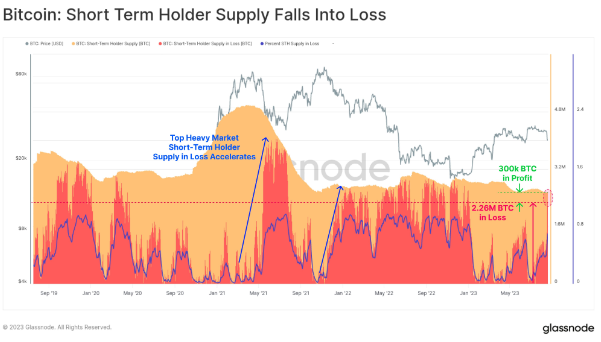

Key Points:

- 88.3% of short-term BTC holders are facing floating losses. Out of their 2.56 million BTC holdings, only 300,000 BTC are profitable.

- The number of short-term holders (STH) is nearing an all-time low, raising questions about trading strategies and market sentiment.

Glassnode analyst @Checkmatey took to Twitter to share a concerning statistic regarding short-term BTC holders.

According to the tweet, a staggering 88.3% of these holders find themselves in a precarious position, grappling with floating losses. This revelation has sent ripples through the cryptocurrency community, shedding light on the challenges faced by those who engage in short-term trading.

The data presented in the tweet also revealed another alarming fact – out of the total 2.56 million BTC held by this group, only a mere 300,000 BTC are currently showing profitability. This striking contrast between profitable and loss-bearing holdings underscores the volatility and unpredictability that can accompany short-term trading strategies. Market fluctuations and sudden price corrections have undoubtedly played a role in this situation, leaving a substantial majority of short-term BTC holders at a disadvantage.

Adding to the complexity of the situation is the revelation that the supply of short-term holders (STH) is now hovering close to an all-time low. This detail suggests that while the number of short-term traders has diminished, a significant portion of them is still grappling with losses. This phenomenon prompts questions about the strategies employed by these holders and the overall sentiment within the crypto trading community.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.