Key Points:

- Aave’s community achieves unanimous support in a critical online vote to “ban CRV mortgage lending.” This landmark decision highlights the community’s dedication to platform stability.

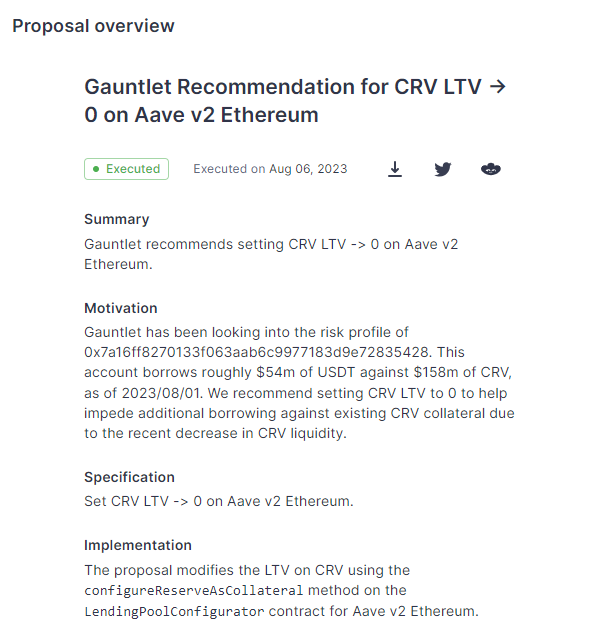

- Triggered by declining CRV liquidity, the proposal aims to protect Aave’s integrity. DeFi Gauntlet’s well-constructed proposal centers on setting CRV Loan-to-Value (LTV) to 0, barring further borrowing against CRV collateral.

- The 100% backing of the proposal reflects Aave’s community’s unity and shared concerns. This decision demonstrates the commitment of stakeholders to ensure security and mitigate risks, despite discussions on potential flexibility limitations.

Aave community has successfully passed an online voting proposal that seeks to “ban the addition of CRV mortgage lending.”

The vote, which received resounding support from all participants, concluded yesterday, marking a pivotal moment for the Aave ecosystem.

The proposal, meticulously put forth by DeFi Gauntlet’s risk manager, has stirred significant attention due to its strategic implications. The core rationale behind the proposal stems from the recent drop in CRV liquidity, a phenomenon that has prompted concerns within the Aave community. With an acute focus on safeguarding the platform’s stability, DeFi Gauntlet outlined their perspective on the necessity of this move.

The crux of the proposal is centered around Aave V2’s CRV Loan-to-Value (LTV) ratio on the Ethereum blockchain. The proposed action involves setting the CRV LTV to 0, effectively blocking any further borrowing against existing CRV collateral. This preventative measure is aimed at curbing the potential risks that might arise from the waning liquidity of CRV tokens.

The outcome of the community vote speaks volumes about the cohesion and shared concern for the Aave ecosystem’s well-being. The resounding 100% support underscores the collective commitment of Aave’s users, stakeholders, and enthusiasts to uphold the platform’s integrity and mitigate risks.

While the move is undoubtedly prudent, it has also raised discussions within the DeFi space. Critics argue that such a drastic step could potentially limit flexibility and innovation in the future. However, proponents of the decision emphasize the necessity to prioritize stability and security, especially when dealing with assets that are susceptible to market fluctuations.

As Aave implements the ban on the addition of CRV mortgage lending, all eyes are on the potential consequences and the broader implications for DeFi projects navigating similar challenges. This move is a testament to the dynamic nature of decentralized governance, where the community’s voice holds paramount importance in shaping the course of action.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.