period. They can choose when to withdraw and repay with either DAI or alUSD at their discretion. Notably, the protocol treats alUSD and DAI equally, enabling users to repay a debt of 1000 alUSD with either 1000 alUSD, 1000 DAI, or a combination of both.

In the event that a user lacks sufficient funds to repay their loan, they have the option to liquidate their collateral to settle the debt. Upon clearing the alUSD debt entirely, users are free to withdraw all the collateral they initially deposited. Moreover, if users forget to withdraw their collateral, they will continue to be credited with alUSD along with the interest generated for that period until they eventually withdraw.

Alchemix Vaults offer versatility by providing powerful immobilization mechanisms. As the alUSD debt can be repaid in alUSD and/or DAI, users can strategically leverage market dynamics. For instance, if alUSD falls below the DAI peg, users can buy it from the market at a discounted price to repay the debt. Conversely, if alUSD exceeds the anchor level, users can mint and sell alUSD for a profit or repay the debt in DAI.

Moreover, Alchemix users can exploit arbitrage opportunities in stablecoin prices when dealing with alUSD backed by multiple assets. They can “mine” alUSD with the cheaper stablecoin, thereby repaying the debt generated from a more expensive stablecoin. This approach, when adopted by many users, helps maintain stability and ensures that backed stablecoins stay closer in value.

Features

The platform’s key features include Vaults, Transmuter, Treasury, and the Alchemix DAO, each contributing to the ecosystem’s success and stability.

Vaults – Generating Profits Made Simple

At the heart of Alchemix lies its Vaults feature, which operates similarly to established lending platforms like AAVE and MakerDAO. Users can deposit DAI into the Vaults contracts, using it as collateral. The deposited DAI is then deployed by the Alchemix Smart Contract to generate profits in Yearn yvDAI Vault, offering users an opportunity to earn returns on their holdings.

Transmuter – Ensuring Stability and Flexibility

Alchemix’s Transmuter serves as the main anchor for the platform’s synthetic tokens. A unique mechanism guarantees that all participants can seamlessly exchange alUSD for DAI tokens at a fixed ratio of 1:1. When users deposit alUSD into the Transmuter, profits are credited proportionally to DAI holders based on their deposit amounts. Conversely, when DAI is withdrawn, an equivalent amount of alUSD is “burned,” ensuring a balanced and stable system.

Treasury – Empowering the Community

A standout feature of Alchemix’s vault is its commitment to community involvement. A well-thought-out mechanism directs 90% of the platform’s profits to Vaults and Transmuter, while the remaining 10% flows into the Treasury. This setup ensures that the community benefits significantly from the platform’s success.

Profit distribution within the Treasury operates as follows:

- 60% of ALCX tokens, Alchemix’s native governance token, are distributed among the community.

- 15% of the supply is community-controlled and allocated to the Alchemix DAO (Decentralized Autonomous Organization), giving token holders a say in protocol decisions and treasury management.

- 5% of the supply is dedicated to bounty rewards for those who discover and report platform bugs, further fostering community participation.

- The remaining allocation is utilized for farming initiatives, bolstering the ecosystem’s growth and sustainability.

Alchemix DAO – Empowering Governance

The Alchemix DAO serves as a developer of Multisig and facilitates decision-making through the Snapshot app. Holders of the ALCX token are granted administrative rights to influence protocol decisions and determine the efficient usage of the treasury, solidifying Alchemix’s commitment to decentralized governance.

ALCX token

Key Metrics

- Token Name: Alchemix Token.

- Ticker: ALCX.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: 0xdbdb4d16eda451d0503b854cf79d55697f90c8df

- Token type: Utility, Governance.

- Total Supply: 2,205,278 ALCX.

- Circulating Supply: 1,895,107 ALCX.

Use Cases

ALCX tokens serve a dual purpose within the platform. Firstly, they function as a means of payment for transaction fees and smart contracts. This ensures smooth and efficient operations on the system while providing a seamless experience for users. Additionally, ALCX tokens are utilized as staking fees for collateral and other essential operations, further solidifying their importance in the platform’s mechanics.

One of the most distinguishing features of ALCX is its role in governance. Token holders are granted the power to directly influence and shape the future of the platform. Through voting mechanisms, ALCX holders can actively participate in key decisions such as vault governance, the election of board members, and updates to the platform’s systems. This democratic approach to governance ensures that the community’s voice is heard and considered in the platform’s evolution.

Furthermore, ALCX plays a vital role in risk management and optimization. The platform’s fund employs ALCX to fine-tune critical parameters like base fees and asset liquidation rates. This flexibility enables the platform to adapt swiftly to changing market conditions and ensures the efficient management of risks.

It is worth noting that the platform’s commitment to transparency and inclusivity has been pivotal to the success of ALCX. Through the implementation of a decentralized governance model, the platform has empowered its community to actively participate in shaping its future, fostering a sense of ownership and accountability among its users.

Token Allocation

Staking Pool: 80%

- Founder, Dev, Community Dev: 16%.

- Rest of the world: 64%.

DAO: 20%

- 15% will be received in advance to serve community.

- Bug Bounties: 5%.

Release Schedule

Staking Pool: All must Staking to get ALCX, including product makers.

- Founder, Dev, Community Dev: Get 20% Block Reward.

- Rest of the world: Get 80% Block Reward.

DAO: 20%

- 15% tokens will be used for the community for 3 years.

- Bug Bounties: used for Bug Bounty programs for 3 years.

Team

Alchemix has not yet formally disclosed details about the project development team. Just know that they are a group of people that have their own moniker and are headed by Scoopy Tro People’s.

Investors and Partners

Investors

Investors in Alchemix include EGirl Capital, DCV (DeFi Chads Ventures), and Weak Simp Capital. These are all well-known figures in the cryptocurrency business.

The initiative has garnered considerable trust funds to support the platform’s operations. Alchemix’s notable investors include Alameda Research, Ledger Prime, and Magic Ventures. Having said that, Alchemix is a really promising cryptocurrency idea.

Partners

The projetct has tight contacts with big brands in addition to investors. These are the companies that define the future of ALCX. Nascent, Protoscale Capital, Fisher8 Capital, and Delphi Digital are the project’s key partners. Alchemix will acquire additional collaboration ties in the future.

Conclusion of Alchemix Review

Alchemix’s primary focus is the development of a robust stablecoin platform situated on the cutting-edge Polkadot ecosystem as a Parachain. This strategic move enables the platform to leverage the inherent scalability and interoperability of Polkadot, thus promising an efficient and seamless user experience.

Currently, the project is undergoing an intensive testing phase, ensuring that the platform meets the highest standards of security and functionality. Despite being in the early stages of development, Alchemix has already achieved several notable milestones.

Looking ahead, the Alchemix team is driven by a strong vision to revolutionize the DeFi landscape, empowering users with greater financial autonomy and security. By eliminating the need for liquidation when tokenizing profits, Alchemix paves the way for a more sustainable and user-friendly DeFi experience. Hopefully the Alchemix Review article has helped you understand more about the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.