Key Points:

- Platypus Finance Hack recovers 90% of the assets that were stolen during a recent security breach.

- The security breach involved three separate flash loan attacks on the automated market maker operating on the Avalanche blockchain, resulting in a significant loss of $2.23 million.

- Despite the attacks, Platypus Finance has shown its commitment to user compensation by committing to return at least 63% of the assets lost in previous attacks.

According Cointelegraph, Platypus Finance Hack recovers successfully 90% of the assets stolen in the recent hack.

Platypus Finance Hack recovers 90% asset after be attacked

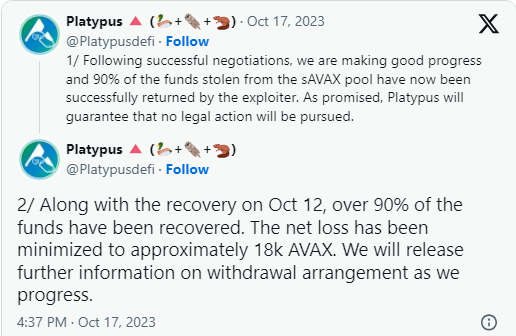

In an announcement on October 17th, the developers disclosed a net loss of “18,000 Avalanche,” valued at $167,400 at the time. Interestingly, the hacker voluntarily returned the funds, and Platypus Finance confirmed that they will not pursue legal action. Thanks to hacker cooperation, Platypus Finance Hack recovers 90% of the assets that were stolen during a recent security breach.

The security breach took place on October 12th when the automated market maker operating on the Avalanche blockchain fell victim to three separate flash loan attacks, resulting in a loss of $2.23 million. It is worth noting that the project secured $3.3 million in funding in 2021, with Three Arrows Capital leading the investment.

Platypus Finance Takes Action to Enhance Security After Third Flash Loan Attack

To enhance security, Platypus developers have suspended all liquidity pools and initiated a comprehensive security audit. Flash loan attacks involve hackers exploiting vulnerabilities to borrow cryptocurrencies without providing collateral. The hacker then withdraws these borrowed assets from the protocol, leaving either the users or the protocol treasury responsible for the debt.

This incident marks the third attack on Platypus this year, with a previous occurrence in July resulting in a $157,000 loss due to a flash loan attack. Another attack, exploiting the DeFi protocol for $8.5 million, also utilized a flash loan. Following the incident in February, Platypus committed to returning at least 63% of the assets lost by users in the attack through its recovery plan.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.