Key Points:

- Balancer suffered flashloan attacks resulting in losses of $2.1M.

- Critical vulnerability reported on August 22nd.

Decentralized exchange Balancer lost ~$2.1M due to flashloan attacks. Users advised to withdraw affected LPs. Critical vulnerability reported on August 22nd.

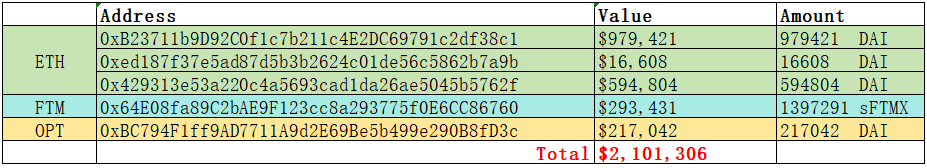

Balancer, a decentralized exchange (DEX) platform, has experienced a series of attacks resulting in a reported total loss of approximately $2.1 million, as reported by Beosin Alert.

| Addresses | |

| ETH | 0xB23711b9D92C0f1c7b211c4E2DC69791c2df38c1 |

| ETH | 0xed187f37e5ad87d5b3b2624c01de56c5862b7a9b |

| ETH | 0x429313e53a220c4a5693cad1da26ae5045b5762f |

| FTM | 0x64E08fa89C2bAE9F123cc8a293775f0E6CC86760 |

| OPT | 0xBC794F1ff9AD7711A9d2E69Be5b499e290B8fD3c |

The attackers targeted the platform’s flashloan feature, which allows users to borrow funds without collateral for a brief period. Beosin Alert reported that Balancer was under multiple flashloan attacks on August 27th, resulting in losses of $870,000.

Users affected by the attack are advised to withdraw their liquidity pool (LP) assets as soon as possible, according to a previous warning by the project.

Additionally, on August 22nd, Balancer reportedly received a critical vulnerability report affecting a number of V2 Pools. Emergency mitigation procedures have been implemented to secure the majority of total value locked (TVL).

However, some funds remain at risk, and users are advised to withdraw affected LPs immediately. The team has assured users that they are working to identify and fix all vulnerabilities and will continue to provide updates as they become available.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.