Bitcoin Is Slowly Gaining Bullish Momentum, $30,000 Price Zone Could Be Recaptured

Key Points:

- Bitcoin experienced a generally sluggish week but showed a bullish renewal on Thursday.

- Technical analysis indicates a positive outlook for Bitcoin, as it rebounded from the $29,000 support level and is attempting to retest the $30,000 resistance zone.

- If Bitcoin manages to break through the upcoming price zone at $30,320, it could pave the way for a potential rally toward higher levels, such as $32,000 and $35,000.

Bitcoin price is trending higher on Thursday following a generally sluggish week in the cryptocurrency market. The most prominent coin is up 0.8% to $29,540 amid a renewed bullish push, with a 24-hour trading volume of $13.1 billion and $573 in market capitalization.

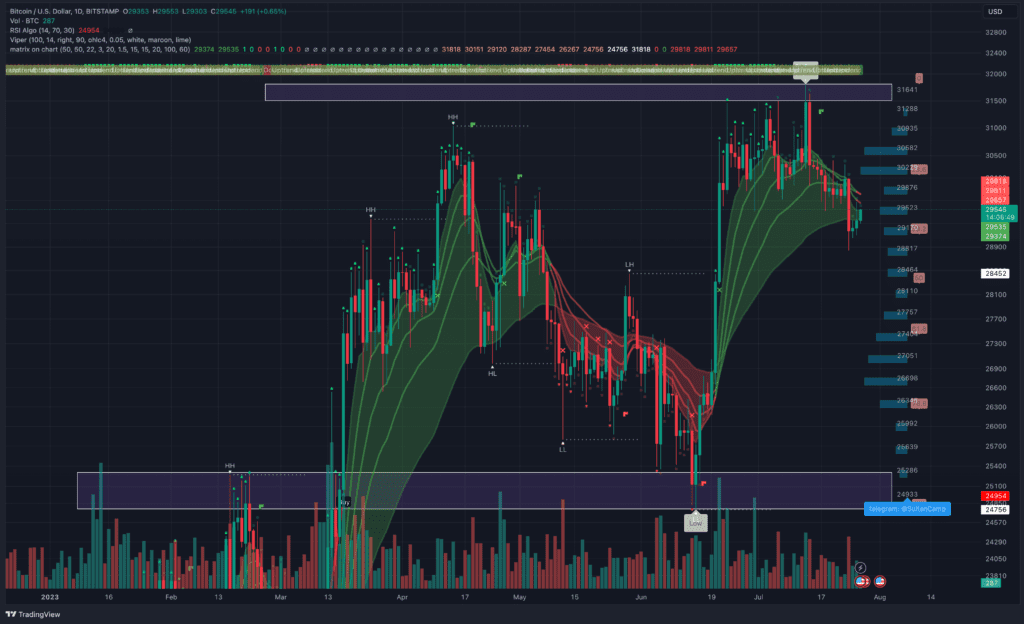

The technical analysis from the daily time frame provides a bullish outlook. On July 13, the BTC price reached a new yearly high of $31,800, only to experience a setback shortly afterward. The subsequent day formed a bearish engulfing candlestick (indicated by a red icon), which occurs when a large bearish candlestick completely engulfs the previous day’s bullish candle. Following that, in the following days, BTC held steady at $29,000 and found new upward momentum.

Presently, Bitcoin is making strides to retest the seller congestion at $30,000, with its uptrend strongly supported by the established zone around $29,000. This crucial area has played a vital role in preventing further declines to $28,000 and, subsequently $25,000.

The recent recovery wave of Bitcoin was initiated above the $29,000 resistance zone, gaining further ground after the Federal Reserve‘s interest rate decision. This move brought Bitcoin above the $29,200 resistance zone.

Despite the rally, the bears have been actively defending the $29,600 resistance zone, leading to no close above this price level. Currently, Bitcoin is trading below $29,600, and it’s worth noting that its gain over the past three days has been from the 38.2% Fibonacci retracement level.

Bitcoin is now trading below $29,600. We should notice that BTC’s gain over the past 3 days is from the 38.2% Fib level. The next big barrier is at the $29,800 level, over which the price may begin to rise steadily into the $30,000 resistance zone. The next big resistance mark is at $30,320, over which the price may develop upward momentum, the bulls can gain a fresh outlook on a rally to higher zones like $32,000 and $35,000.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.