iZUMi Finance Review: DeFi Project Provides Effective Multi-Chain Liquidity Service

iZUMi Finance helps to solve the difficulty of using liquidity effectively as it brings systematic liquidity service to the multi-chain ecosystem and eventually becomes a one-stop liquidity service platform with efficient, super capital in the DeFi industry. In this iZUMi Finance review, let’s find out through the article below.

What is iZUMi Finance?

iZUMi Finance is a platform that provides tunable liquidity as a service on Uniswap V3, which runs multi-chains.

iZUMi Finance is expanding its services to multiple chains with DEX and Bridge integration in the future. It will help liquidity providers earn more liquidity mining rewards as well as trading fees on Uniswap V3.

iZUMi’s core products are LiquidBox, iZiSwap, iZumi Bond, and veiZi. Besides, the platform also offers several other side products such as Impermanent Loss Insurance, Dual Currency Products, and Fixed Income Product.

On the other hand, this also helps protocols to attract more liquidity effectively and long term. iZUMi Finance solves the “pool 2 dilemma” by providing structured incentive modules and auto-recovery, which can attract more liquidity with low emission rates for coin protocols allow occasional loss of liquidity for liquidity providers.

iZUMi Finance Review: Highlights

Using the DL-AMM model

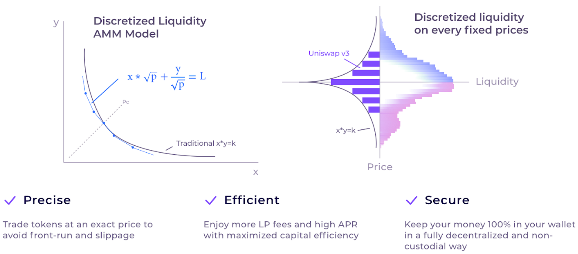

The main innovation of iZiswap lies in the proposal and implementation of Discretized-Liquidity-AMM (DL-AMM). The DL-AMM does not use a constant product formula but sets liquidity at different discrete prices, and each price follows the constant sum formula L = X* √ P + Y/√ P. Many separate price points are connected to form a complete Uniswap-like AMM price curve, as shown on the left in the figure below.

Liquidity in DL-AMM will be divided into LP liquidity and limit order liquidity. The two are combined, stacked, and distributed in different price areas, as shown in the figure to the right.

The DL-AMM algorithm makes use of a novel discrete concentrated liquidity algorithm with market-making features for concentrated liquidity comparable to Uniswap V3, but it allows for accurate distribution of liquidity on any price rather than a price range. As a result, iZiSwap can handle additional trading strategies, such limit orders, and have more controlled liquidity.

Various forms of liquidity provision

In addition to DL-AMM, iZUMi Finance designed LiquidBox, a centralized liquidity-based liquidity incentive service. V2-based liquidity mining offers are simple. Users can get token rewards by staking LP certificates, which equates to incentivizing liquidity at any price. However, the design that encourages centralized liquidity, like V3, DL-AMM, and BL is much more complex.

For users, LiquidBox is a place for them to deposit liquidity and receive incentives. For incentive parties (usually token project parties and iZUMi), they can distribute the resulting liquidity in intervals at different timescales to achieve the project’s desired liquidity target.

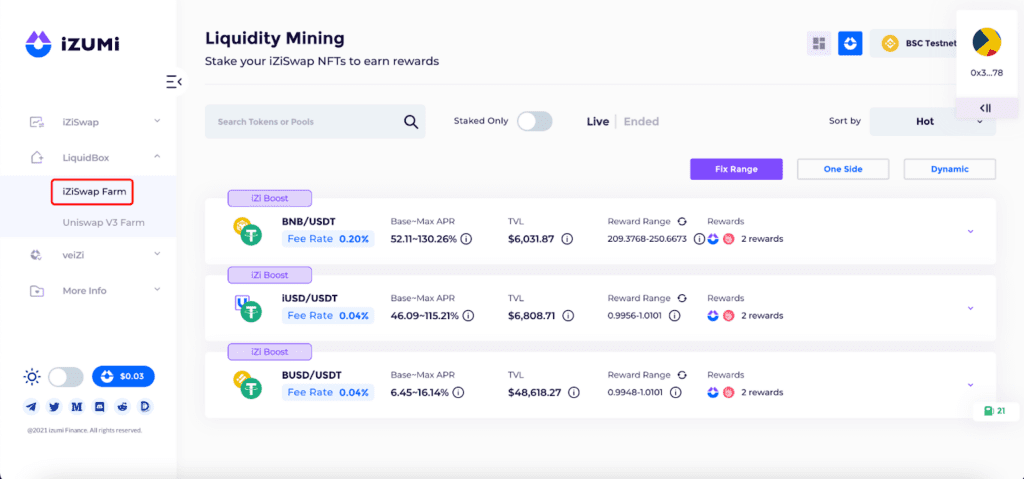

LiquidBox’s solution is to provide three solutions, and the liquidity incentive party (usually the token project side and iZUMi) jointly decides which resolution to adopt:

- Fixed Range: Provides centralized liquidity for stablecoin and pegged-asset pairs.

- Dynamic Range: LiquidBox will automatically stake the UniSwap V3 NFT LP Token into the protocol after providing liquidity. This helps to increase the expected profit for users by both enjoying the reward for providing liquidity from iZUMi and the protocol and enjoying a part of the revenue from transaction fees on Uniswap V3 (if the token price is still within the price range that LP set).

- One Side: When LP provides liquidity, the liquidity portion of the stablecoin or pegged asset will be placed at the established price range, and the project token portion will be staked in the LiquidBox module (not on Uniswap V3 ) to lock in liquidity, thereby preventing the token from being sold automatically when the price breaks out of the set range. Helps users avoid the risk of temporary loss while reducing the pressure of passive token sales for the project.

iZUMi Finance Review: Products

iZUMi Finance offers a suite of products, including: iZiSwap, LiquidBox, iZUMi Bond and veiZi.

iZiSwap

Innovative Discretized-Liquidity-AMM iZiSwap offers DEX customers an order book trading experience similar to CEX and effective on-chain liquidity for Web3 assets. It might offer 5000 times greater capital efficiency than the conventional x*y=k DEX, according to the DLAMM mechanism.

With iZiSwap Finance review, users can enjoy advanced features to enhance their trading experience:

- Fast trades: Instant trade execution with minimal slippage.

- Limit Order: Allows users to place orders at a specific price, giving them better control over their trades.

- Pro Trading: iZiSwap provides a professional trading interface similar to centralized exchanges, allowing users to place buy and sell orders on the order book (Order-book).

- Liquidity: iZiSwap provides centralized liquidity in a specific price range, allowing users to receive rewards from trading fees.

- Campaign: Participate in events and campaigns organized by iZiSwap, offering the opportunity to receive additional benefits and promotions.

- Analytics: iZiSwap provides an overview of transaction data, including TVL, trading volume, liquidity pool, top tokens, and transaction information…

LiquidBox

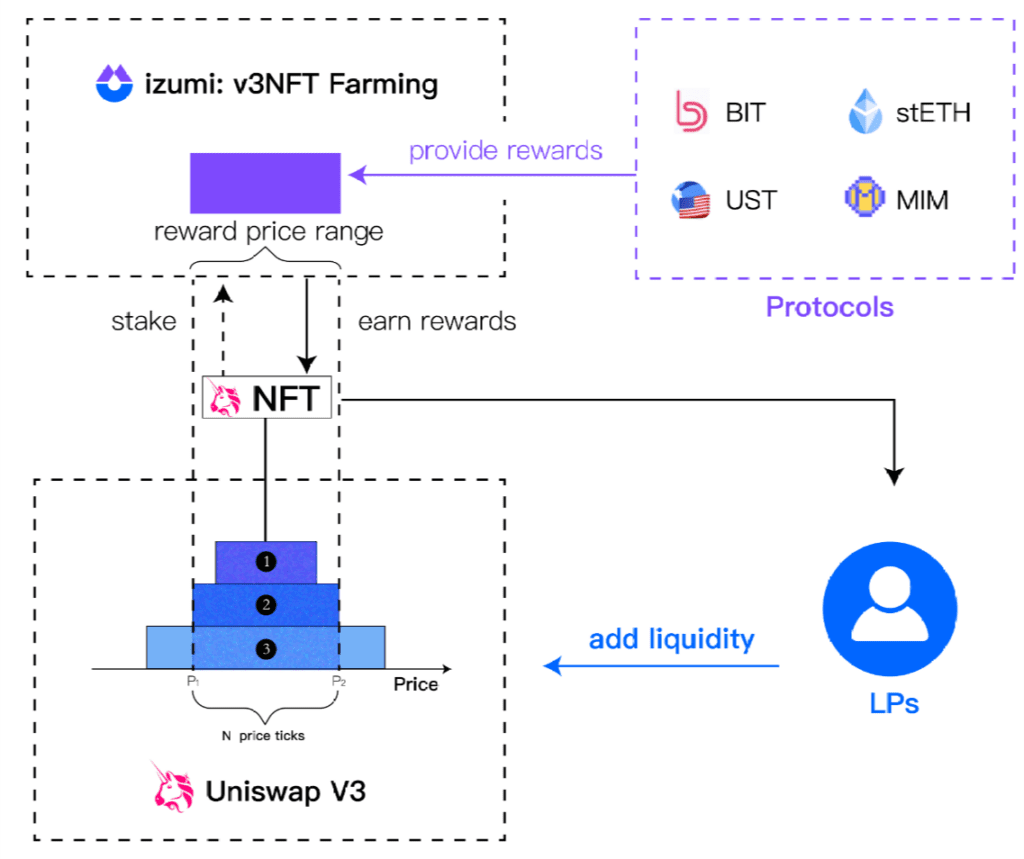

The iZUMi team first proposed and implemented the “LiquidBox” liquidity mining plan, based on the Uniswap V3 NFT LP token. Unlike traditional V2 replaceable LP tokens that are directly staked for mining, when designing a plan to incentivize liquidity mining in LiquidBox, the protocol can explicitly set the value range of LP tokens that are incentivized.

DeFi users provide liquidity on Uniswap to earn transaction fees, and they will also receive NFT LP tokens representing their Liquidity portion. They can stake their NFT LP tokens on Izumi to start mining liquidity and earn more incentive tokens provided by different project teams and Izumi governance tokens.

Currently, we have three options: Fixed Range, One Side, and Dynamic Range. Although, we have deployed on Ethereum, Polygon, and Arbitrum.

iZUMi Bond (iUSD)

iZUMi Bond (or iUSD, iZUMi Bond USD) is a bond issued by iZUMi Finance, 100% backed by collateral and project revenue. The value of iUSD is pegged 1:1 to the USD. Bond Farming is a systematic technique for extracting liquidity that gives bondholders risk-free returns.

iZUMi Finance sells iUSDs to investors in a private funding round to raise funds for the future development of the iZUMi ecosystem.

iZUMi Finance Review: Tokenomics

Currently iZUMi has 2 types of tokens: IZI (utility token) and veiZI (administration token).

iZi token

The utility token for the iZUMi Finance platform is called the iZi token, and it may be used to build up incentive pools and employ other functions. Additionally, users must stake iZi token to get ve-iZi token, the governance token for the iZUMi platform that entitles holders to a number of advantages and participation in governance.

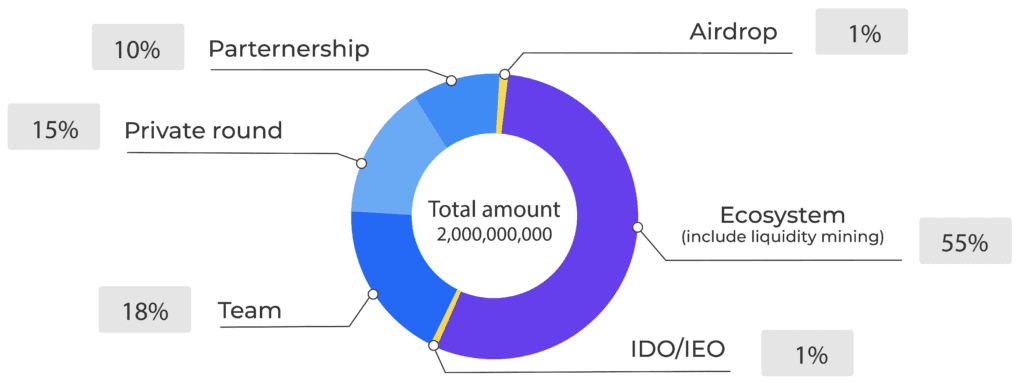

Distributed and issued as follows:

- Core Team: 18% – Lock for 6 months, then unlock 10% and pay linearly over the next 18 months.

- Ecosystem: 55% – 3% will be taken to provide liquidity on Uniswap V3, the rest will pay linearly over 4 years.

- Private Round: 15% – Unlocks 10% at Token Generation Event (TGE) and is locked for the next 3 months then pays linearly for the next 12 months.

- Partnership: 10% – Lock for 6 months, then unlock 10% and pay linearly over the next 18 months.

- IDO: 1% – Unlock 100% at TGE

- Airdrop: 1% – 100% Unlocked at TGE

veiZi

According to the ERC-721 standard, veiZi (iZUMi DAO veNFT) is the governance token of iZUMi Finance in the form of NFT. By locking iZi for a variable amount of time (up to 4 years), users may create veiZi. Once the lock time (block) has passed, users can redeem veiZi and receive their original iiZi. After receiving veiZi NFT, you can stake it using NFT’s Manage option.

Use cases:

- Voting: Participate in voting on governance-related issues in the iZUMi DAO.

- Staking: 50% of iZUMi Finance monthly revenue will be used to redeem IZI tokens and divide them among veiZi holders as staking rewards.

- Boosting: Holding veiZi is seen as a form of NFT staking on LiquidBox, which increases the APR of pools up to 2.5 times.

iZUMi Finance Review: Fee

Fees mainly come from iZiSwap.

Pool Fee tier:

- 1%-0.2%-0.04%-0.01% (taker pay)

- 1% suitable for emerging tokens and high-volatility trading pair

- 0.2% suitable for mainstream pairs

- 0.04% and 0.01% suitable for stablecoin pairs

Fee distribution:

- 50% to LP

- 25% buyback iZi

- 25% buyback iUSD and promotion

iZUMi Finance Review: Investors

iZUMi Finance has raised a total of $27.6 million after 3 rounds of funding. Information about funding rounds:

- Seed Round (November 10, 2021): Raised $2.1 million, led by Mirana Ventures, with the participation of Youbi Capital, Everest Ventures Group…

- Series A round (December 9, 2021): Raised $3.5 million, with the participation of Gate Labs, GSR Ventures, IOSG Ventures, MEXC Global, Mirana Ventures…

- Venture Round (April 21, 2023): Raised USD 22 million, with the participation of Unicode Digital, NextGen Digital Venture, Incuba Alpha, Bella Protocol…

Conclusion

Inefficient usage of liquidity plagues DeFi ventures frequently. With the groundbreaking Discretized-Liquidity-AMM(DL-AMM) model, iZUMi Finance review stands out from the competition. It was improved from the concentrated liquidity model of Uniswap V3 to adopt an AMM mechanism that allows discrete liquidity on every price tick, offering DEX users a trading experience comparable to CEX and enabling them to place limit orders without the requirement of a custodial orderbook.

Additionally, iZUMi Finance has successfully released iZUMi Bond USD (iUSD) and iZUMi Bond, supported Bond Farming, and provided users with a high yield fixed income investment product by combining with the TradFi product model of convertible bonds to give iZUMi Bond investors the option to convert their bonds into iZi tokens.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.