Key Points:

- Gary Wang testified that FTX used covert Python code to inflate the value of their insurance funds, which are meant to protect users from losses during significant liquidation events.

- Wang revealed that FTX’s insurance fund was often insufficient to cover losses and that Alameda was instructed to “take on” the loss to hide it, as Alameda’s balance sheets were more private than FTX’s.

In a stunning turn of events, the true nature of FTX’s insurance funds has been brought to light, as Gary Wang, co-founder of the platform, testified that they were artificially inflated using covert Python code.

Allegations of Fraud in FTX’s Insurance Fund

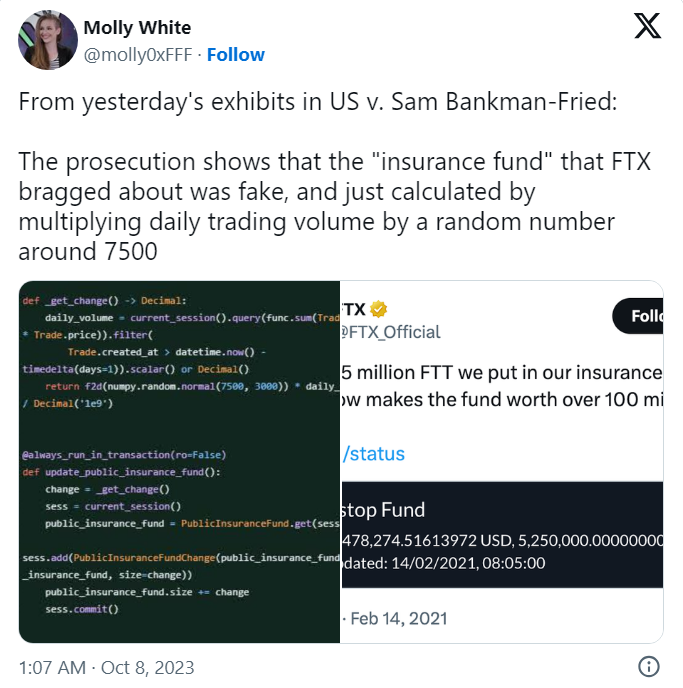

The figure of approximately 7,500, which was presented to the public, is not calculated by multiplying the daily trading volume of FTX. Gary Wang, a co-founder of FTX, testified that FTX used covert Python code to inflate the value of their insurance funds.

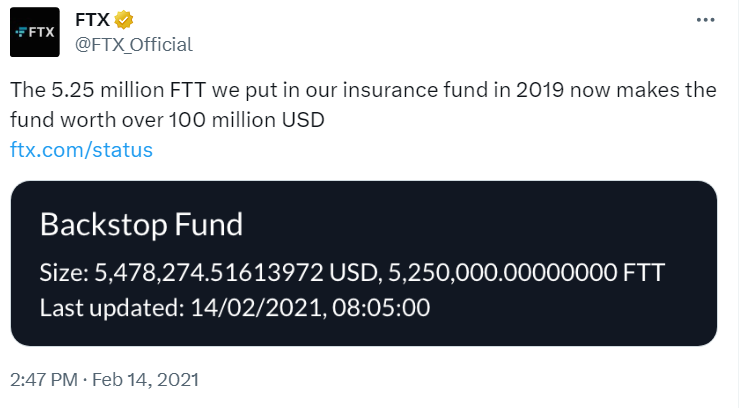

On October 6, Gary Wang, a former chief technology officer of FTX, provided new testimony. He claimed that FTX’s alleged $100 million insurance funds for 2021 were fraudulent and did not include any of the claimed exchanges of FTX’s tokens (FTT).

During the trial, the prosecutors presented a tweet and other public evidence of the fund’s value and asked Wang about its accuracy. He simply replied with a single word, “No.”

Revelations about FTX’s Insurance Fund Insufficiency and Manipulation

The alleged code used to determine the size of the so-called “Backstop Fund” or public insurance fund was displayed as an exhibit on October 6th. FTX’s insurance fund is designed to protect users from losses during significant market activities and is often praised on the website and social media.

Wang’s testimony revealed that the amount contained within the funds was often insufficient to cover these losses. He claims that he was instructed to have Alameda “take on” the loss when Bankman-Fried realized that the insurance fund was almost depleted. Allegedly, this was an effort to hide the loss, as Alameda’s balance sheets were more private than FTX’s.

In addition to exposing the fraudulent nature of FTX’s insurance fund, Wang stated that Bankman-Fried instructed him and Nishad Singh to implement an “allow_negative” balance feature in the code at FTX. This feature allowed Alameda Research to trade with almost unlimited liquidity on the cryptocurrency exchange.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.