Key Points:

- Bitcoin falls nearly 1% to trade near a two-month low of $26,000 amidst global bond selloff.

- Analysts are not optimistic about the outcome of the Federal Reserve’s annual symposium in Jackson Hole.

Bitcoin’s value drops as global bond selloff leads to multi-year highs in US Treasury yields. Federal Reserve meeting watched for policy outlook clues, as per Bloomberg.

Bitcoin’s value continues to decline amidst a global bond selloff that has led to multi-year highs in longer-term US Treasury yields. On Monday, the largest digital asset fell nearly 1% to trade near a two-month low of $26,000. Other cryptocurrencies, such as Ether and XRP, also experienced a decline.

The Federal Reserve’s annual symposium in Jackson Hole this week will be closely watched, with Fed Chair Jerome Powell’s comments on Friday expected to give clues about the policy outlook. Analysts are not optimistic about the outcome, expecting the S&P 500 stock index to drop another 2% to 3% amid a climb in the 10-year US Treasury yield past 4.33%. Bitcoin is reportedly extending its decline to about $25,000.

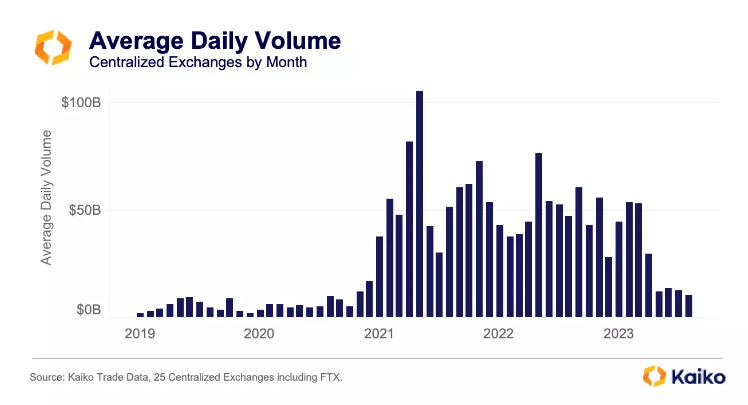

Despite the macro risk, some in the crypto industry hope for a tailwind from pending applications to start US spot Bitcoin and Ether futures exchange-traded funds. However, other metrics suggest a reluctance among retail and institutional investors to engage with crypto following last year’s rout, blowups like FTX, and an ever-shifting regulatory landscape.

Technical signals followed by chart analysts offer a mixed picture, with some suggesting Bitcoin is close to the most oversold level since mid-2022. In contrast, others indicate it may be on the cusp of a deeper retrenchment if it sinks below $25,700.

Bitcoin’s drawdown last week was the largest since the collapse of the FTX crypto exchange in the final quarter of 2022, and its year-to-date gain stands at 57%, down from 90% through mid-July.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.