1inch Fund’s Bold $10M ETH Purchase Elevates Crypto Portfolio Success!

Key Points:

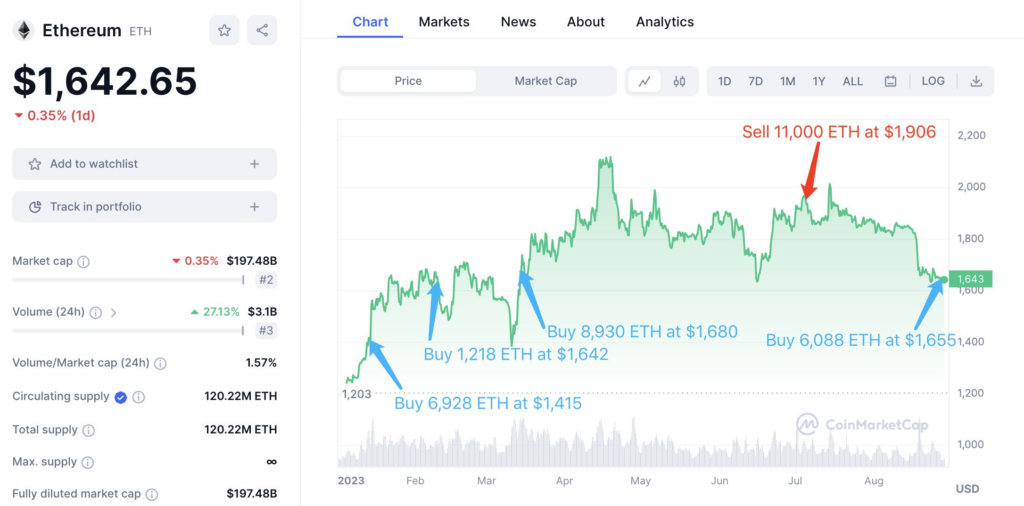

- 1inch Investment Fund makes a savvy $10M move, snapping up 6,088 $ETH at $1,655 just hours ago.

- Previous purchases amount to 17K $ETH ($26.8M) at a $1,569 average. on Jan 13, Feb 9, and Mar 14.

- Strategic sell of 11K $ETH ($21M) at $1,906 on July 5 reaps ~$3.7M.

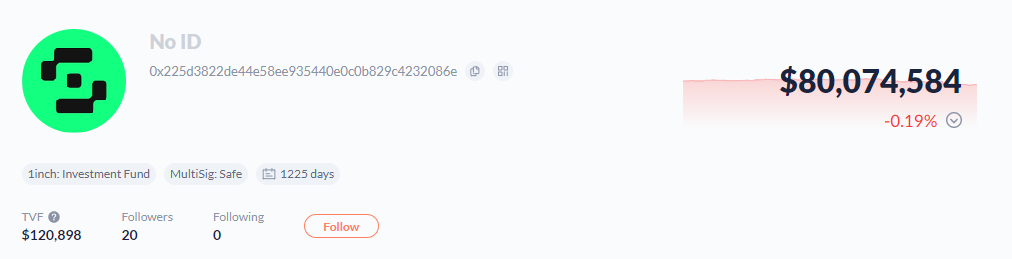

The 1inch investment fund wallet made a noteworthy investment of $10 million, acquiring 6,088 units of Ethereum (ETH) at a price of $1,655.

This substantial purchase, which took place a mere six hours ago, underlines the fund’s commitment to capitalizing on the evolving crypto market trends.

This latest acquisition adds to the wallet’s impressive crypto portfolio, as it had previously acquired a total of 17,000 ETH, amounting to $26.8 million, at an average price of $1,569. These strategic purchases were executed on key dates, namely January 13, February 9, and March 14, demonstrating the wallet’s ability to identify opportune moments for investment.

However, the wallet’s strategy is not solely centered around accumulation. On July 5, the 1inch Investment Fund wallet executed a calculated move by selling 11,000 ETH, which was valued at $21 million, at a price of $1,906. This shrewd decision resulted in a profit of approximately $3.7 million, showcasing the fund’s adeptness at both acquisition and timely divestment.

These actions illustrate the fund’s agility and proficiency in navigating the volatile cryptocurrency landscape. The fund’s ability to strategically time its purchases and sales, coupled with its substantial investment prowess, paints a picture of a player that is not only engaged but also thriving in the crypto space.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.