Key Points:

- Binance withdraws crypto license applications in Germany due to regulatory concerns.

- Mounting pressure forces Binance to exit operations in several European countries.

- The exchange remains committed to complying with evolving regulations while seeking appropriate licensing.

In the face of mounting regulatory challenges, Binance, the world’s largest cryptocurrency exchange, has withdrawn its application for a crypto license with the German financial regulator BaFin, Bloomberg reported.

This move marks the latest setback for the exchange as it navigates a tough regulatory landscape in Europe and beyond.

Last month, Binance received news from German regulators that they would not be granting the company a crypto custody license. In response to this development, the exchange has proactively withdrawn its application, indicating a reevaluation of its immediate expansion plans in light of the changing regulatory environment.

Earlier discussions between Binance and BaFin had hinted at the denial of a license, but the exchange was still engaging with officials to explore possibilities. However, on June 29, BaFin officially rejected Binance’s custody license application, prompting the exchange to formally withdraw its submission.

A spokesperson for the company emphasized that the global market and regulatory conditions have undergone significant changes, prompting the need for a more accurate reflection of these factors in their license application. The company still intends to seek appropriate licensing in Germany, but it is now taking a more considered approach to ensure compliance with the evolving regulations.

The regulatory challenges faced by Binance are not limited to Germany alone. The exchange has been under mounting pressure across various European jurisdictions. Recently, the exchange made the decision to exit operations in Belgium, Cyprus, and the Netherlands, either voluntarily or in response to requests from local authorities. Furthermore, the exchange is currently facing investigations and lawsuits from regulators in the United States and France for alleged money laundering activities.

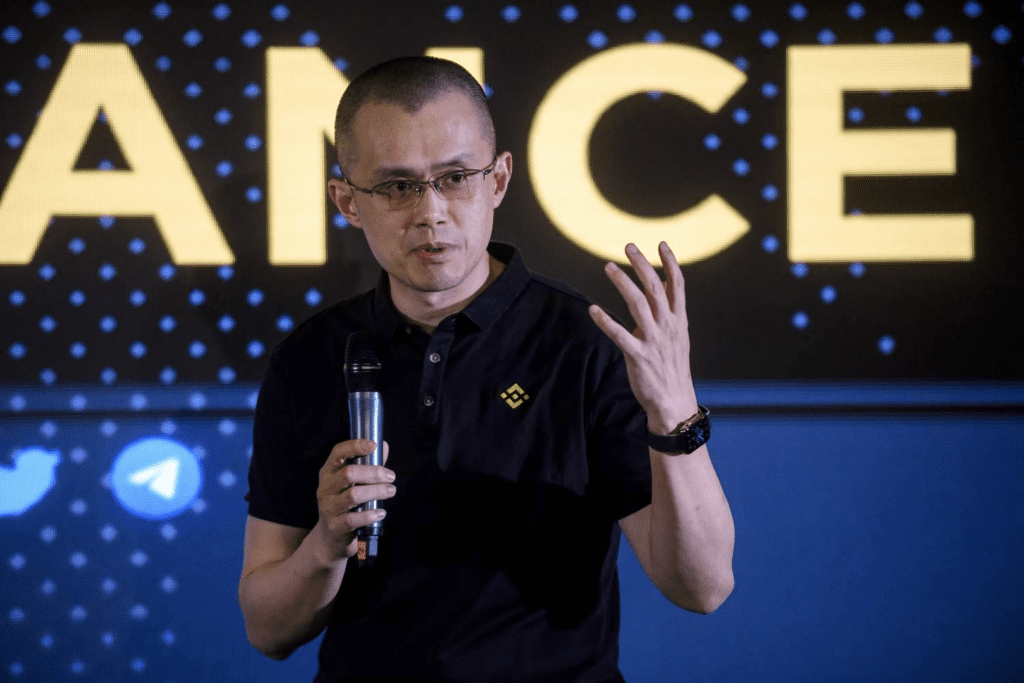

Despite the challenges, Binance’s Chief Executive Officer, Changpeng Zhao, remains resolute about the exchange’s presence in France. He has stated that France continues to be the flagship center for Binance in Europe, despite the ongoing money laundering probe.

Looking ahead, European Union laws that are set to take effect in 2024 are expected to allow cryptocurrency service providers to operate across the bloc with a single license, potentially streamlining operations for exchanges like Binance.

As the cryptocurrency industry continues to evolve, regulatory scrutiny is intensifying, and Binance’s recent actions demonstrate the need for careful consideration and compliance with the changing landscape to ensure long-term viability in the market.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.