Key Points:

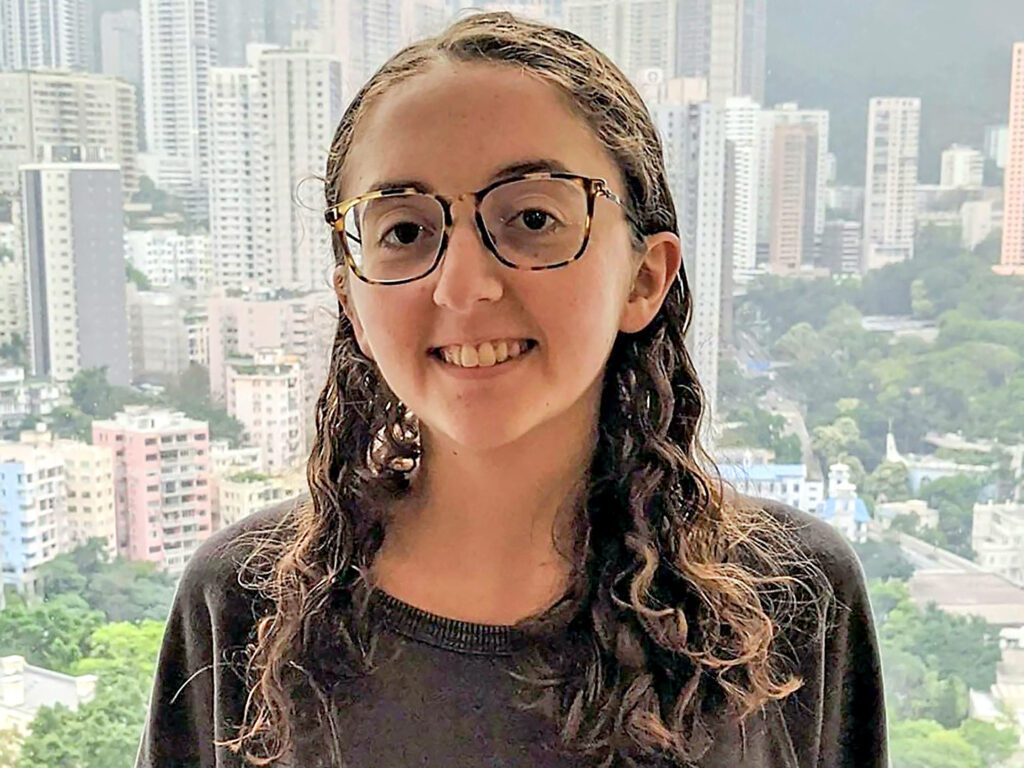

- US prosecutors will use Caroline Ellison’s notes in the trial against FTX co-founder SBF.

- Notes detail discussions on FTX fund use and business concerns.

- Bankman-Fried’s defense challenges the timing, trial starts October 2.

In a surprising turn of events, US prosecutors are gearing up to employ personal notes and diaries belonging to ex-Alameda Research CEO Caroline Ellison as crucial evidence in the impending criminal trial of Sam Bankman-Fried (SBF), co-founder of FTX.

The move comes as prosecutors seek to shed light on alleged fraudulent activities involving FTX customer funds.

The evidentiary treasure trove, which encompasses a collection of Ellison’s personal notes, includes a particularly intriguing list titled “Things Sam is Freaking Out About.”

This list appears to encapsulate discussions between Ellison and SBF on topics ranging from business concerns to fundraising, as well as Alameda’s trade hedging strategies and controversial reports concerning the hedge fund’s association with FTX.

A pivotal recording obtained from an all-hands meeting on November 9, 2022, further underscores the severity of the allegations. In this recording, Ellison allegedly attributes the decision to use customer funds to plug financial gaps in the collapsing hedge fund to SBF.

Notably, this decision was made just days before the dual bankruptcy filings of FTX and Alameda.

During the meeting, Ellison reportedly acknowledged her conversations about the shortfall with SBF, Gary Wang (FTX co-founder), and Nishad Singh (former director of engineering), both of whom have already pleaded guilty to fraud charges and are cooperating with the prosecution.

However, Bankman-Fried’s defense team has responded vehemently, challenging the timing and delivery of the evidence.

They assert that prosecutors’ delays in sharing key information, such as the contents of Wang’s laptop and Ellison’s encrypted Telegram chats, have hampered their ability to adequately prepare for the trial.

As the trial, set to commence on October 2 in Manhattan federal court, approaches, it remains to be seen how these personal notes and recordings will shape the narrative surrounding Bankman-Fried’s alleged fraudulent actions.

Prosecutors are confident that these pieces of evidence will establish a connection between the misuse of FTX customer funds and the unraveling of Alameda, ultimately bolstering their case against the once high-flying cryptocurrency exchange.

Coincu will continue to update the situation related to Sam Bankman-Fried, you can find out more information through this article.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.