How Are Real World Assets (RWAs) Integrated Into Defi Protocols?

The growing popularity of RWAs in DeFi underscores the growing importance of incorporating real-world assets into decentralized financial solutions to open up more opportunities to bring more stable assets into DeFi, making user investments safer and protocols more accessible. So why is the integration of these two areas becoming more and more important, and are there ways to bring RWA deep into the Defi market?

Real World Assets (RWA) became a significant driver of Defi

DeFi is successful in the crypto space because it benefits all participants. Cryptocurrency holders can earn passive income from their assets through mechanisms like yield farming. At the same time, borrowers can get loans in seconds on favorable terms that no other traditional financial institution can match.

One of the biggest drawbacks of DeFi is the requirement that borrowers over-collateralize their loans to account for price fluctuations. Most DeFi protocols require collateral that is higher than the loan’s value. This excessive collateral requirement poses a significant risk to the borrower and severely impedes access. Currently, most businesses cannot use DeFi as a source of funding because they are not allowed to use anything but cryptocurrencies as collateral.

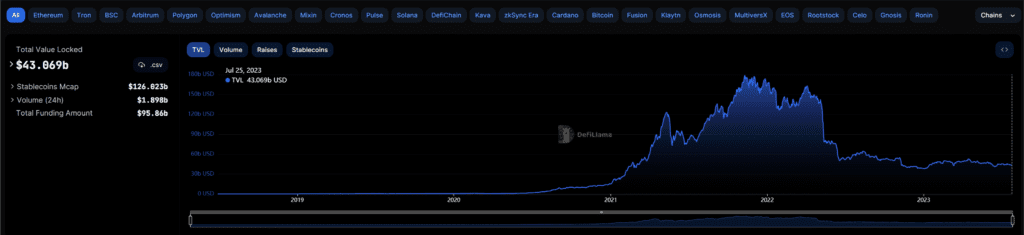

Besides, the DeFi Market has grown enormously since the beginning of 2020 and reached the TVL milestone of more than $180 billion by the end of 2021. Since then, along with the market’s downtrend, the TVL on DeFi protocols has plummeted to less than $50 billion as it is now.

As a pillar of technological progress and the driving force of the entire blockchain industry today, however, DeFi still needs to work on better tokenomics models with a high token inflation rate.

Some tokens lost more than 90% of their value, and even disappeared from the market, leading to a significant reduction in profits for users. The yield from DeFi is now only equivalent to TradFi (Traditional Finance).

Now there is a new innovation in the field of DeFi that can revolutionize the traditional way of lending/borrowing and drive DeFi adoption globally across all businesses, small and large. RWA refer to physical assets with tangible value, such as real estate, merchandise, vehicles, and collectibles. These assets are increasingly tokenized, meaning their ownership is represented by digital tokens that can be bought, sold, or traded on the blockchain.

Integrating Real World Assets (RWA) into decentralized finance (DeFi) has greatly expanded the range of financial opportunities and services available to users, including lending, borrowing, and trading. By making high-value, physical assets more accessible, liquid, and interoperable, tokenized real-world assets are creating opportunities for both individual investors and companies to participate in the process.

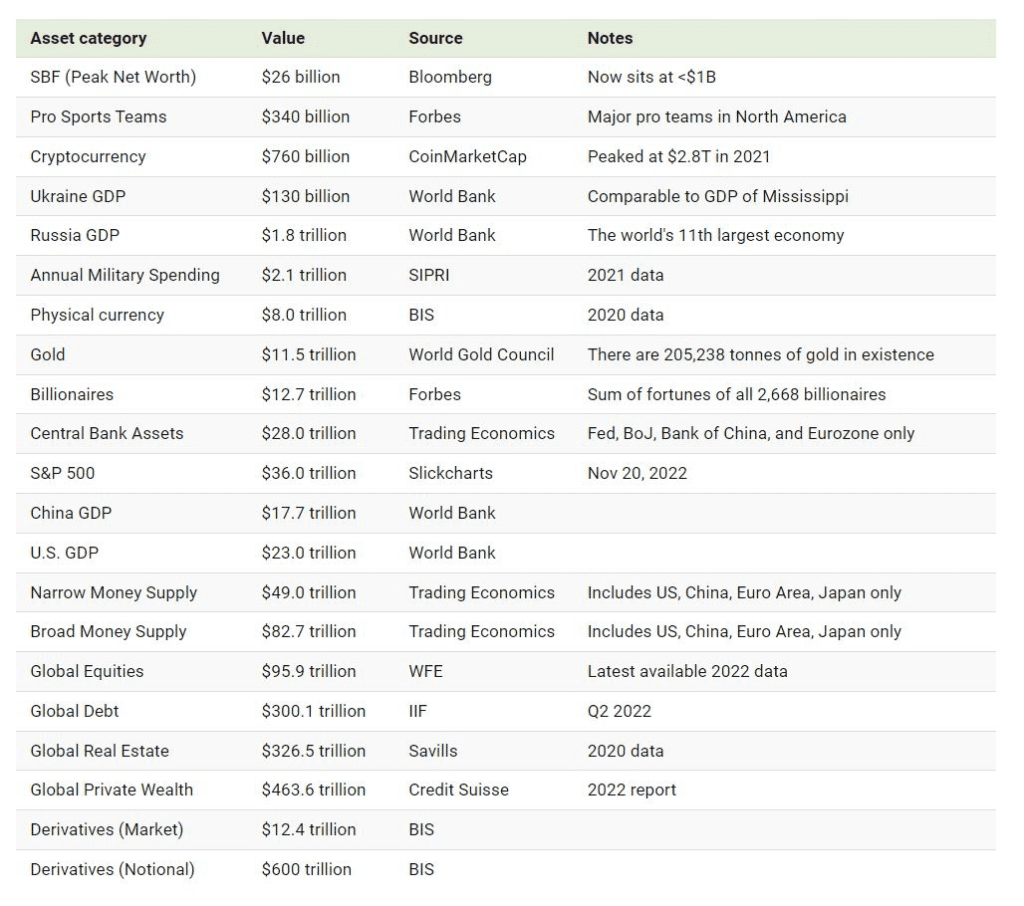

Currently, Real World Assets is contributing a huge part to the value of global finance. Of which, the debt market (with fixed cash flow) is already worth about $127 trillion, the real estate market is worth about $362 trillion, and the gold market capitalization is about $11,5 trillion.

Meanwhile, with TVL at just $50 billion, the DeFi market is like a tiny person compared to RWA’s capitalization. If RWA is put on the blockchain, the DeFi market will receive a richer stream of assets with more diverse profit models, thereby driving growth.

Ways DeFi Leverages RWA to Real Profits

In recent years, the term Real World Asset (RWA) has emerged more commonly to distinguish cryptocurrencies from traditional financial assets. Compared to cryptocurrencies that only exist in digital form, physical assets (RWAs) are often tangible assets and involve physical institutions.

However, with the development of blockchain technology, real assets have become able to connect to DeFi. The developer uses smart contracts to generate a token that represents an RWA and provides off-chain security to ensure the token is redeemable for the underlying asset.

So when Real World Assets are put on the blockchain, how will they be used in DeFi?

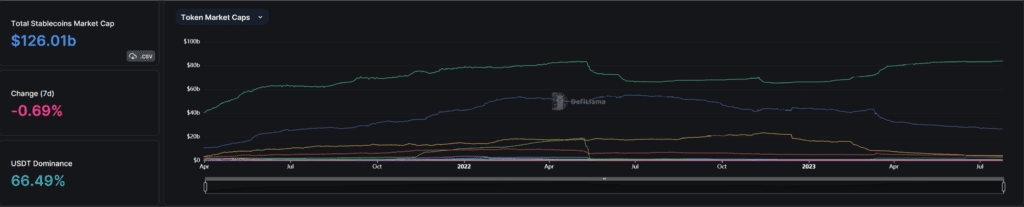

Stablecoins

Stablecoins are a perfect example of successful real-world use of assets in DeFi, with three of the top seven crypto tokens by market capitalization being stablecoins ($126 billion in total). USDT and USDC are two stablecoins that are regularly in the top 5 crypto tokens by market capitalization. What both have in common is that real assets like USD and bonds back them.

Currently, USDC is backed by a 1:1 peg against the USD, thanks to an asset reserve of $8.1 billion in cash and $29 billion in U.S. Treasuries. Similarly, more than 80% of USDT’s reserve assets are in cash and Treasuries, with the remainder in corporate bonds, loans, and other investments.

By this nature, stablecoins are an important asset of DeFi, supporting the transfer of value between the real world and the blockchain, as well as an intermediary asset to shelter from market volatility.

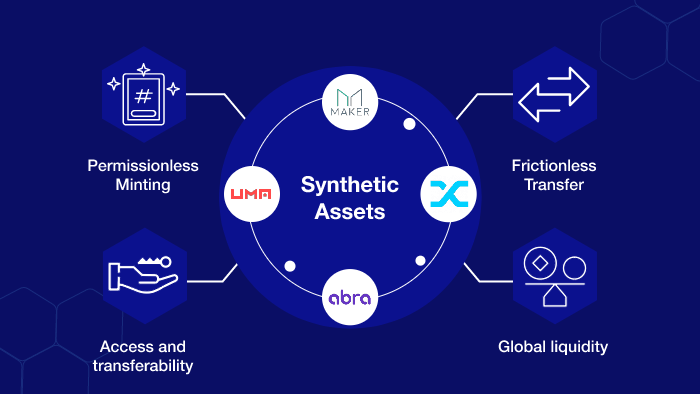

Synthetic tokens

Another application of the synthetic token involves connecting physical assets to DeFi. This synthetic token enables on-chain trading of financial futures involving currencies, stocks, and commodities. The leading synthetic token trading platform, Synthetix, locked up to $3 billion worth of assets in its protocol during a massive bull run in 2021.

Synthetic tokens have many interesting uses. For example, holders of real assets such as real estate can securitize cash flows from rental operations, then tokenize that security into a synthetic token for trading on DeFi.

Lending Protocol

Another interesting application of RWA in DeFi is related to lending protocols. Compared to primitive lending protocols that use crypto borrowing, DeFi platforms focus on RWAs to serve actual businesses that are borrowing money. This pattern offers relatively stable yields and is protected from cryptocurrency volatility.

It’s also no surprise that lending protocols lead the DeFi space. Out of the top 10 DeFi protocols on the market, 4 are just lending deals.

With RWA-based crypto loans, you are providing collateral that may have an objective value lower than the amount you are borrowing. In some cases, you may not even need to put down any collateral. RWA-based loans help businesses survive and expand by allowing them to access capital without having to put up large amounts of collateral.

Yield Generator

The DeFi lending business model provides the most cost-effective way to pool and distribute capital among many lenders and borrowers. It eliminates middlemen and automates money transfers while providing users with relative anonymity.

However, the focus on serving crypto investors creates significant limitations. The capital pool in DeFi needs to be more utilized, especially during bear markets. The world’s biggest borrowers don’t have access to these funds either – real world businesses don’t have crypto assets as collateral.

Lending protocols address these limitations by building a robust model to help businesses with real-world economic activity access DeFi capital.

Real Yield platforms can use RWAs as real estate (Real Estate) tokenized into NFTs as collateral for loans. Then, Yield Generator will generate profits from this lending and share profits with investors through tokens issued by the platform.

Conclusion

Bringing real-world assets onto the blockchain and integrating them into decentralized finance is one of the most significant potential use cases of cryptocurrencies and Web 3 technology.

Some of the prominent applications of RWA in DeFi are stablecoins, synthetic tokens, lending, and yield generators. These are just simple applications, so this field has a lot of potential for future growth.

Currently, the introduction of RWA into the Crypto market is still facing many challenges. One of them is the ability to evaluate and convert RWA value to cryptocurrency accurately. Besides, the stability of RWA value in the Crypto market is also affected by volatility and the possibility of capital loss.

However, the development of Blockchain technology and DeFi applications are helping to solve some of the above problems and provide new solutions for RWA trading in the Crypto market. This is attracting the interest of many investors and financial professionals in the hope of creating a connection between the Crypto market and the traditional asset market, helping to bring greater investment opportunities to investors around the globe.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.