Key Points:

- Bitcoin price reaches new three-month highs, surging close to year-to-date highs in a potential “Uptober.”

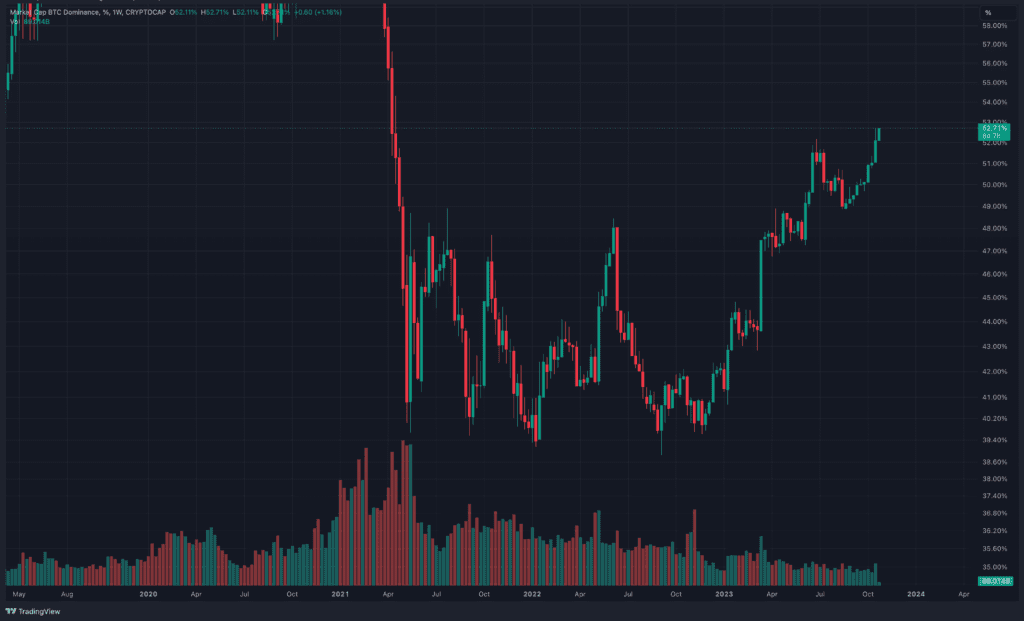

- BTC.D has risen for eight consecutive weeks, defying historical patterns as investors remain cautious about diversifying into altcoins.

- Excitement grows as the US SEC engages with major applicants for the approval of spot Bitcoin ETFs.

Bitcoin is making a significant resurgence, nearing year-to-date highs, as it continues its remarkable uptrend. On October 23, Bitcoin price reached new three-month highs during the first US trading session of the week.

Bitcoin price has crossed the $31,000 mark, pushing its monthly gains into double digits, indicating an increasingly bullish sentiment among investors. However, essential indicators suggest that the cryptocurrency is poised to climb even higher in the coming days.

An intriguing factor contributing to Bitcoin’s continued dominance is the surprising rise of Bitcoin Dominance (BTC.D), which has been on an upward trajectory for eight consecutive weeks since August 21.

Historically, when the Bitcoin price achieves significant gains and reaches milestone levels, investors tend to diversify their portfolios into altcoins to maximize their returns. This time, though, the skittish macroeconomic landscape and ongoing events in the Middle East crisis appear to be keeping investors from venturing into altcoins.

Despite Bitcoin’s surge, market participants are cautious and believe that a weekly candle close is needed to confirm the rally’s sustainability.

Excitement is brewing within the crypto community as rumors circulate about the potential approval of the first-ever spot Bitcoin exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC).

Notably, the SEC is actively engaging with prominent applicants such as Grayscale, BlackRock, Fidelity, Invesco, and Ark Invest. This marks a significant departure from the SEC’s historical stance of rejecting spot Bitcoin ETFs, leading to speculation that the market may be “front-running” the approval of a spot ETF.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.