Key Points:

- Fake tokens flood networks following PayPal’s stablecoin debut, raising caution.

- Legitimate PYUSD is only for verified PayPal wallets, users warned of imitations on decentralized exchanges.

- PayPal pioneers major stablecoin issuance, enabling secure transfers amidst scam attempts.

In the wake of PayPal’s recent debut of its dollar-pegged PYUSD stablecoin, fraudulent actors are attempting to take advantage of the situation by circulating counterfeit tokens across various networks.

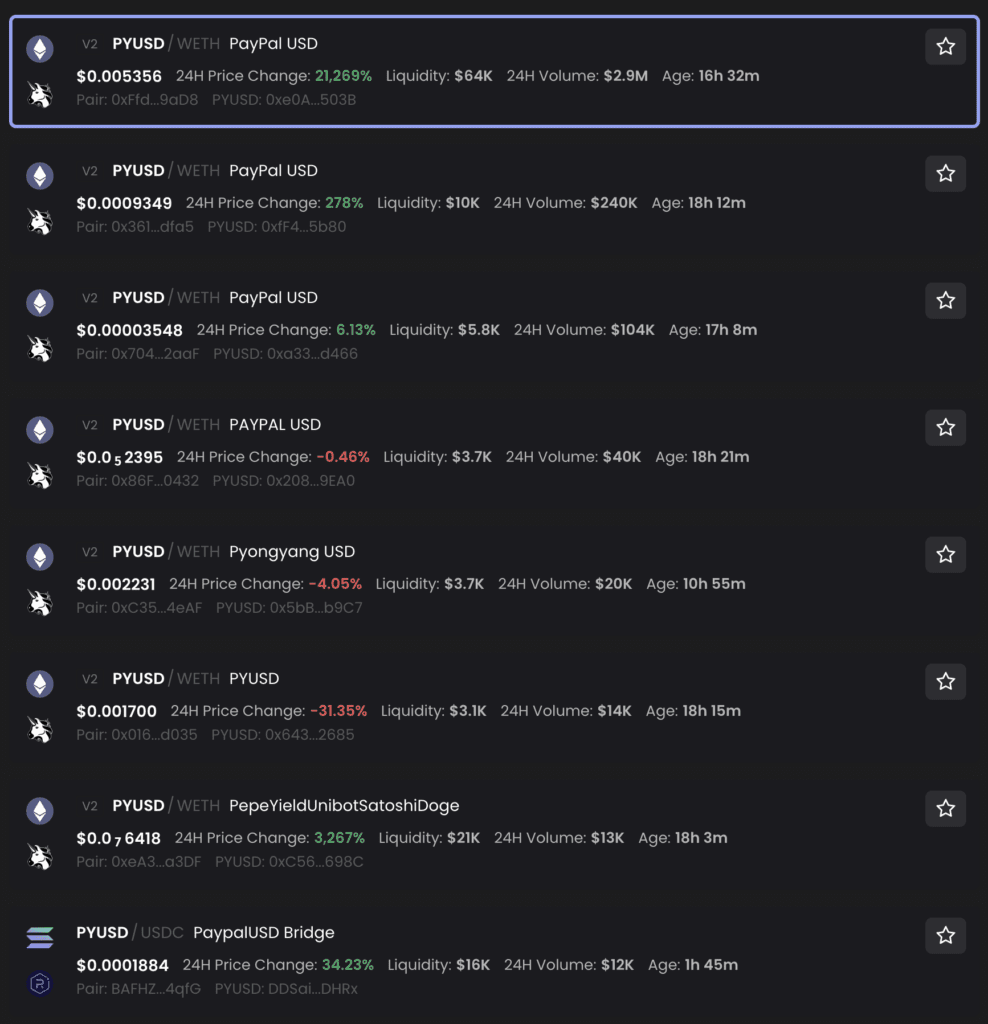

The influx of opportunists, speculators, and potential scammers has given rise to a surge in look-alike tokens, each sporting the “PYUSD” ticker.

Decentralized exchange scanner DEX Screener has identified more than 60 newly spawned token pairs under the “PYUSD” label since the announcement.

These counterfeit tokens have proliferated on diverse blockchain networks such as BNB Smart Chain, Ethereum, and Coinbase’s latest layer 2 platform, Base.

It is imperative to note that the authentic PYUSD was introduced in November 2022, with its legitimacy verifiable via the designated contract address.

PayPal’s stipulation that PYUSD can only be transacted between verified PayPal and compatible wallets underscores the improbability of any similarly titled tokens on decentralized exchanges like UniSwap being genuine.

The most prominent imitation, a PYUSD token minted on Ethereum, has amassed an astonishing $2.9 million in trading volume merely a day following the PYUSD revelation.

New York-based financial giant PayPal disclosed its forthcoming plan to introduce the PYUSD stablecoin, becoming the first major financial institution to launch its own stablecoin.

The token will facilitate seamless transfers between PayPal accounts and supported external digital wallets, enabling token usage for payments and conversion with its backed cryptocurrencies.

While anticipation for the authentic tokens remains, scammers have already initiated their schemes. Their ploy involves minting tokens named “PYUSD,” infusing liquidity with ether or alternative tokens, and marketing them to decentralized exchange users.

As users await legitimate PYUSD tokens, heightened vigilance against scams is imperative in this evolving landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.