Ethereum Is Experiencing Difficulty As The $1900 Price Zone Still Cannot Be Recovered

Key Points:

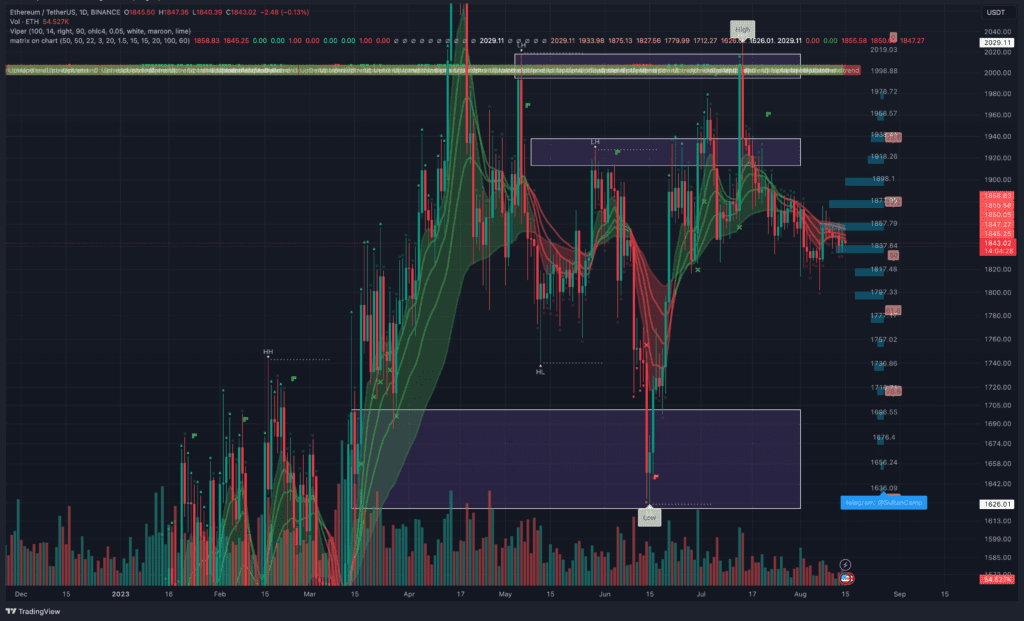

- Ethereum’s price decline continues after the April peak, locked between $1,830 and $1,880.

- Strong BTC movement could push ETH above $1,900, reflecting the recent price correlation.

- Despite volatility dropping to 19.90% on August 15, ETH’s negative sentiment persists, with a potential retest of $1,730 if the downward trend continues.

Ethereum (ETH) has been experiencing a downward trajectory since April when it breached the $2,000 resistance level before slipping beneath it.

Presently, the ETH price finds itself constrained between the $1,830 and $1,880 marks. The scenario could shift if Bitcoin (BTC) displays a robust uptrend, potentially propelling ETH above $1,900.

This prognosis takes into account the recent strong correlation between Bitcoin and Ethereum. Both cryptocurrencies exhibited similar price actions over the weekend in the four-hour timeframe.

In an optimistic scenario, Ethereum, the leading altcoin by market capitalization, might even surge towards the $2,000 region, aiming to touch $2,010, a milestone last tested in mid-July.

On August 15, data from Derbit indicated that ETH’s volatility dipped below 20%, currently resting at 19.90%.

Analyzing the weekly timeframe reveals a prevailing negative sentiment, as the decline is attributed to the deviation and subsequent breach of the $1,950 resistance. Such a downward shift often indicates significant market movements to the downside.

Should this trend persist, there’s a likelihood that the price zone around $1,730 could be retested in the near future. At present, ETH is trading at $1,843, positioned above the 50% Fibonacci level. However, the recent proximity to the $1,830 range has caused apprehension among bullish investors.

While the prospect of ETH maintaining a position above $1,800 appears favorable, the focus remains on breaking through the $1,900 barrier for a more positive outlook.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.