3AC’s Su Zhu Rebuttals Amid The Dispute $140M Fund Ownership With DeFiance Capital

Key Points:

- DeFiance Capital and 3AC’s liquidator dispute ownership of joint venture funds.

- Su Zhu spoke out against DeFiance Capital’s arguments.

- Resolution to impact crypto investment dynamics, highlighting collaborative fund intricacies.

A clash has erupted between DeFiance Capital and the liquidator of 3AC, a cryptocurrency investment fund, as both parties vie for control over a $140 million fund. The dispute centers around the ownership and distribution of the funds collected from their joint venture.

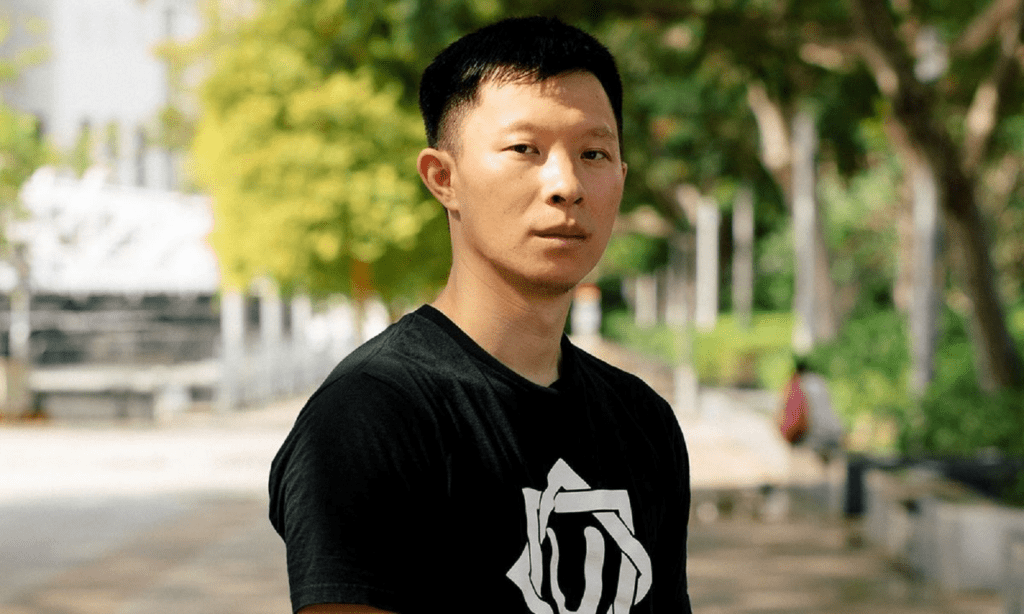

In response to the ongoing dispute, Su Zhu, founder of Three Arrows Capital, released a statement on Twitter emphasizing the separation of DeFiance Capital (DC) and Starry Night Capital (SNC) funds from other pools of capital at Three Arrows Capital Ltd (TACL).

The statement clarified that the DC and SNC assets should be treated as segregated funds and were not actively managed by TACL directors.

DeFiance Capital, a prominent decentralized finance (DeFi) investment firm founded by Arthur Cheong, alleges that the liquidator, Teneo, is overstepping its bounds by attempting to lay claim to the funds gathered through a collaboration between the two entities.

The collaboration resulted in the establishment of a joint fund named DeFiance Partners LP, managed by DeFiance Capital Management Ltd, a subsidiary of DeFiance Capital Ltd.

However, 3AC counters these claims. The liquidator, Teneo, argues that the funds should be considered part of the 3AC estate and be distributed to settle debts. This contention arises from 3AC’s announcement of bankruptcy and subsequent liquidation due to losses suffered during the May 2022 cryptocurrency market crash.

The core issue revolves around whether the funds gathered under the joint venture are connected to 3AC’s assets or should be treated as separate from the company’s liquidation. DeFiance Capital asserts that the mutual fund is an independent legal entity distinct from 3AC’s operations.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.