Key Points:

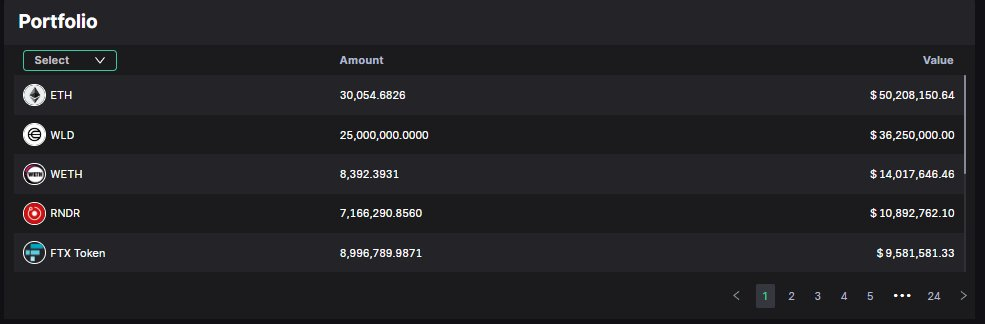

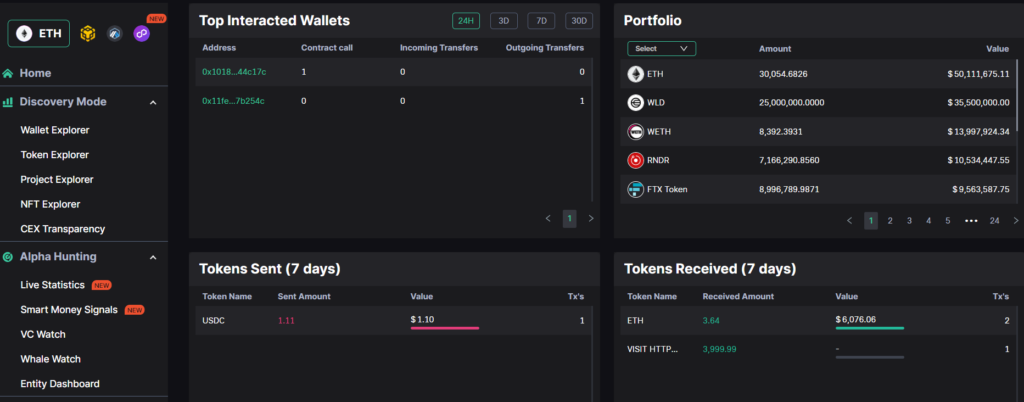

- Scopescan’s monitoring reveals FTX liquidation address contains 25M WLD ($36.5M).

- Token transferred from Worldcoin address just a week ago.

- SBF’s involvement as an early Worldcoin investor sparks speculation on the motive behind the move.

Scopescan monitoring has unveiled intriguing information about the FTX liquidation address.

As per the data, the address presently contains a substantial holding of 25 million WLD, valued at approximately $36.5 million based on the current market price.

What adds a layer of complexity to this discovery is the fact that the token in question was transferred from the Worldcoin address a mere week ago. This revelation has piqued the interest of market analysts and enthusiasts, prompting speculation about potential motivations behind this movement.

Sam Bankman-Fried (SBF), a prominent figure in the cryptocurrency space, is recognized as an early investor in the Worldcoin project. The involvement of SBF raises questions about his connection to this substantial transfer and whether it signals strategic decision-making within the Worldcoin ecosystem.

Worldcoin, a project that aims to establish a universal basic income (UBI) system through blockchain technology, has garnered attention for its ambitious goals and innovative approach. While the project’s primary focus remains on creating a more equitable financial system, this recent transfer of tokens has diverted attention to its financial activities.

Market experts are keeping a close watch on how this situation unfolds, especially considering SBF’s influential position and the potential implications of such a significant token movement. The dynamics of cryptocurrency investments and their interconnectedness with high-profile figures often lead to speculative discussions and market reactions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.