Bitcoin Is Showing Accumulation As The $29,000 Price Zone Holds

Key Points:

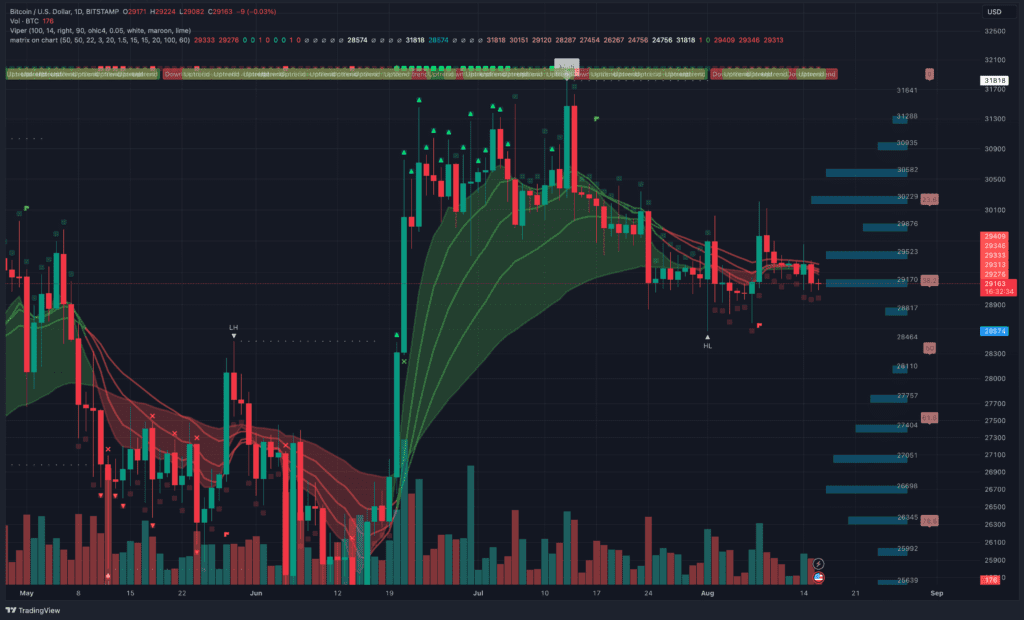

- Bitcoin’s recovery falters at $29,500 resistance and consolidates near $29,100 support.

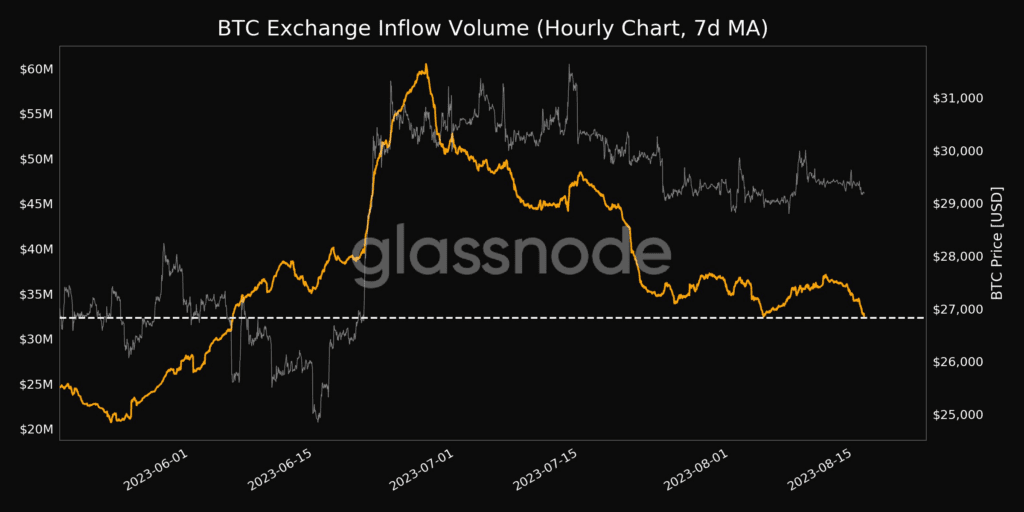

- Whale accumulation is evident as BTC Exchange Inflow Volume hits a one-month low, anticipating a short-term breakout and post-September recovery.

- September historically challenges Bitcoin’s price, while $29,500 and $29,750 resistances hold potential for a rally toward $30,000.

Bitcoin’s attempts at recovery have faltered as it faced resistance at the $29,500 zone, leading to a decline from the recent $29,450 peak.

The digital currency underwent a clear downtrend, slipping below the $29,250 mark. Finding support near $29,100, it reached a low of $29,075 before entering a phase of consolidation.

Presently trading below $29,200, Bitcoin has held the attention of steadfast investors who have clung to the $29,000 mark over the past two months, despite a brief dip to the $28,800 territory.

Interestingly, BTC’s Exchange Inflow Volume (7d MA) recently hit a one-month low of $32,325,304.35, indicating potential accumulation by whales anticipating a price surge. This hints at the possibility of a strong short-term breakout, while a more substantial recovery is anticipated post-September.

The cryptocurrency sphere experienced a stark juxtaposition between 2021’s impressive performance and 2022’s severe downturn, with Bitcoin plunging from about $50,000 in September 2021 to $20,000 in September 2022.

Remarkably, historical trends reveal that September has consistently presented challenges for Bitcoin’s price trajectory, aligning with similar patterns observed in traditional stock markets. The ongoing struggle to breach the $29,500 resistance level underscores the uncertainty.

Looking ahead, a notable resistance near $29,500 looms, followed by a more significant barrier at $29,750. Should Bitcoin surpass this resistance, it could pave the way for a substantial rally toward the $30,000 zone.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.