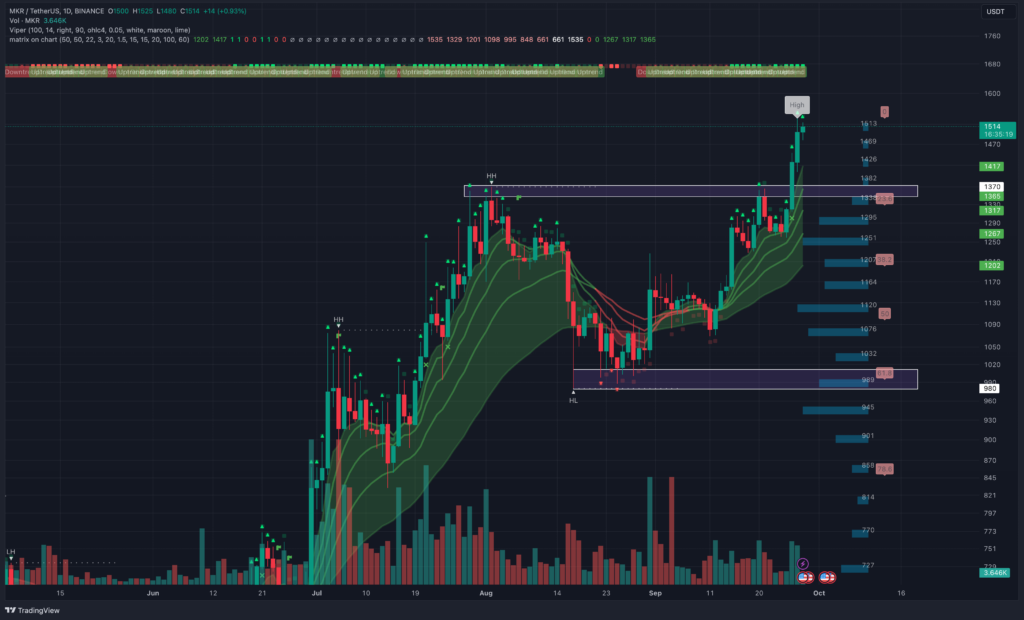

Key Points:

- Maker price hits 16-month price high on strong DeFi presence.

- Its trading volume surges, eyeing $1,500 resistance.

- Caution is urged due to potential selling pressure from token transfers.

Maker price is witnessing a remarkable surge, reaching its highest price point since last May. This rally is attributed to growing protocol profits and substantial accumulation by large investors.

Maker Price Soars to 16-Month Highs Amidst DeFi Dominance

In contrast to many cryptocurrencies grappling with liquidity and volatility issues, Maker (MKR) stands out with a surge in trading volume, recording a remarkable $120 million in trading activity over the past 24 hours. This surge in trading activity indicates a strong short-term technical outlook, potentially propelling the Maker price above the crucial $1,500 support/resistance level.

As of Thursday, Maker price is trading at $1,514, with bullish sentiment aiming to consolidate its position in the ongoing uptrend. Should the interest in MKR persist through the weekend, there is a possibility of closing the gap toward the $2,000 mark.

Caution Advised as Maker’s Bullish Surge Sparks Liquidity Concerns

One notable indicator of MakerDAO‘s prominence in the cryptocurrency sector is its heavy involvement in asset tokenization, boasting an impressive $3.1 billion invested in RWAs (Real-World Assets). Recent reports confirm an addition of approximately $101 million to its expanding portfolio. Maker’s substantial growth is evident not only in its chart performance but also in its presence within the decentralized finance (DeFi) sector.

However, despite the bullish outlook, caution is advised. An influx of MKR tokens moving from self-custody platforms to exchanges could introduce selling pressure into the market. Traders and investors should remain vigilant in the face of potential market fluctuations.

In summary, Maker is experiencing a significant resurgence, driven by protocol profits, increased investor interest, and its influential role in DeFi. As it approaches the $1,500 level, all eyes are on whether the bullish momentum can sustain its climb toward $2,000.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.