MakerDAO RWA Assets Now Reach $3.1 Billion After Platform Adds $101 Million To Back DAI

Key Points:

- MakerDAO RWA assets have been added to $101 million in the DAI escrow fund.

- This move is part of Maker’s strategy to diversify the assets backing DAI and make it more resilient to market fluctuations.

- The trend of stablecoins shifting to traditional assets is likely to have a positive impact on the overall stablecoin market.

MakerDAO, the leading project in the trend of bringing traditional assets to the blockchain space, has recently taken steps to penetrate deeper into the Real World Assets (RWAs) market.

MakerDAO RWA Assets Reach More Than $3 Billion

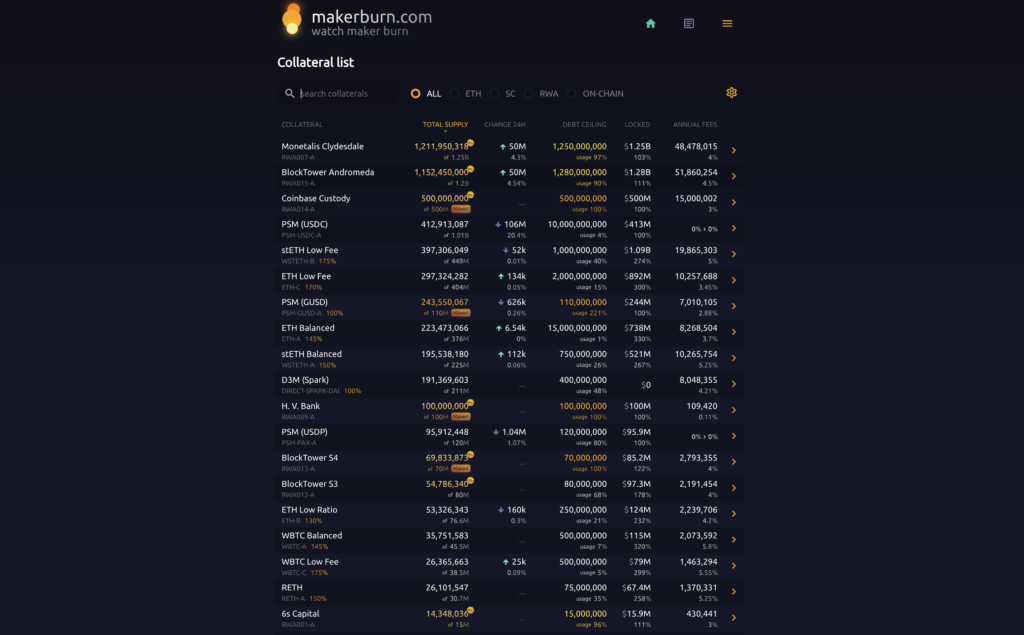

According to the latest figures from the MakerBurn statistics page provided by Wu Blockchain, $101 million in MakerDAO RWA assets have been added to the DAI escrow fund in the past 24 hours. This amount of assets has been accumulated through Monetalis Clydesdale, BlockTower Andromeda, and New Silver.

At press time, MakerDAO RWA assets have reached $3.1 billion, of which $1.28 billion is in Andromeda’s Vault. The transaction is the latest step in Maker’s strategy to diversify the assets backing the $5.3 billion dollar-pegged stablecoin DAI by increasing the role of traditional financial assets such as government bonds in the reserve.

The trend of shifting to traditional assets is increasingly clear, especially with stablecoin projects. Frax Finance also recently announced a proposal to deploy sFRAX to be able to take advantage of large income sources from government bonds.

Stablecoins Shift to Traditional Assets

MakerDAO’s increased focus on RWAs is a positive sign for the stability of DAI. By backing DAI with a variety of assets, including government bonds, MakerDAO is making DAI more resilient to market fluctuations.

This trend is also likely to have a positive impact on the overall stablecoin market. As more stablecoins shift to using RWAs as collateral, the entire market will become more stable and reliable.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.